The Current Events, News, and Politics Thread

#2241

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

In what way is the Federal Reserve "propping [it] up?"

#2242

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

How much you wanna bet CBS lobbied for this extra regulation and qrgued that it was for the poor or the common good or someting silly that silly people acutally believe?

A new report out of Pivotal Research Group investment analysts indicates that broadcasting giant CBS could be set to make $1 billion per year in retransmission fees, aided by a pro-broadcaster Federal Communications Commission (FCC) and a highly regulated TV marketplace regime that critics charge is minimally reflective of free market principles:

http://mobile.multichannel.com/artic...hp?rssid=20059

http://mobile.multichannel.com/artic...hp?rssid=20059

#2243

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,026

Total Cats: 6,592

So, let me see if I correctly understand the argument being made here:

1: Local network affiliates spend money to obtain programming, whether it be locally-originated (eg, local news, community-interest, etc), sourced from the parent network (eg, prime-time entertainment), or sourced from a third-party syndicator (eg, re-runs of Seinfeld.) They expect to profit from this by selling advertising time and by selling re-transmission rights.

2: Cable distribute programming to subscribers, and must generally obtain this programming from other sources such as "cable networks" (ESPN, HBO, etc), syndicators (pay-per-view, video-on-demand, etc), and local network affiliates. They expect to profit from this by selling advertising time and by charging subscription fees.

3: Cable operators should be allowed to pirate the signals transmitted by network affiliates (eg, re-distribute them for profit without paying for them).

4: By the same logic, I assume that cable operators should also be allowed to pirate HBO, ESPN, Speed Network, the Discovery Channel, etc. And since individual consumers "should" have more rights than corporations, it stands to reason that we should be able to obtain cable / satellite service for free as well.

Oh, wait- that wouldn't work.

In fact, the author seems to be suggesting that the government should restrain commerce by preventing network affiliates and cable operators from conducting business with one another. How exactly is that reflective of "free market principles"?

What that article fails to mention is that the government does not force cable operators to pay network affiliates. The full law allows network affiliates to make one of two choices:

1: The network affiliate may give its programming to the cable operator for free, with the requirement that the cable operator carry it. This is called "must carry" and was specifically designed to ensure that local programming and news was available to cable subscribers.

2: The network affiliate may forgo the protection of must carry, and instead negotiate with the cable operator to receive payment for their programming. Under this election, the cable operator may choose not to carry the signal. This is "re-transmission consent."

To me, that sounds like a pretty good example of a "free market."

1: Local network affiliates spend money to obtain programming, whether it be locally-originated (eg, local news, community-interest, etc), sourced from the parent network (eg, prime-time entertainment), or sourced from a third-party syndicator (eg, re-runs of Seinfeld.) They expect to profit from this by selling advertising time and by selling re-transmission rights.

2: Cable distribute programming to subscribers, and must generally obtain this programming from other sources such as "cable networks" (ESPN, HBO, etc), syndicators (pay-per-view, video-on-demand, etc), and local network affiliates. They expect to profit from this by selling advertising time and by charging subscription fees.

3: Cable operators should be allowed to pirate the signals transmitted by network affiliates (eg, re-distribute them for profit without paying for them).

4: By the same logic, I assume that cable operators should also be allowed to pirate HBO, ESPN, Speed Network, the Discovery Channel, etc. And since individual consumers "should" have more rights than corporations, it stands to reason that we should be able to obtain cable / satellite service for free as well.

Oh, wait- that wouldn't work.

In fact, the author seems to be suggesting that the government should restrain commerce by preventing network affiliates and cable operators from conducting business with one another. How exactly is that reflective of "free market principles"?

What that article fails to mention is that the government does not force cable operators to pay network affiliates. The full law allows network affiliates to make one of two choices:

1: The network affiliate may give its programming to the cable operator for free, with the requirement that the cable operator carry it. This is called "must carry" and was specifically designed to ensure that local programming and news was available to cable subscribers.

2: The network affiliate may forgo the protection of must carry, and instead negotiate with the cable operator to receive payment for their programming. Under this election, the cable operator may choose not to carry the signal. This is "re-transmission consent."

