The Current Events, News, and Politics Thread

#3901

I'm simply calling bullshit on your charts. That's all. lowering tax rates, especially across the board, has historically raised tax revenues. Kennedy, Reagan, Bush, all of them. Sure, there were other issues at hand; there always are. The inverse has been true since they've kept records. Hell, go back see what happened to Rome.

Your charts = bullshit

Let me now go on record to say that while I'm virally anti-Socialist redistribution, the Republicans can suck it too. Government at our current size is bad, whether blue or red.

Your charts = bullshit

Let me now go on record to say that while I'm virally anti-Socialist redistribution, the Republicans can suck it too. Government at our current size is bad, whether blue or red.

Furthermore, the receipts from individual income taxes (the only receipts directly affected by the tax cuts) went up a lower 91.3 percent during the 80's. Meanwhile, receipts from Social Insurance, which are directly affected by the FICA tax rate, went up 140.8 percent. This large increase was largely due to the fact that the FICA tax rate went up 25% from 6.13 to 7.65 percent of payroll. The reference to the doubling of revenues under Reagan commonly refers to TOTAL revenues. These include the above-mentioned Social Insurance revenues for which the tax rate went UP. It seems highly hypocritical to include these revenues (which were likely bolstered by the tax hike) as proof for the effectiveness of a tax cut.

#3902

It's like magic!!!

From JFK To Bush, Treasury Swelled After 'Tax Cuts For The Rich' - Investors.com

This stuff is so obvious that most thinking liberals wouldn't touch it with a 10' pole, which is why Biden jumped right in during the debates.

The inverse is also painfully true. Look out window. See truth.

From JFK To Bush, Treasury Swelled After 'Tax Cuts For The Rich' - Investors.com

This stuff is so obvious that most thinking liberals wouldn't touch it with a 10' pole, which is why Biden jumped right in during the debates.

The inverse is also painfully true. Look out window. See truth.

#3903

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

You're both right.

Federal tax receipts have generally gone up with tax cuts. They also generally go up after tax increases. They essentially always go up over time on an absolute basis because of economic and population growth.

