Attention, France:

#1

Boost Pope

Thread Starter

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,019

Total Cats: 6,587

Seriously?

You guys have one of the strongest economies in Europe, life, by all practical standards, is pretty good for you right now, and yet you decide to elect a fuсking socialist president with ties to Soviet-style Marxism?

You guys have one of the strongest economies in Europe, life, by all practical standards, is pretty good for you right now, and yet you decide to elect a fuсking socialist president with ties to Soviet-style Marxism?

#8

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,490

Total Cats: 4,079

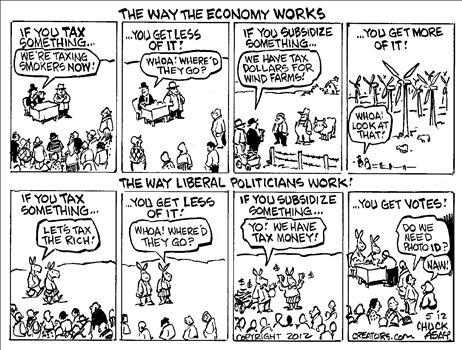

meanwhile in cognitive world view land:

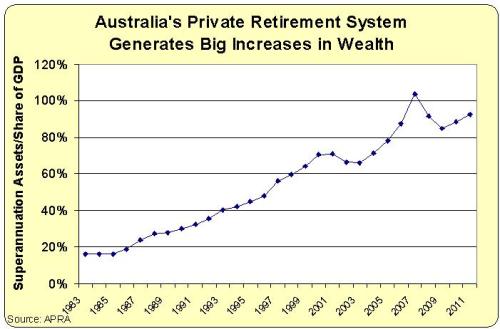

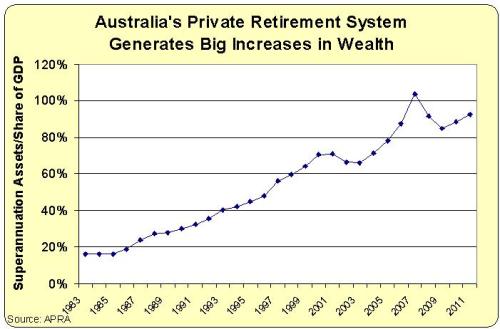

Smart:

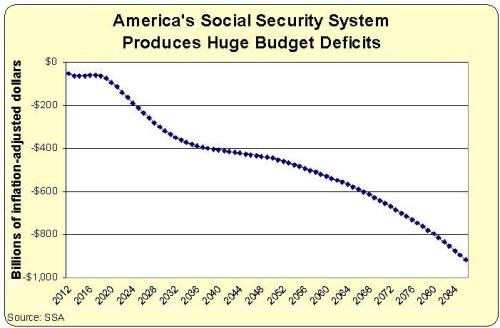

vs Stupid:

Australia to become first major economy since start of financial crisis to record surplus--Australia will become the first major economy in the developed world to record a surplus since the start of the global financial crisis.

vs Stupid:

Only a dozen economies are bigger, and only six nations are richer—of which Switzerland alone has even a third as many people. Australia is rich, tranquil and mostly overlooked, yet it has a story to tell. Its current prosperity was far from inevitable. Twenty-five years ago Paul Keating, the country’s treasurer (finance minister), declared that if Australia failed to reform it would become a banana republic. Barely five years later, after a nasty recession, the country began a period of uninterrupted economic expansion matched by no other rich country. It continues to this day. This special report will explain how this has come about and ask whether it can last. …With the popular, politically astute Mr Hawke presiding, and the coruscating, aggressive Mr Keating doing most of the pushing, this Labor government floated the Australian dollar, deregulated the financial system, abolished import quotas and cut tariffs. The reforms were continued by Mr Keating when he took over as prime minister in 1991, and then by the Liberal-led (which in Australia means conservative-led) coalition government of John Howard and his treasurer, Peter Costello, after 1996. …By 2003 the effective rate of protection in manufacturing had fallen from about 35% in the 1970s to 5%. Foreign banks had been allowed to compete. Airlines, shipping and telecoms had been deregulated. The labour market had been largely freed, with centralised wage-fixing replaced by enterprise bargaining. State-owned firms had been privatised. …the double taxation of dividends ended. Corporate and income taxes had both been cut.