To me, that sounds like a pretty good example of a "free market."

#2247

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

#2249

Anti-Romney Protesters paid to Heckle (by unions):

http://www.buzzfeed.com/mckaycoppins...paid-to-heckle

So funny on so many levels, but the best is that the female paid-heckler got $7.25/hr while her male counterpart made $17.

http://www.buzzfeed.com/mckaycoppins...paid-to-heckle

So funny on so many levels, but the best is that the female paid-heckler got $7.25/hr while her male counterpart made $17.

#2253

The smartest guys in the room have built a house of cards. If that doesn't have you running for the door, I don't know what will.

Personally, the only things that keep me from running are the numbing use of the word "Trillion" over and over again by the media. I'm somewhat immune to the shock now, and so when they finally come on and say a trillion zombies are coming for my family and myself, I'll probably fret because we don't have enough plastic sporks to accomodate all those flesh-eating jack-asses.

There's a leak in the White House--ALL THE WAY AT THE TOP--that's given out information that has gotten people tortured and killed in Iran, there's a second little case out of Mexico having to do with guns and an American was killed--oh about 300 Mexicans were killed too, but that's barely germain to the argument. If there's already been perjury, obstruction and there's no executive privilege, well then we can just call it "judicial misconduct". Over 300 dead sounds worse than "judicial misconduct". Hope that gets swept under the rug.

Europe seems so far away, and it's the brotherly thing to do to prop up these governments, right? Technically the American people (just the ones paying taxes) are on the hook, but it's the right thing to do right? Probably. The FED isn't known for having live hearings to discuss this stuff, but we should all just TRUST that they're doing what's best for us, right?

Awww, I fell much better now. I'll be sleeping like a BABY tonight.

Personally, the only things that keep me from running are the numbing use of the word "Trillion" over and over again by the media. I'm somewhat immune to the shock now, and so when they finally come on and say a trillion zombies are coming for my family and myself, I'll probably fret because we don't have enough plastic sporks to accomodate all those flesh-eating jack-asses.

There's a leak in the White House--ALL THE WAY AT THE TOP--that's given out information that has gotten people tortured and killed in Iran, there's a second little case out of Mexico having to do with guns and an American was killed--oh about 300 Mexicans were killed too, but that's barely germain to the argument. If there's already been perjury, obstruction and there's no executive privilege, well then we can just call it "judicial misconduct". Over 300 dead sounds worse than "judicial misconduct". Hope that gets swept under the rug.

Europe seems so far away, and it's the brotherly thing to do to prop up these governments, right? Technically the American people (just the ones paying taxes) are on the hook, but it's the right thing to do right? Probably. The FED isn't known for having live hearings to discuss this stuff, but we should all just TRUST that they're doing what's best for us, right?

Awww, I fell much better now. I'll be sleeping like a BABY tonight.

#2254

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

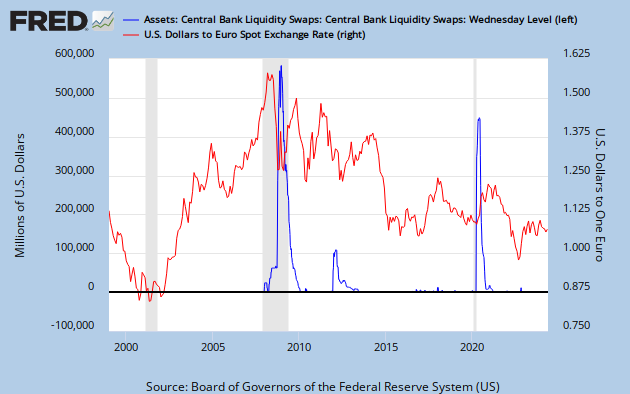

There was a small spike in the beginning of 2012 that has fallen off significantly and was still way smaller than the 2008-2009 amount. Meanwhile, the euro has fallen and is worth less (relative to the dollar) than at the beginning of 2011.

If the Federal Reserve is trying to prop up the value of the euro relative to the dollar, it is failing. More likely, that is not the intention of opening the Fed swap lines to multiple currencies.