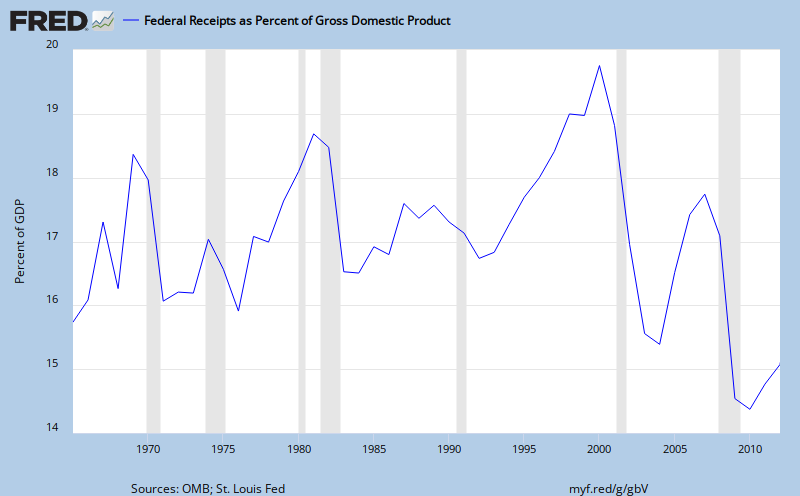

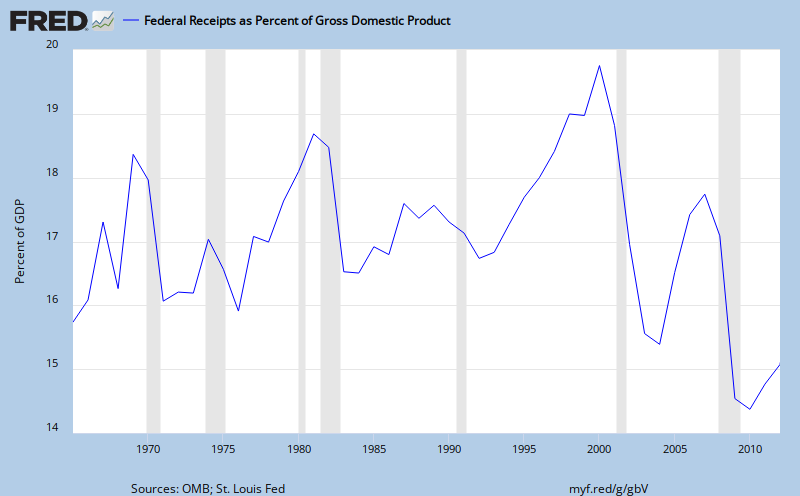

Federal tax receipts as a percent of GDP tend to have less correlation with the tax increases or reductions than most might think.

The reality is, it's very difficult to separate economic growth, contraction, tax increases, tax cuts and Federal receipts. If the economy is in contraction and Washington cuts taxes and then the economy recovers, tax receipts with go up. Did the economy recover because of the tax cuts?

Likewise, if an economy is growing and tax rates are raised, tax receipts might go up as the economic growth continues (potentially at a slower rate, but still growth).

Cord's article cited only decreases in the top marginal income tax bracket. I find that less useful than examining the effective tax rates. If my marginal tax rate is 90% but I have an effective of 30%, that's actually less taxes out of my pocket than a marginal rate of 39% and an effective of 33%.

Federal tax receipts have generally gone up with tax cuts. They also generally go up after tax increases. They essentially always go up over time on an absolute basis because of economic and population growth.

Federal tax receipts as a percent of GDP tend to have less correlation with the tax increases or reductions than most might think.

The reality is, it's very difficult to separate economic growth, contraction, tax increases, tax cuts and Federal receipts. If the economy is in contraction and Washington cuts taxes and then the economy recovers, tax receipts with go up. Did the economy recover because of the tax cuts?

Likewise, if an economy is growing and tax rates are raised, tax receipts might go up as the economic growth continues (potentially at a slower rate, but still growth).

Cord's article cited only decreases in the top marginal income tax bracket. I find that less useful than examining the effective tax rates. If my marginal tax rate is 90% but I have an effective of 30%, that's actually less taxes out of my pocket than a marginal rate of 39% and an effective of 33%.

#3905

The other guys who drive me crazy are the ones who say, "See?! The DOW is at an all-time high! Obama has done such a wonderful job."

The Last Time The Dow Was Here... | Zero Hedge

#3906

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,490

Total Cats: 4,079

But history has proven time and time again that it knows best and always give its citizens the best life ever.

Look how awesome life is in France with 75% tax rate on the rich, the income distribution is so much better and everyone pretty much lives in nirvana. there is never war and unicorns poop rainbows

Look how awesome life is in France with 75% tax rate on the rich, the income distribution is so much better and everyone pretty much lives in nirvana. there is never war and unicorns poop rainbows

#3907

It's like magic!!!

From JFK To Bush, Treasury Swelled After 'Tax Cuts For The Rich' - Investors.com

This stuff is so obvious that most thinking liberals wouldn't touch it with a 10' pole, which is why Biden jumped right in during the debates.

The inverse is also painfully true. Look out window. See truth.

From JFK To Bush, Treasury Swelled After 'Tax Cuts For The Rich' - Investors.com

This stuff is so obvious that most thinking liberals wouldn't touch it with a 10' pole, which is why Biden jumped right in during the debates.

The inverse is also painfully true. Look out window. See truth.

Furthermore, the receipts from individual income taxes (the only receipts directly affected by the tax cuts) went up a lower 91.3 percent during the 80's. Meanwhile, receipts from Social Insurance, which are directly affected by the FICA tax rate, went up 140.8 percent. This large increase was largely due to the fact that the FICA tax rate went up 25% from 6.13 to 7.65 percent of payroll. The reference to the doubling of revenues under Reagan commonly refers to TOTAL revenues. These include the above-mentioned Social Insurance revenues for which the tax rate went UP. It seems highly hypocritical to include these revenues (which were likely bolstered by the tax hike) as proof for the effectiveness of a tax cut.