#10

I feel like I am witnessing the beginning of a global collapse. In the middle of a financial crisis people keep insisting on electing those who want to increase spending and tax rates to rediculous levels when it was these very things that bankrupted their economies to begin with. I really hope America doesn't follow in their foot steps come November.

#12

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

I don't have time to go through all of this piece by piece, but Australia has a lot of potential mean reverting ahead of it. Check out a list of the most unaffordable cities by median house price-to-median income and you'll find something like 5 out of the top 10 are in Australia.

Their mining boom supports something like less than 5% of the national population and their economic success has as much to do with the emerging markets and China as it does their own internal policies (which certainly helped in many ways).

Australia has done a lot of things well, but I would expect a lot of shine to come off in the next few years.

The European Monetary Union's debt crisis is a result of a currency crisis. It is subtly, but distinctly, different from the USA's issues which began as a private sector balance sheet issue.

It was not spending and taxation alone that has done in the EMU. Internal imbalances caused by forming a currency union without a fiscal union were the root causes.

Their mining boom supports something like less than 5% of the national population and their economic success has as much to do with the emerging markets and China as it does their own internal policies (which certainly helped in many ways).

Australia has done a lot of things well, but I would expect a lot of shine to come off in the next few years.

I feel like I am witnessing the beginning of a global collapse. In the middle of a financial crisis people keep insisting on electing those who want to increase spending and tax rates to rediculous levels when it was these very things that bankrupted their economies to begin with. I really hope America doesn't follow in their foot steps come November.

It was not spending and taxation alone that has done in the EMU. Internal imbalances caused by forming a currency union without a fiscal union were the root causes.

#13

I understand that the crisis differs from europe to america and I do understand that the reasons behind each are more complex then my post may have implied yet both had one very large common factor.... Overspending whether it was public or private. In America reckless loans and consumer trends coupled with complex transactions at the corporate level finally caught up with reality. In europe the vast overspending on government programs and benefits was a major factor. While these may not be the sole causes they were huge catalysts that seem to just keep on thriving because people don't want to suffer through reforms or lifestyle changes and would rather just repeat the process of overspending. The scariest part of the trend is now that people are asking where the money will come from more and more politicians and other powerful figures say the rich should pay. This is socialism and socialism fails.

#15

If we want to study cause/effect relationships, "unaffordable house prices/cost of living vs. median income" is part of the cause of the economic boom. When people are forced to work harder to eek out a living, production increases relative to consumption, and that is the very definition of economic growth.

On the flipside, gov't subsidies can be defined as "consumption", so if gov't gives those people money so they can afford their cost of living, then consumption is increasing relative to production, this is the opposite of "economic growth".

On the flipside, gov't subsidies can be defined as "consumption", so if gov't gives those people money so they can afford their cost of living, then consumption is increasing relative to production, this is the opposite of "economic growth".

#17

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,490

Total Cats: 4,079

Oh Krugman:

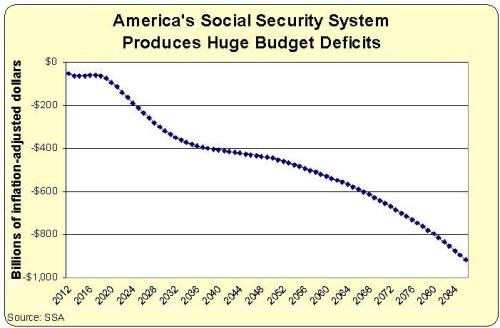

this is the austerity (spending cuts) he speaks of:

The Rahn and Laffer curves are real...keep ignoring them.

The French are revolting. …Mr. Hollande’s victory means the end of “Merkozy,” the Franco-German axis that has enforced the austerity regime of the past two years. This would be a “dangerous” development if that strategy were working, or even had a reasonable chance of working. But it isn’t and doesn’t; it’s time to move on. …What’s wrong with the prescription of spending cuts as the remedy for Europe’s ills? One answer is that the confidence fairy doesn’t exist — that is, claims that slashing government spending would somehow encourage consumers and businesses to spend more have been overwhelmingly refuted by the experience of the past two years. So spending cuts in a depressed economy just make the depression deeper.

this is the austerity (spending cuts) he speaks of:

The Rahn and Laffer curves are real...keep ignoring them.

Last edited by Braineack; 05-08-2012 at 11:47 AM.

Thread

Thread Starter

Forum

Replies

Last Post