I think you are misunderstanding a couple of things, both of which are completely unintuitive and/or complicated so it makes sense to misunderstand. I "live and breath" finance and economics (professionally) and struggle to wrap my head around some of this stuff [edit: and a lot of what I was originally taught and many colleagues operate under was wrong or outdated].

First, the Federal Reserve swap lines that are open to multiple currencies are largely a non-issue and are there to provide dollar funding for the central banks of a few European countries, not all of whom are in the EMU currency system (like the UK and Switzerland).

Second, worst case scenario: the Federal Reserve participates in a swap of dollars for euros and the EMU dissolves as each member nation returns to its own sovereign currency, leaving the Fed holding a few billion of now worthless euro-denominated 0s and 1s on its spreadsheet.

What effect would that have on the US economy?

#2255

Second, worst case scenario: the Federal Reserve participates in a swap of dollars for euros and the EMU dissolves as each member nation returns to its own sovereign currency, leaving the Fed holding a few billion of now worthless euro-denominated 0s and 1s on its spreadsheet.

What effect would that have on the US economy?

What effect would that have on the US economy?

...except that, those dollars are now held in foreign hands. Inflationary, then? The money supply was increased and spent into the hands of those from whom it cannot be taxed.

#2259

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Mark has it correct. The Federal Reserve never initiates fiscal policy (i.e. "direct government spending" like infrastructure, military or social welfare spending) so any money they spend does not take away money from anything Congress initiates.

In the worst case scenario of a complete dissolution of the EMU and the euro currency, there will have been a direct injection of X number of dollars equal to the swaps denominated in euros (net of those denominated in dollars, British pounds, Swiss francs, etc). That will be inflationary to the monetary base, but not necessarily to prices (it may or may not be, depending on other conditions). The money multiplier is mostly a myth - especially in times of deleveraging.

The Federal Reserve's "loss" will have zero impact on the economy or anything else as they mark down their spreadsheet.

Look at the graph I posted again. Note the blue line. It represents reality. Now note the graph below from one of the many sites making a lot of money by selling fear and dismay:

This is the same sort of analysis that has been predicting major inflation and imminently rising interest rates for the past 4+ years. These are the same people that (understandably) do not fully appreciate that the USA - on a Federal level - is not comparably to a household or corporation or state (or country inside the EMU).

They are consistently wrong in their fearmongering (because they are consistently wrong in their analysis) so you shouldn't lose sleep over their doomsday predictions. Lots of things can go badly, but they won't be for the reasons most of those types are claiming.

Now back to your regularly scheduled "all government is bad, THEY TOOK OUR JOBS!, the American dream is over, I wish things were as good today as they were in the 1960s/1910, etc" programming.

Last edited by Braineack; 10-08-2019 at 09:48 AM.

#2260

In a nutshell, what? I am not necessarily a fan of opening the Fed swap lines to foreign currencies but probably for entirely different reasons than you or the WSJ.

Mark has it correct. The Federal Reserve never initiates fiscal policy (i.e. "direct government spending" like infrastructure, military or social welfare spending) so any money they spend does not take away money from anything Congress initiates.

In the worst case scenario of a complete dissolution of the EMU and the euro currency, there will have been a direct injection of X number of dollars equal to the swaps denominated in euros (net of those denominated in dollars, British pounds, Swiss francs, etc). That will be inflationary to the monetary base, but not necessarily to prices (it may or may not be, depending on other conditions). The money multiplier is mostly a myth - especially in times of deleveraging.

The Federal Reserve's "loss" will have zero impact on the economy or anything else as they mark down their spreadsheet.

...

Mark has it correct. The Federal Reserve never initiates fiscal policy (i.e. "direct government spending" like infrastructure, military or social welfare spending) so any money they spend does not take away money from anything Congress initiates.

In the worst case scenario of a complete dissolution of the EMU and the euro currency, there will have been a direct injection of X number of dollars equal to the swaps denominated in euros (net of those denominated in dollars, British pounds, Swiss francs, etc). That will be inflationary to the monetary base, but not necessarily to prices (it may or may not be, depending on other conditions). The money multiplier is mostly a myth - especially in times of deleveraging.

The Federal Reserve's "loss" will have zero impact on the economy or anything else as they mark down their spreadsheet.

...