Finally, FactCheck.org : The Impact of Tax Cuts - feel free to cite actual rigorous studies, with actual sources instead of news sound bites if you want, Cordy. But as always, you are linking nice sound bites with no real content and numerous severe problems in the article.

*: Article's argument made no discussion about adjustments for inflation, GDP growth, et al so this is an assumption. It's a common mantra to only look at absolute numbers - but if we only look at absolute numbers, and not adjusted numbers...ERMAGERDSZ, our current national debt is tens or hundreds of times the budget of 1867, we're all going to die!

You're both right.

Federal tax receipts have generally gone up with tax cuts. They also generally go up after tax increases. They essentially always go up over time on an absolute basis because of economic and population growth.

Federal tax receipts as a percent of GDP tend to have less correlation with the tax increases or reductions than most might think.

The reality is, it's very difficult to separate economic growth, contraction, tax increases, tax cuts and Federal receipts. If the economy is in contraction and Washington cuts taxes and then the economy recovers, tax receipts with go up. Did the economy recover because of the tax cuts?

Likewise, if an economy is growing and tax rates are raised, tax receipts might go up as the economic growth continues (potentially at a slower rate, but still growth).

Cord's article cited only decreases in the top marginal income tax bracket. I find that less useful than examining the effective tax rates. If my marginal tax rate is 90% but I have an effective of 30%, that's actually less taxes out of my pocket than a marginal rate of 39% and an effective of 33%.

Federal tax receipts have generally gone up with tax cuts. They also generally go up after tax increases. They essentially always go up over time on an absolute basis because of economic and population growth.

Federal tax receipts as a percent of GDP tend to have less correlation with the tax increases or reductions than most might think.

The reality is, it's very difficult to separate economic growth, contraction, tax increases, tax cuts and Federal receipts. If the economy is in contraction and Washington cuts taxes and then the economy recovers, tax receipts with go up. Did the economy recover because of the tax cuts?

Likewise, if an economy is growing and tax rates are raised, tax receipts might go up as the economic growth continues (potentially at a slower rate, but still growth).

Cord's article cited only decreases in the top marginal income tax bracket. I find that less useful than examining the effective tax rates. If my marginal tax rate is 90% but I have an effective of 30%, that's actually less taxes out of my pocket than a marginal rate of 39% and an effective of 33%.

Premise: Tax cuts do not pay for themselves in federal tax revenue (Note: I am not saying they do not spur GDP growth, revenue growth, or anything else. My claim is VERY specific that no tax cut in the US's federal government's history has ever paid for itself in tax revenue, although I do not doubt that there are tax cuts who have more than paid for themselves in GDP Growth/et al as a result. My argument is very, very specific.)

H1: As provided previously, the administration most oft cited for massive growth due to tax cuts included significant tax increases. We cannot logically say "But tax revenue increased" as a whole as a result of this - if I cut one tax by 20%, but raise another tax by 10% - but the other tax's base is twice as large as the first, it's not a wise argument to make.

H2: Due to published public data based on tax revenue, we can extrapolate specific taxes from year to year from a specific tax source. Thus, we can demonstrate if a specific tax cut resulted in that increased tax revenue specifically, or a specific tax increase resulted in decreased tax revenue (See: Reagan's various tax increases, such as a FICA increase, while decreasing other taxes).

H3: We need to adjust for inflation and similar adjustments in ANY numbers used - using absolute numbers is retarded, see previous 1863 budget mention.

