Tax rates, coddling the rich and investors is a tried failed idea.

#1

Elite Member

Thread Starter

Join Date: Jul 2005

Location: Anacortes, WA

Posts: 2,478

Total Cats: 144

Non Partisan Congressional Research Service

http://graphics8.nytimes.com/news/bu...andeconomy.pdf

My theory is income and wealth disparity drastically out of line with real individual contributions to productivity is a major contributor to economy collapse. The corporatist and their Ayn Rand philosophical pursuit of their own self-interest currently mostly backing conservative republican candidates are pushing ideologies to repeat the buildup to the Great Depression of the 1920’s.

“The results of the analysis suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth. The reduction in the top tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie.

However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution. As measured by IRS data, the share of income accruing to the top 0.1% of U.S. families increased from 4.2% in 1945 to 12.3% by 2007 before falling to 9.2% due to the 2007-2009 recession. At the same time, the average tax rate paid by the top 0.1% fell from over 50% in 1945 to about 25% in 2009. Tax policy could have a relation to how the economic pie is sliced—lower top tax rates may be associated with greater income disparities.”

However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution. As measured by IRS data, the share of income accruing to the top 0.1% of U.S. families increased from 4.2% in 1945 to 12.3% by 2007 before falling to 9.2% due to the 2007-2009 recession. At the same time, the average tax rate paid by the top 0.1% fell from over 50% in 1945 to about 25% in 2009. Tax policy could have a relation to how the economic pie is sliced—lower top tax rates may be associated with greater income disparities.”

My theory is income and wealth disparity drastically out of line with real individual contributions to productivity is a major contributor to economy collapse. The corporatist and their Ayn Rand philosophical pursuit of their own self-interest currently mostly backing conservative republican candidates are pushing ideologies to repeat the buildup to the Great Depression of the 1920’s.

#2

Something seems strange about the excerpt. Why would the top .01% see a decline in their share of the wealth, and consequently the bottom 99.9% see an increase in their share of wealth in a reccesion. This seems counter intuitive to me, wouldn't the absolute richest be less affected by a reccesion?

Either way the logic in this article is highly flawed, it shows two trends moving in opposite directions over time but never proves they are directly correlated and fails to mention there are many more variables to the problem than given, let me give you a similar, in form, arguement.

Jeff faps very frequently and has no purple shirts. Over the next 8 years he begins to buy many purpe shirts, and faps less frequently, therefore purple shirts curve peoples masturbatory tendencies.

Rock solid logic right there.

Either way the logic in this article is highly flawed, it shows two trends moving in opposite directions over time but never proves they are directly correlated and fails to mention there are many more variables to the problem than given, let me give you a similar, in form, arguement.

Jeff faps very frequently and has no purple shirts. Over the next 8 years he begins to buy many purpe shirts, and faps less frequently, therefore purple shirts curve peoples masturbatory tendencies.

Rock solid logic right there.

#3

Elite Member

Thread Starter

Join Date: Jul 2005

Location: Anacortes, WA

Posts: 2,478

Total Cats: 144

Something seems strange about the excerpt. Why would the top .01% see a decline in their share of the wealth, and consequently the bottom 99.9% see an increase in their share of wealth in a reccesion. This seems counter intuitive to me, wouldn't the absolute richest be less affected by a reccesion?

Either way the logic in this article is highly flawed, it shows two trends moving in opposite directions over time but never proves they are directly correlated and fails to mention there are many more variables to the problem than given, let me give you a similar, in form, arguement.

Jeff faps very frequently and has no purple shirts. Over the next 8 years he begins to buy many purpe shirts, and faps less frequently, therefore purple shirts curve peoples masturbatory tendencies.

Rock solid logic right there.

Either way the logic in this article is highly flawed, it shows two trends moving in opposite directions over time but never proves they are directly correlated and fails to mention there are many more variables to the problem than given, let me give you a similar, in form, arguement.

