lets bore each other to death

#142

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Scrappy, do you fundamentally believe in top-down central control of the money supply, or do you think competing central banks would result in a more stable economy? I understand that you believe that Chartalism is the best system for describing how the system works as-is today....

The current system in the USA is a symbiotic system (parasitic or mutually beneficial depending on who you ask) between the private and governmental sectors.

B) I really don't have a good answer for that as it is so outside of my realm of probable application. It's just not something I'm willing to devote resources (time and energy) researching and contemplating enough to give a thoughtful response to.

#143

A) It is top-down central control because the central bank has monopoly power granted by gov't. Specifically the legal tender laws, and the CB's power over interest rates and the money supply. Yes absolutely there is a symbiotic relationship between gov't and central banking (and some sectors/and politically connected corporations within the financial industry), ... just look at how CB's have enabled wars... and this manipulation of the free market is to the detriment of everyone else (if you look at Austrian school analysis). Really the "choice" I pointed out is more correctly framed as "top down central control" vs. no gov't granted monopoly central bank (and the possible alternatives, one of which is to have competing central banks).

B) Interesting that you are very knowledgeable about Chartalism and the monetary system, yet it sounds like you have never questioned the very assumption that there should even *be* a (monopoly) central bank... nor the history that led to its creation.

B) Interesting that you are very knowledgeable about Chartalism and the monetary system, yet it sounds like you have never questioned the very assumption that there should even *be* a (monopoly) central bank... nor the history that led to its creation.

#145

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

You could think of it like the difference between practical engineering and theoretical physics. I get paid to make people money in the realities of the present, not to sit and theorize on hypothetical alternate realities that may or may not be superior.

My job is to try and understand and act based on what is, not to theorize or advocate for what I think should be.

#148

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

I saw that. A bummer, but not hard to imagine in a small community on the fringe of US politics. It would be like voter fraud in Puerto Rico - I don't think anyone would be surprised at that.

It also wouldn't be a surprise if the incumbent won simply because she had the local political machine behind her in greater force.

It also wouldn't be a surprise if the incumbent won simply because she had the local political machine behind her in greater force.

#150

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

In the 2009-10 tax year, more than 16,000 people declared an annual income of more than £1 million to HM Revenue and Customs.

This number fell to just 6,000 after Gordon Brown introduced the new 50% top rate of income tax shortly before the last general election.

This number fell to just 6,000 after Gordon Brown introduced the new 50% top rate of income tax shortly before the last general election.

#151

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

And by trying to cut spending and raise taxes (both of which take money out of the economy) during slow periods of economic growth - aka "getting their fiscal house in order" and trying to better balance their budget - the UK has slipped in and out of negative GDP growth.

Meanwhile, the USA took stronger, quicker deficit spending action than either the UK, the EMU or Japan in the '90s and we continue to crawl out of the worst recession since the Great Depression.

But some day, some day! we are going to face hyperinflation. I can't explain the actual mechanisms or operational process that will lead to it, but I know debt and deficits are evil boogeymen and they will definitely lead to the collapse of American civilization as we currently know it.

Some day.

Meanwhile, the USA took stronger, quicker deficit spending action than either the UK, the EMU or Japan in the '90s and we continue to crawl out of the worst recession since the Great Depression.

But some day, some day! we are going to face hyperinflation. I can't explain the actual mechanisms or operational process that will lead to it, but I know debt and deficits are evil boogeymen and they will definitely lead to the collapse of American civilization as we currently know it.

Some day.

#153

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

here scrappy, this is just for you

NWFS LANGUAGE. But full of laughs.

NWFS LANGUAGE. But full of laughs.

The torjan horse is the bailout; never trust a greek who's broke. Everybody's saying that Greece is going to crumble the EU union, no, we going to save EU from the German empire trying to rise again. how? banckrupt them. muahahha.

NWFS LANGUAGE. But full of laughs.

NWFS LANGUAGE. But full of laughs.The torjan horse is the bailout; never trust a greek who's broke. Everybody's saying that Greece is going to crumble the EU union, no, we going to save EU from the German empire trying to rise again. how? banckrupt them. muahahha.

#154

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

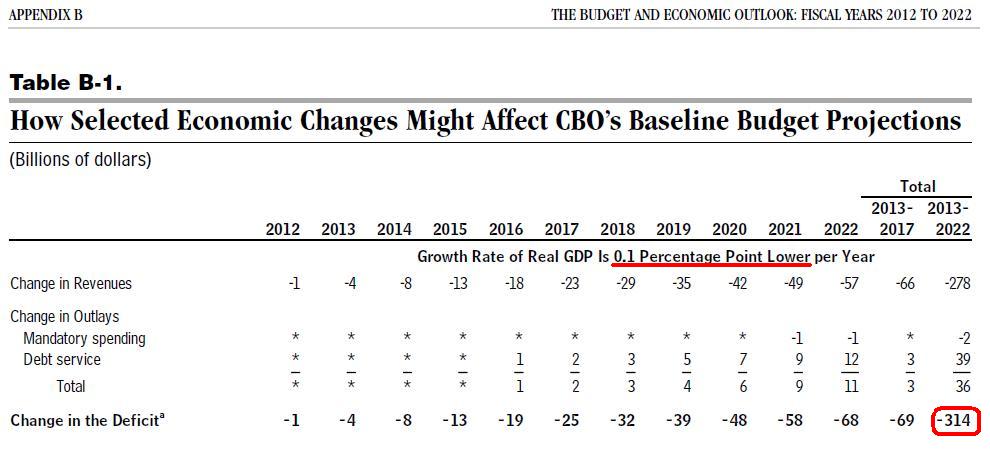

This picture is largely worthless without context.

http://www.cbo.gov/sites/default/fil...12_Outlook.pdf

You want page 126 for an explanation of that chart, including the fact that the highlighted phrase, "Growth Rate of Real GDP Is 0.1 Percentage Point Lower per Year" is the assumption the CBO built in.

It is not a projection or result of a projection.

In other words, that chart says, "If we assume real GDP growth is 0.1% lower per year, here is what we think would happen to Revenues, Mandatory Spending and Debt Service."

Said another way, that chart is virtually non-applicable to the discussion.

http://www.cbo.gov/sites/default/fil...12_Outlook.pdf

You want page 126 for an explanation of that chart, including the fact that the highlighted phrase, "Growth Rate of Real GDP Is 0.1 Percentage Point Lower per Year" is the assumption the CBO built in.

It is not a projection or result of a projection.

In other words, that chart says, "If we assume real GDP growth is 0.1% lower per year, here is what we think would happen to Revenues, Mandatory Spending and Debt Service."

Said another way, that chart is virtually non-applicable to the discussion.

#156

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Oh, cool. Then you agree that raising taxes and cutting spending during slow economic growth is likely to reduce economic growth even further.

Ergo, attempting to balance the budget during a period of weak economic growth (such as we have now) would be a bad thing. Glad to see you are coming around.

Ergo, attempting to balance the budget during a period of weak economic growth (such as we have now) would be a bad thing. Glad to see you are coming around.

#159

Here's food for thought. The 1920-1921 recession was deep, but was followed by a quick recovery. Austrians say that it's because the gov't and the FedRes didn't intervene (no stimulus, no spending, no bailouts). Compare this with all recessions since.

Here is Tom Woods' take on it:

"Warren Harding and the Forgotten Depression of 1920"

Warren Harding and the Forgotten Depression of 1920 by Thomas E. Woods, Jr.