Anyways, what I'm getting at Scrappy. Looking at just one metric that is easily proven seriously flawed is retarded, we have to look at more than just one metric, and the metrics used must be adjusted. The article that Cordy links, as an example, uses absolute, non-adjusted numbers (Or if it is adjusted, it does not state it). The peak tax cut #'s it cites comes years later - and when they are adjusted for inflation and tax increases (Kennedy had a 10% income tax surcharge in '69, and that's when Kenndy's tax revenues soared), they are lower than the post-tax cut numbers. These statements are based solely on IRS numbers. To say they are bullshit is to say the IRS and the government is lying about the tax revenues it received, as well calls bullshit on the very data Cordy is advocating from.

Explaining Cordy's oft-cited numbers.

It's entirely possible to look at specific Reagan tax cuts, as well as specific Reagan tax increases. I've provided that previously. We can further adjust those for inflation.

Once adjusted for inflation, Reagan's GDP growth was lower than the previous decade and roughly the same as the next decade of growth. Reagan's tax cuts were, in general after adjustment, a net tax revenue decrease (See the articles for in-depth info there), and Reagan's tax increases were, in general after adjustment, a net tax revenue increase.

Quoted is a more lengthly explanation.

The above table shows that Reagan's initial tax cut in 1981 was estimated to have a large negative effect on revenues. This is apparent in the graph titled "Receipts and Selected Tax Rates" at recsrc11.html which shows a sharp drop in individual income tax revenues from 1982 to 1984. This drop was arguably a major motivation for the Tax Equity and Fiscal Responsibility Act of 1982 and the Deficit Reduction Act of 1984, both of which had a positive effect on revenues and helped to stabilize them. The Tax Reform Act of 1986 (which cut the top marginal rate from 50 to 28 percent), however, appeared to have only a slight effect on revenues. How could this be? The answer lies in looking more closely at the provisions in the two tax bills. Following are the provisions listed by the Treasury document for the 1981 tax bill:

Economic Recovery Tax Act of 1981

phased-in 23% cut in individual tax rates; top rate dropped from 70% to 50%

accelerated depreciation deductions; replaced depreciation system with ACRS

indexed individual income tax parameters (beginning in 1985)

created 10% exclusion on income for two-earner married couples ($3,000 cap)

phased-in increase in estate tax exemption from $175,625 to $600,000 in 1987

reduced Windfall Profit taxes

allowed all working taxpayers to establish IRAs

expanded provisions for employee stock ownership plans (ESOPs)

replaced $200 interest exclusion with 15% net interest exclusion ($900 cap) (begin in 1985)

As can be seen, all of the provisions are effectively tax cuts. On the other hand, following are the provisions listed by the document for the 1986 tax bill:

Tax Reform Act of 1986

reduced individual income tax rates (top rate 28%) and repealed capital gains exclusion

repealed investment tax credit

lowered corporation income tax rates; top rate lowered to 34 percent

increased personal exemption amount from $1,080 to $2,000

set uniform capitalization rules for manufacturing or construction

increased standard deduction from $3,670 to $5,000 (joints)

limited deduction for nonbusiness interest

repealed second earner deduction

limited passive losses

established income limits on use of IRAs for taxpayers covered by pensions

revised corporate minimum tax

repealed sales tax deduction for individuals

set 2-percent floor on miscellaneous itemized deductions

As can be seen, a number of these provisions are effectively tax hikes, offsetting the additional cuts in the tax rates. Those provisions include items 2, 7 through 10, 12, 13, and the second half of item 1 (repeal of the capital gains exclusion). That is likely the major reason why revenues did not fall further. In any case, this shows that the top marginal rate does not always tell the whole story about the level of individual income taxes.

