Modern Poverty Includes A.C. and an Xbox

#22

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,490

Total Cats: 4,079

that's what i was looking at, but I did not calculate the net. And please forgive me I'm rusty on my GOP talking points, I went to a liberal Art School full of hippies and took an urban planning class to learn my politics.

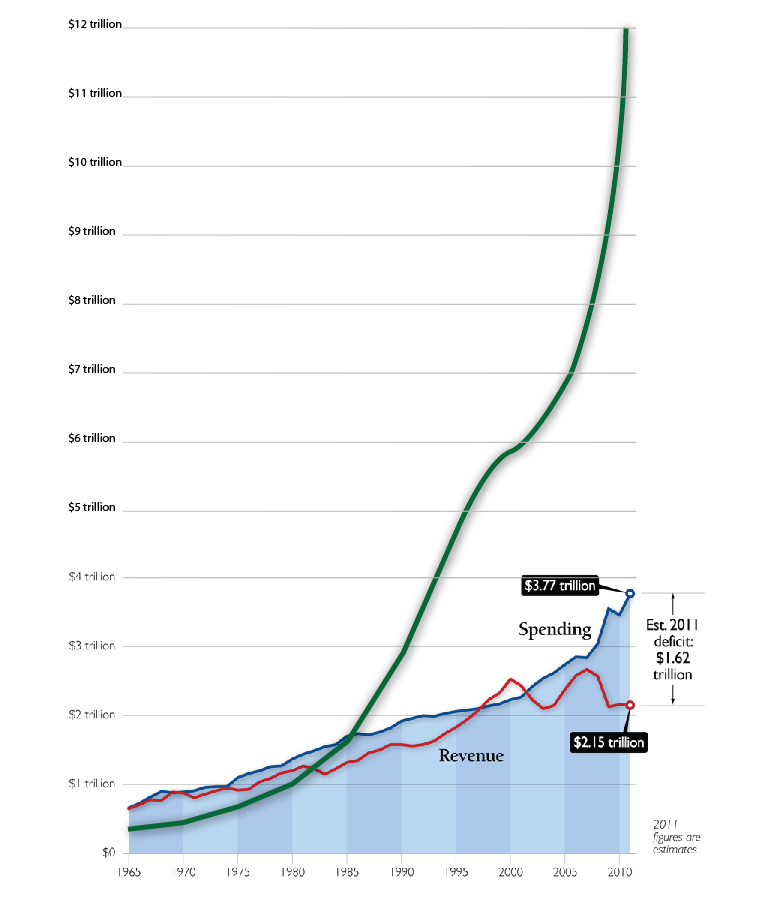

Still doesn't solve the issue: Washington has a spending problem.

Tax cuts don't increase deficits anymore than tax increases decrease deficits.

Deficits are only decreased by spending less.

Increasing taxes to solve our "unstainable" -BB deficit issue is like going to balance your checkbook, finding you are overspending each month, and then going to your boss for a raise and issuing a new credit card as the only solution.

And you must remember, no President can create either a budget deficit or a budget surplus. All spending bills originate in the House and all taxes are voted into law by Congress. This means Bill Clinton did not balance the budget, the Republicans did. This means Reagan didn't increase taxes, the Democrats did (who owned the house his entire term). There's more to it.

All in all, Reagan worked to lower the tax burden and tried to shrink Gov't. And as a result , there was huge economic growth - that's all you need to take away from him. Right now we are doing the opposite and things aren't getting any better, I'd say things are pretty bleak.

To bring it back full circle of the thread. CA makes up 12% of the US population, and 32% of those on welfare - how many of those do you suppose are exaggrating their "needs?"

Last edited by Braineack; 07-20-2011 at 10:11 AM.

#23

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Some good dialogue and info in this thread. I am in agreement with Savington about the phrasing of the criticism from the National Review author.

Hey Sav - I looked through your link but could not find the listing for effective tax rates. I think it is important to consider both the marginal and the effective, rather than one or the other.

Likewise, I think it is important to consider both Federal income and payroll taxation.