Jeff faps very frequently and has no purple shirts. Over the next 8 years he begins to buy many purpe shirts, and faps less frequently, therefore purple shirts curve peoples masturbatory tendencies.

Rock solid logic right there.

I don’t know what graph you’re having problems understanding they show the only measure that correlates well with where the top marginal and capital gains rate is set is that lowering them results in the rich getting a larger share of the total income.

It also shows that Mitt Romney is right He can lower the tax rate disproportionaly for the 1, .1, and .01% and they will still pay the same share of total taxes. They will do it because they will be taking a bigger share of the total income in the process. Take it to the limit and the rich pay 0% take all the income and nobody is left to pay for government.

#4

Last time I looked into the earnings info, the top 1.5-2% made 250K and up and top 1% was about 400K and up. This is refering to the top .01% which is the top 1% of the top 1%.

These are the really rich people, billionaires and multimillionares, and dont let the libs fool you not all rich people are evil masterminds playing with your money on wall street. If we were referring to the top 1-2% i'd agree they would be the most affected, but when we are talking about the richest of the rich in the US, I still maintain they would be less sensitive to a recession.

What I was getting at about the logic was this is an incomplete argument, there is way more to the equation than what they show.

Like in 09 the top 1% made 13% of all income but paid 22.3% of all taxes, that seems disproportionate to me.

Its retarded to think that the tax rate for the top .01% is all that affects economic growth, and since the tax rate for the top .01% and the share of wealth that percentage has, inst inversely correlated then obviously it is a failed policy to lower the tax rate for the highest earners.

This is incomplete, and therefore the logic behind the argument is flawed.

These are the really rich people, billionaires and multimillionares, and dont let the libs fool you not all rich people are evil masterminds playing with your money on wall street. If we were referring to the top 1-2% i'd agree they would be the most affected, but when we are talking about the richest of the rich in the US, I still maintain they would be less sensitive to a recession.

What I was getting at about the logic was this is an incomplete argument, there is way more to the equation than what they show.

Like in 09 the top 1% made 13% of all income but paid 22.3% of all taxes, that seems disproportionate to me.

Its retarded to think that the tax rate for the top .01% is all that affects economic growth, and since the tax rate for the top .01% and the share of wealth that percentage has, inst inversely correlated then obviously it is a failed policy to lower the tax rate for the highest earners.

This is incomplete, and therefore the logic behind the argument is flawed.

#5

Elite Member

Thread Starter

Join Date: Jul 2005

Location: Anacortes, WA

Posts: 2,478

Total Cats: 144

The distribution of income in the US goes hyperbolic at about the 95th percentile. Which I think might be wrong in that I think the knee has moved up. Keep lowering taxes for the rich or make them zero as the Ryan plan would and it will get worse like a L layiny on its side. Flat line of little opportunity with little chance for gains at any level of effort or luck for most everybody but if you’re beyond the knee you own everything and your heirs will continue to own everything with little effort until the inequality produces economic collapse and civil unrest. Welcome to the dark ages.

#6

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,023

Total Cats: 6,591

In the world of reliability testing and failure analysis, we have a saying: Correlation does not imply causality. Or if B followed A, you cannot simply assume that A caused B.

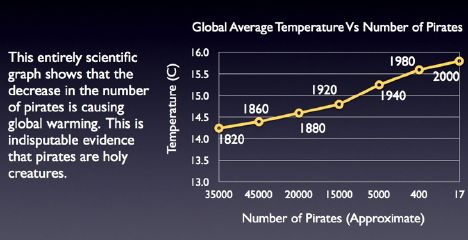

Let me step into a tangent for a moment, and offer some data that is unrelated to taxation or US economic policy.

Since the early 1800s, incidents of piracy on the high seas have decreased at an almost exponential rate. This is due in part to improved regulation and policing by the navies of the major sea-faring nations (England, France, Spain, the US, etc), to reduced commercial demand for pirated goods (by way of customs / import regulation), and to an overall decline in the relative attractiveness of the profession of commercial pirating owing to the overall improvements in economic security and working conditions which accompanied the industrial revolution.