Economic Recovery Tax Act of 1981

phased-in 23% cut in individual tax rates; top rate dropped from 70% to 50%

accelerated depreciation deductions; replaced depreciation system with ACRS

indexed individual income tax parameters (beginning in 1985)

created 10% exclusion on income for two-earner married couples ($3,000 cap)

phased-in increase in estate tax exemption from $175,625 to $600,000 in 1987

reduced Windfall Profit taxes

allowed all working taxpayers to establish IRAs

expanded provisions for employee stock ownership plans (ESOPs)

replaced $200 interest exclusion with 15% net interest exclusion ($900 cap) (begin in 1985)

As can be seen, all of the provisions are effectively tax cuts. On the other hand, following are the provisions listed by the document for the 1986 tax bill:

Tax Reform Act of 1986

reduced individual income tax rates (top rate 28%) and repealed capital gains exclusion

repealed investment tax credit

lowered corporation income tax rates; top rate lowered to 34 percent

increased personal exemption amount from $1,080 to $2,000

set uniform capitalization rules for manufacturing or construction

increased standard deduction from $3,670 to $5,000 (joints)

limited deduction for nonbusiness interest

repealed second earner deduction

limited passive losses

established income limits on use of IRAs for taxpayers covered by pensions

revised corporate minimum tax

repealed sales tax deduction for individuals

set 2-percent floor on miscellaneous itemized deductions

As can be seen, a number of these provisions are effectively tax hikes, offsetting the additional cuts in the tax rates. Those provisions include items 2, 7 through 10, 12, 13, and the second half of item 1 (repeal of the capital gains exclusion). That is likely the major reason why revenues did not fall further. In any case, this shows that the top marginal rate does not always tell the whole story about the level of individual income taxes.

Last edited by blaen99; 03-05-2013 at 12:21 PM.

#3908

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,490

Total Cats: 4,079

My claim is VERY specific that no tax cut in the US's federal government's history has ever paid for itself in tax revenue, although I do not doubt that there are tax cuts who have more than paid for themselves in GDP Growth/et al as a result. My argument is very, very specific.)

1 Why do tax cuts have to pay for themselves in tax revenue?

2. Is that even the point?

#3909

Holy crap Blaen! Was that a post or a dissertation?

In response I will just say that you should be horse-whipped for even introducing 'Factcheck.org' into the hallowed halls of MT.

And this, ladies and gentlemen, is the mental gymnastics required to offset the simple beauty of the Laffer Curve.

In response I will just say that you should be horse-whipped for even introducing 'Factcheck.org' into the hallowed halls of MT.

And this, ladies and gentlemen, is the mental gymnastics required to offset the simple beauty of the Laffer Curve.

#3910

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

You might as well be trying to convince a devout Catholic that there is no such thing as God, Jesus, Heaven and Hell. Cord holds strong beliefs. These beliefs are unwavering.

I looked out my window. Taxes went up on everyone this year and there were waits for dinner on Friday, lunch on Saturday and lunch on Sunday. Home prices are going up in my neighborhood and have been for the past year. My clients are making more money.

Ergo, raising taxes is good for the economy.

How would you expect to see the counter premise proved? That is, if I posit that "Federal income tax rate reductions pay for themselves in Federal tax revenue," how would I prove that?

I don't think you can prove or disprove it. I think there are far too many variables at play to say conclusively one way or the other. I also think where on Braineack's Lafferer Curve you are makes a difference. Going from 50% effective to 30% effective is probably going to be different than going from 30% effective to 25% effective. Likewise, the inverse.

I think you make a fair point, but I would argue several politicians have pitched tax rate cuts as doing just that ("paying for themselves").

I looked out my window. Taxes went up on everyone this year and there were waits for dinner on Friday, lunch on Saturday and lunch on Sunday. Home prices are going up in my neighborhood and have been for the past year. My clients are making more money.

Ergo, raising taxes is good for the economy.

Premise: Tax cuts do not pay for themselves in federal tax revenue (Note: I am not saying they do not spur GDP growth, revenue growth, or anything else. My claim is VERY specific that no tax cut in the US's federal government's history has ever paid for itself in tax revenue, although I do not doubt that there are tax cuts who have more than paid for themselves in GDP Growth/et al as a result. My argument is very, very specific.)

I don't think you can prove or disprove it. I think there are far too many variables at play to say conclusively one way or the other. I also think where on Braineack's Lafferer Curve you are makes a difference. Going from 50% effective to 30% effective is probably going to be different than going from 30% effective to 25% effective. Likewise, the inverse.