That's the top rate, which tells you almost nothing about the effective tax rates on various income groups. I actually did the math using this page, including the 33% bubble for '88.

Likewise, I think it is important to consider both Federal income and payroll taxation.

#24

Friedrich Hayek made this argument decades ago - as long as those who are worst off have enough to live decently, society is better off with an income distribution that is wide, because those at the upper end defray the cost of experiments in living which eventually can be made more cheaply as a result, and become affordable to the whole population.

Last edited by JasonC SBB; 07-26-2011 at 12:28 PM.

#27

Elite Member

iTrader: (21)

Join Date: Jun 2007

Location: Rochester, NY

Posts: 6,593

Total Cats: 1,259

"representative government"? In name only. Have you ever tried to talk to a state office holder? Damn near impossible. Hell, it's hard enough to get a hold of a local gov't official (other than a county clerk or similar) to get a straight answer.

The federal gov't is so out of touch with the way most people live (budgets, anyone?) that I consider them the #1 threat to my freedom and happiness in the world.

The federal gov't is so out of touch with the way most people live (budgets, anyone?) that I consider them the #1 threat to my freedom and happiness in the world.

#29

One of the best investments in real estate to be had is renting to the poor. 90% of the rent guaranteed by the US government and the ability to overinflate rental costs. All the while your tenants are pumping out kids, chomping on cheetos while playing xbox, and making cash under the table to cover the measly 10% they don't even need to pay you. What a beautiful life.

#31

"representative government"? In name only. Have you ever tried to talk to a state office holder? Damn near impossible. Hell, it's hard enough to get a hold of a local gov't official (other than a county clerk or similar) to get a straight answer.

The federal gov't is so out of touch with the way most people live (budgets, anyone?) that I consider them the #1 threat to my freedom and happiness in the world.

The federal gov't is so out of touch with the way most people live (budgets, anyone?) that I consider them the #1 threat to my freedom and happiness in the world.

http://en.wikipedia.org/wiki/Subsidiarity

Subsidiarity is an organizing principle that matters ought to be handled by the smallest, lowest or least centralized competent authority.

It is astounding to me how so many people cling on to "let's change the Federal Gov't", instead of "let's exert our State's 10th Amendment Rights". Especially the liberals. They somehow believe that more centralized power is better to go with their belief in the big-benevolent-government unicorn.

Check out

http://www.tenthamendmentcenter.com/

#33

Can one of the "increase taxes" types here explain why the gov't can't be rolled back to year 2000 levels of spending? What has the gov't done for you now that it couldn't back in 2000? (Yes I would start by pulling troops out of Iraq, Afghanistan, and Libya, as well as the other 100-odd countries we're in).

#35

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Hey Sav - I looked through your link but could not find the listing for effective tax rates. I think it is important to consider both the marginal and the effective, rather than one or the other.

Likewise, I think it is important to consider both Federal income and payroll taxation.

Likewise, I think it is important to consider both Federal income and payroll taxation.

#37

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,490

Total Cats: 4,079

“To make matters worse, the recession meant that there was less money coming in, and it required us to spend even more.”

“Now, every family knows that a little credit card debt is manageable. But if we stay on the current path, our growing debt could cost us jobs and do serious damage to the economy.”

“For the last decade, we have spent more money than we take in.”

“Let’s cut defense spending at the Pentagon by hundreds of billions of dollars.”

“Finally, let’s ask the wealthiest Americans and biggest corporations to give up some of their tax breaks and special deductions.”

“The only reason this balanced approach isn’t on its way to becoming law right now is because a significant number of Republicans in Congress are insisting on a cuts-only approach – an approach that doesn’t ask the wealthiest Americans or biggest corporations to contribute anything at all.”

“Understand – raising the debt ceiling does not allow Congress to spend more money.”

Thread

Thread Starter

Forum

Replies

Last Post

StratoBlue1109

Miata parts for sale/trade

21

09-30-2018 01:09 PM

chris101

Miata parts for sale/trade

2

10-09-2015 09:08 AM