Over the same period of time, the average global temperature has risen by approximately 1.5° C, and at a rate which closely mirrors the rate of decline of seafaring piracy. The following chart graphically illustrates this trend, and I assure you, the data is 100% real:

That's right. Global warming is caused by a lack of pirates.

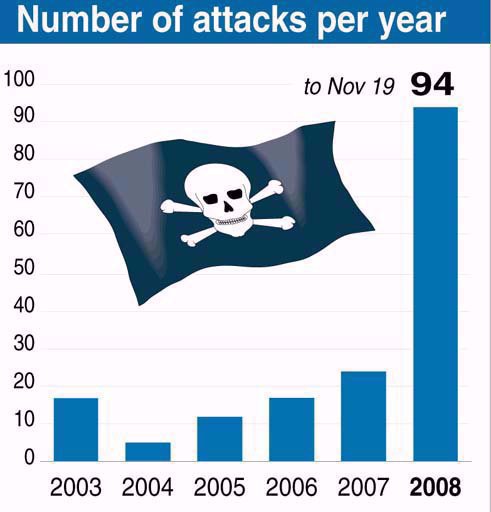

Now, a curious thing happened during the period from 2003-2008. Just as the whole "global warming" debate was really starting to bore people, the temperature trend actually began to reverse itself. The Hadley data in particular show a clear average decrease of roughly 0.1° per year, with an extremely sharp drop in 2008:

Initially, this data was baffling to both climate scientists and enviro-**** politicians as well. It wasn't until the pirate data was re-examined that the cause of this trend reversal became clear:

This should come as no surprise, really. Once seafaring pirates from eastern Africa started really ramping up their game, it was inevitable that the global average temperature would start to correct itself in the direction of pre-US Navy levels.

I know, you're thinking "Joe, this is BS. You're just cherry-picking data to support a ridiculous claim."

Am I?

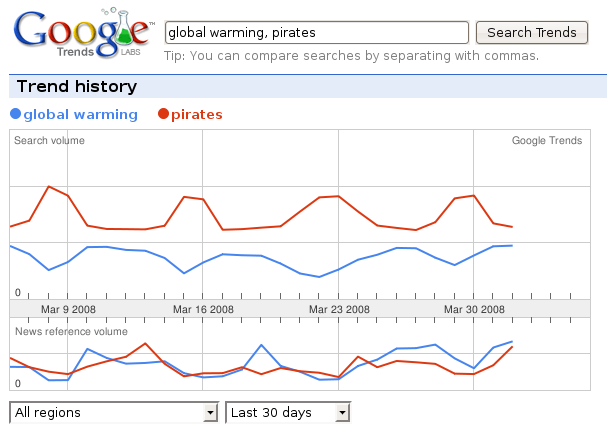

It turns out that internet piracy is not so poorly named as was once joked about. By analyzing trends in Google search data, we can see that not only is the pirate-temperature data 100% reliable in the long term, it also holds perfectly true in the short term as well. Here, for instance, is a chart showing month-to-month correlation between people looking to illegally download movies and global warming:

And even on a DAY-TO-DAY basis, the data is still rock-solid:

#7

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,023

Total Cats: 6,591

... or maybe not.

It could just be that you naturally expect the total wealth of people whose income is derived principally from securities to go up when the stock market exhibits a generally positive trend (1945-2007), and down when the stock market exhibits a generally negative trend (2007-2009).

And that whatever might have been happening to the effective tax rate at the same time was about as relevant to that as the fact that in 2008, Carlos Delgado played his eleventh consecutive season with 30 home runs.

It could just be that you naturally expect the total wealth of people whose income is derived principally from securities to go up when the stock market exhibits a generally positive trend (1945-2007), and down when the stock market exhibits a generally negative trend (2007-2009).