Federal tax receipts as a percent of GDP tend to have less correlation with the tax increases or reductions than most might think.

[img]http://research.stlouisfed.org/fredgraph.png?g=gbV[img]

The reality is, it's very difficult to separate economic growth, contraction, tax increases, tax cuts and Federal receipts. If the economy is in contraction and Washington cuts taxes and then the economy recovers, tax receipts with go up. Did the economy recover because of the tax cuts?

Likewise, if an economy is growing and tax rates are raised, tax receipts might go up as the economic growth continues (potentially at a slower rate, but still growth).

[img]http://research.stlouisfed.org/fredgraph.png?g=gbV[img]

The reality is, it's very difficult to separate economic growth, contraction, tax increases, tax cuts and Federal receipts. If the economy is in contraction and Washington cuts taxes and then the economy recovers, tax receipts with go up. Did the economy recover because of the tax cuts?

Likewise, if an economy is growing and tax rates are raised, tax receipts might go up as the economic growth continues (potentially at a slower rate, but still growth).

#3911

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,490

Total Cats: 4,079

Those guys just need to be better at networking:

Email tells feds to make sequester as painful as promised - Washington Times

#3912

I can understand an argument about where on the Laffer curve we are at this moment, but not an argument over whether there exists a point on the Laffer curve at which a tax cut would result in a tax revenue increase.

#3914

[QUOTE=Scrappy Jack;985934]You might as well be trying to convince a devout Catholic that there is no such thing as God, Jesus, Heaven and Hell. Cord holds strong beliefs.

The point is that this is the WRONG VENUE to discuss intricate economic policy. What you end up with is what you see--nonsense.

"Wait, you ignored the point I made in the fourth paragraph."

"You clearly didn't read to the bottom of that Mother Jones article."

"My chart clearly disproved your chart."

Nonsense.

The point is that this is the WRONG VENUE to discuss intricate economic policy. What you end up with is what you see--nonsense.

"Wait, you ignored the point I made in the fourth paragraph."

"You clearly didn't read to the bottom of that Mother Jones article."

"My chart clearly disproved your chart."

Nonsense.

#3915

Hugo Chavez, passionate but polarizing Venezuelan president, dead at 58 - The Washington Post

Chavez is dead.

The Washington Post's reporter, Juan Forero, sounds like he has a chubby for Hugo Chavez. But then again, it's the WaPo...

He could have written this:

http://pjmedia.com/blog/the-chavez-legacy-in-venezuela/

Chavez is dead.

The Washington Post's reporter, Juan Forero, sounds like he has a chubby for Hugo Chavez. But then again, it's the WaPo...

He could have written this:

http://pjmedia.com/blog/the-chavez-legacy-in-venezuela/

Last edited by cordycord; 03-05-2013 at 07:07 PM.

#3916

Kerry Stammers: 'Can't Answer' Why No One Allowed To Interview Benghazi Survivors

Really....is anybody curious? If one of the 25 survivors wanted to talk to the press, WOULD WE KNOW ABOUT IT?

Really....is anybody curious? If one of the 25 survivors wanted to talk to the press, WOULD WE KNOW ABOUT IT?

#3917

or that Obama was born in the US

or that Obama was born in the US  . I didn't connect it until you put it that way.

. I didn't connect it until you put it that way.

I looked out my window. Taxes went up on everyone this year and there were waits for dinner on Friday, lunch on Saturday and lunch on Sunday. Home prices are going up in my neighborhood and have been for the past year. My clients are making more money.

Ergo, raising taxes is good for the economy.

Ergo, raising taxes is good for the economy.

How would you expect to see the counter premise proved? That is, if I posit that "Federal income tax rate reductions pay for themselves in Federal tax revenue," how would I prove that?

See further commentary.

I don't think you can prove or disprove it. I think there are far too many variables at play to say conclusively one way or the other. I also think where on Braineack's Lafferer Curve you are makes a difference. Going from 50% effective to 30% effective is probably going to be different than going from 30% effective to 25% effective. Likewise, the inverse.

I think you make a fair point, but I would argue several politicians have pitched tax rate cuts as doing just that ("paying for themselves").

I'm not calling BS that cutting taxes can stimulate the economy, or give us a myriad of excellent benefits as a country. I'm not calling BS on anything except for the idea that "Tax cuts give us more tax revenue". They never have historically in this country.

However, interestingly, and as a counter-example in one of the articles I linked, Ireland DID see a tax revenue increase from cutting taxes.

It's not impossible to see a tax revenue increase from cutting taxes, it's this specific country that never has seen them on a federal level in modern history* - and I would speculate that it is because our tax cuts are all extremely politically motivated, with the primary gain meant for specific groups rather than to specifically stimulate the economy or to increase tax revenues.

(Edit)*: And to be even more specific, I'm not claiming this is even the case of the US's entire history, just our modern history. I have NO IDEA if this holds true for the country's entire past history, just for the specific timerange I've looked into.

Last edited by blaen99; 03-06-2013 at 12:34 AM.

#3918

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

I looked out my window. Taxes went up on everyone this year and there were waits for dinner on Friday, lunch on Saturday and lunch on Sunday. Home prices are going up in my neighborhood and have been for the past year. My clients are making more money.

Ergo, raising taxes is good for the economy.

Ergo, raising taxes is good for the economy.

Easy. As pointed above, you simply track year to year income tax revenue, offset for items such as inflation.

[...]

I'm not calling BS that cutting taxes can stimulate the economy, or give us a myriad of excellent benefits as a country. I'm not calling BS on anything except for the idea that "Tax cuts give us more tax revenue". They never have historically in this country.

[...]

I'm not calling BS that cutting taxes can stimulate the economy, or give us a myriad of excellent benefits as a country. I'm not calling BS on anything except for the idea that "Tax cuts give us more tax revenue". They never have historically in this country.

Some would argue that the marginal income tax brackets are the only thing they are discussing when they talk about "tax cuts."

Second, I don't think you can make a direct causal link to year-to-year income tax revenue from tax cuts or increases. As we have belabored, there are way too many variables.

Third, even if you did accept that there was a direct causal relationship, I would argue they probably work on a lag and that there are seasonal adjustments that would need to be made for the fact that you have three different time periods (tax year, calendar year, Federal fiscal year).

But, even ASSuming correlation = direct causation, 2010 = 14.92% of GDP and 2011 = 15.28% of GDP (2012 = 15.62%). In 2010, the payroll tax holiday was enacted. So, you have at least one example in which taxes were cut and tax receipts went up.

If you apply a two to three year lag, you find more examples. Keep in mind you are talking about a data set of like 4 marginal income tax reductions since 1960.

#3920

The more recent iron-clad proof of the Laffer Curve are handled similarly, with some really creative charts and graphs.

Bottom line; you don't need to convince everyone, just your own on the Left, who are inclined to believe anyway. Then they can look over at the supply-siders, point, and say "look at those dunces, blindly believing the Laffer Curve even after I've shown them this nifty chart." It's a wonderful circular game.

Obama is playing the "It's not my fault, it's their fault." game to perfection. The amazing thing is that even with trillion dollar + deficits for the past five years, he's yet to cut anything, except White House tours, which are put on by VOLUNTEERS anyway.

Government is bigger, spending more, bringing in more revenue (for now), all with fewer people paying the taxes. This course of action is unsustainable in ANY economic model, but the Left dare not slow down the juggernaut because they're getting their "stick it to the rich" utopian society. Bubble, meet pin.

Government is bigger, spending more, bringing in more revenue (for now), all with fewer people paying the taxes. This course of action is unsustainable in ANY economic model, but the Left dare not slow down the juggernaut because they're getting their "stick it to the rich" utopian society. Bubble, meet pin.