And that whatever might have been happening to the effective tax rate at the same time was about as relevant to that as the fact that in 2008, Carlos Delgado played his eleventh consecutive season with 30 home runs.

#8

Elite Member

Thread Starter

Join Date: Jul 2005

Location: Anacortes, WA

Posts: 2,478

Total Cats: 144

... or maybe not.

It could just be that you naturally expect the total wealth of people whose income is derived principally from securities to go up when the stock market exhibits a generally positive trend (1945-2007), and down when the stock market exhibits a generally negative trend (2007-2009).

And that whatever might have been happening to the effective tax rate at the same time was about as relevant to that as the fact that in 2008, Carlos Delgado played his eleventh consecutive season with 30 home runs.

It could just be that you naturally expect the total wealth of people whose income is derived principally from securities to go up when the stock market exhibits a generally positive trend (1945-2007), and down when the stock market exhibits a generally negative trend (2007-2009).

And that whatever might have been happening to the effective tax rate at the same time was about as relevant to that as the fact that in 2008, Carlos Delgado played his eleventh consecutive season with 30 home runs.

#9

I am making the argument against the repeated arguments by conservative that we need to extend and preseve tax cuts engeneerd to benifit the wealthy and investors in order to stimulate the economy. We did that already it did not correlate to a stronger economy, the rich got richer.

Also something your argument must assume is the rich getting richer is a bad thing, are only the bottom 99% allowed to gain wealth.

Also well illustrated point Joe. Props to you.

#10

Elite Member

Thread Starter

Join Date: Jul 2005

Location: Anacortes, WA

Posts: 2,478

Total Cats: 144

The problem with your argument is you showed no information about the economy or its growth, only the amount of wealth held by the top .01%, plus its missing many of the other variables which affect the economy. It is incomplete at best.

Also something your argument must assume is the rich getting richer is a bad thing, are only the bottom 99% allowed to gain wealth.

Also well illustrated point Joe. Props to you.

Also something your argument must assume is the rich getting richer is a bad thing, are only the bottom 99% allowed to gain wealth.

Also well illustrated point Joe. Props to you.

#13

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,023

Total Cats: 6,591

2: Have the bottom 99% been directly responsible for large increases in productivity, or have they simply conformed to whatever measures have been introduced by the 1%, presupposing that the majority of those responsible for great innovative leaps in productivity have been members of that group?

#14

Elite Member

Thread Starter

Join Date: Jul 2005

Location: Anacortes, WA

Posts: 2,478

Total Cats: 144

One party seems to be stuck on tax cuts for the rich deregulation though that only seems to happen when it benefits the rich and corporations, corporate-government partnerships (Privatizing government services), Shrinking government services and the role of government, while scapegoating the poor, underemployed, and unemployed. If you study history we tried that government philosophy under Coolidge, Harding, and Hoover with a conservative republican congress at the time that all followed that philosophy from 1921 into the 1930’s. It followed that what we ended up with was a great depression. When even educated and talented people could not find work or opportunity to put food on the table through no fault of their own then things are not going to be too good for people for a while.

In a capitalist economy tweaking the levers to favor concentration of wealth too much while ignoring the promotion of the general welfare and even scapegoating it can have disastrous effects.

#15

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

One might also make the argument that the study cited in the original post as "bi-partisan" is stretching the term. There were some questions as to the neutrality of the author, who has been a regular contributor to Obama, the DNC (and Gore before that).

There were also some questions about the economic methodology of the report. That's not to say it is definitely incorrect and I have not had a chance to read through all of it in detail.

Mr. Hungerford, a specialist in public finance who earned his economics doctorate from the University of Michigan, has contributed at least $5,000 this election cycle to a combination of Mr. Obama’s campaign, the Democratic National Committee, the Democratic Senatorial Campaign Committee and the Democratic Congressional Campaign Committee.

You have politically weighted phrasing like "Bush tax cuts" and "tax cuts for the rich." There were also some questions about the economic methodology of the report. That's not to say it is definitely incorrect and I have not had a chance to read through all of it in detail.

#17

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,023

Total Cats: 6,591

One group of people seem to be fixated on what "the rich" pay in income taxes as a percentage of income without paying any attention to what they're paying in real dollars, and to the exclusion of what "everyone else pays" under the same regulations. (They also seem to fail to understand the distinction between federal payroll tax and federal income tax, but that's another topic.)

The fact is that everyone's net effective tax rate has been steadily declining over the past several decades, both "rich" and "not rich." And the "rich" still pay more in taxes, both as a percentage of income and in real dollars, than everyone else.

I have looked at data from several different sources, and while there are subtle variations, they all tell the same basic story.

Those who spend all of their time whining about how it's unfair that I only pay 30% of my entire income in taxes would be well advised to take not of what they are paying, and stop being butt-hurt about the fact that we don't live in a communist society.

So, yeah. The "rich" are paying less in income taxes than they were 40 years ago. So is everybody else. In fact, the tax code is so favorable to lower-income earners that after you add up all of the deductions, exclusions and credits, forty-something percent of all Americans wind up with an effective net federal income tax rate of 0% or less. (The exact percentage varies depending on whether or not you include the unemployed, how you handle certain indirect federal benefits, etc. But it's always in that general neighborhood.)

I have shifted back into serious mode at this point, because I literally cannot understand what you perceive as the injustice here. Because of all of the tax cuts at the middle to lower end of the scale, the "rich" are funding a higher percentage of all federal income tax revenue today than at any other point in many decades.

The fact is that everyone's net effective tax rate has been steadily declining over the past several decades, both "rich" and "not rich." And the "rich" still pay more in taxes, both as a percentage of income and in real dollars, than everyone else.

I have looked at data from several different sources, and while there are subtle variations, they all tell the same basic story.

Those who spend all of their time whining about how it's unfair that I only pay 30% of my entire income in taxes would be well advised to take not of what they are paying, and stop being butt-hurt about the fact that we don't live in a communist society.

So, yeah. The "rich" are paying less in income taxes than they were 40 years ago. So is everybody else. In fact, the tax code is so favorable to lower-income earners that after you add up all of the deductions, exclusions and credits, forty-something percent of all Americans wind up with an effective net federal income tax rate of 0% or less. (The exact percentage varies depending on whether or not you include the unemployed, how you handle certain indirect federal benefits, etc. But it's always in that general neighborhood.)

I have shifted back into serious mode at this point, because I literally cannot understand what you perceive as the injustice here. Because of all of the tax cuts at the middle to lower end of the scale, the "rich" are funding a higher percentage of all federal income tax revenue today than at any other point in many decades.

Last edited by Joe Perez; 11-05-2012 at 02:22 PM. Reason: schpelling

#18

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

I have shifted back into serious mode at this point, and I literally cannot understand what you perceive as the injustice here. Because of all of the tax cuts at the middle to lower end of the scale, the "rich" are funding a higher percentage of all federal income tax revenue today than at any other point in many decades.

This is a similar cognitive issue with people on the right who genuinely believe things like, "everything run by the government gets worse and more expensive over time" and "everything run by the private sector gets better and cheaper over time."

I tend to think this is a result of the continued polarization of the two party political system and the "red team versus blue team" mentality, which is a natural (?) offshoot of the binary mode of thinking most people tend to slip in to.

#20

Elite Member

iTrader: (21)

Join Date: Jun 2007

Location: Rochester, NY

Posts: 6,593

Total Cats: 1,259

Government promoting and investing in Education, innovation, technology, infrastructure and public utility enhancement, and equal opportunity has worked in the past. And it was largely responsible for prior decades of great times in America with tremendous productivity growth.

You seem to think that the Dems are all poor blue collar workers and the Repubs are all non-working rich fat cats. The reality is that both sides have their own corporate welfare, and are screwing the American people from both sides at once. The solution at this point is to vote the bastards out every election until they start doing their jobs (budget, anyone?) and turn things around.