Who here is using Bitcoin?

#41

some 4chan user bought a gallardo with bitcoins:

The Daily Dot - This 4chan user bought a Lamborghini with $200K in Bitcoin

The Daily Dot - This 4chan user bought a Lamborghini with $200K in Bitcoin

#42

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,017

Total Cats: 6,587

Money is something which is used to represent value. We create value when we perform a service which of use to others (building a house, painting a picture, giving a blow-job), when we excavate a material that is useful in some process or industry (oil, aluminum ore, etc), and so on. As such, the supply of money in most economies is regulated to approximately track the rate of the creation of value.

By contrast, gold and bitcoins both allow individuals to "create" money directly, without actually creating anything of intrinsic value.

And, unlike money, the supply of gold and bitcoins are, as you said, finite and nearly impossible to regulate. As such, they cannot track the rate of the creation of value within the economy, and will tend to lead to deflation which, according to any reasonable interpretation, is worse than inflation because it encourages the hoarding of money.

#43

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,017

Total Cats: 6,587

You are, I am sure, familiar with a chap by the name of Archimedes. He figured out how to tell whether or not gold has been diluted by immersing it in water.

Sadly, we haven't really improved on this technique in the 2,200 years since he did his best work. So in order for your theory to hold water (pun intended), we'd need the minimum-wage drone working the register at the grocery store to immerse everyone's payment in a hyper-accurate graduated cylinder and measure the volume of liquid which it displaces. Bad enough on the face of things, but then consider the sort of precision you'd need to determine a few percent difference in density in a sample having a mass of less than a gram.

In other words, the difference between theory in practice is that, in theory, there is no difference between theory and practice, while in practice, there is.

Jefferson, Madison and some others saw the destruction of the Continental and hated paper money in general.

#44

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,017

Total Cats: 6,587

You just seem to be ignoring the fact that other countries exist. If the US were to standardize on gold as a peg for its currency, the fact that gold is speculated upon as a commodity in every other nation in the world would mean that its value would continue to fluctuate as it does presently.

The only way your idea could possibly work would be for all of the industrialized nations of the world to simultaneously agree upon a single currency, and that's the sort of thing that the tin-foil-hat crowd would tend to point towards as the harbinger of the antichrist or some kind of masonic plot.

#46

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,488

Total Cats: 4,077

up?

Bitcoin plummets as China's largest exchange blocks new deposits | Technology | theguardian.com

Bitcoin plummets as China's largest exchange blocks new deposits | Technology | theguardian.com

Digital cryptocurrency has lost almost 50% of its value overnight after BTC China said it could no longer accept deposits in the Chinese currency

#48

It's a couple days old, but I found this interesting: These Three Graphs Prove That Bitcoin Is a Speculative Bubble | Ordinary Times

The transactions vs market cap graph is quite telling. Nobody is using bitcoins as money, they're hoarding them waiting for the price to hit $10k

The transactions vs market cap graph is quite telling. Nobody is using bitcoins as money, they're hoarding them waiting for the price to hit $10k

#50

mkturbo.com

iTrader: (24)

Join Date: May 2006

Location: Charleston SC

Posts: 15,176

Total Cats: 1,680

It's a couple days old, but I found this interesting: These Three Graphs Prove That Bitcoin Is a Speculative Bubble | Ordinary Times

The transactions vs market cap graph is quite telling. Nobody is using bitcoins as money, they're hoarding them waiting for the price to hit $10k

The transactions vs market cap graph is quite telling. Nobody is using bitcoins as money, they're hoarding them waiting for the price to hit $10k

#51

#52

mkturbo.com

iTrader: (24)

Join Date: May 2006

Location: Charleston SC

Posts: 15,176

Total Cats: 1,680

You're right, not "nobody," just a lot fewer than there used to be, relatively. I'm not at all surprised that the transactions vs market cap graph starts to plummet at the same time the price starts to go up.

#53

For sure, it dropped after Silk Road got shut down. But it had already dropped considerably more than 6 months prior (Silk Road was shut down October 2nd). I'm no macroeconomist, but that seems to be what would be expected for a deflationary currency (that it be hoarded for future value rather than spent on goods or services).

#54

Holy crap this bitcoin mining thing is confusing...

On the discussion of currencies..

1) I think that not one government of the world will let a non governmental entity control the money supply. Nor do I think it is a smart idea. (not that I think the US central bank is is doing a particularly good job but they too are limited in their capacity)

2) I believe as China returns back to the top as biggest world economic power, and with India and the rest of Asia in the mix, we are talking about having over half of the worlds economic activity happening in the continent of Asia in perhaps 30-40 years. As economic influence of the US wanes, a new world reserve currency will rise from the Asia region.

3) With that said, I believe that the American dollar will continue to remain the world currency for many many decades and even when they loose that position, it will remain to be very influential in the world economy, just as the Euro. The US still has allot of natural resources, land, capital, military and wheat/corn and these will remain important in the world economy.

On the discussion of currencies..

1) I think that not one government of the world will let a non governmental entity control the money supply. Nor do I think it is a smart idea. (not that I think the US central bank is is doing a particularly good job but they too are limited in their capacity)

2) I believe as China returns back to the top as biggest world economic power, and with India and the rest of Asia in the mix, we are talking about having over half of the worlds economic activity happening in the continent of Asia in perhaps 30-40 years. As economic influence of the US wanes, a new world reserve currency will rise from the Asia region.

3) With that said, I believe that the American dollar will continue to remain the world currency for many many decades and even when they loose that position, it will remain to be very influential in the world economy, just as the Euro. The US still has allot of natural resources, land, capital, military and wheat/corn and these will remain important in the world economy.

#55

This thread got me thinking again about currencies so in reference to gold as a currency. I'll throw my basic assumptions of mine but am open to learn and discuss..

1) Theres not enough gold, and even if there was, it cannot be created fast enough to keep up with the wealth/money being created in the world economy. (for gold backing)

2) Gold as money, is not flexible and creation of credit is difficult. Credit expansion is needed for growth.

3) Most people and countries want and need growth or governments will face revolution. (this is putting aside the fact that environment will be trashed from the always grow idea)

With that said, I do understand gold as a way to hedge against the devaluation of the dollar. BUT, I don't know of the regulations and what not to buy, sell and trade large amounts of gold in or from US to other countries... Are there not barriers and fee's to buying and selling gold internationally? I would be afraid that even if I had physical gold while living in the US, it would be rendered must less useful because of government intervention.. If I am trying to maintain wealth rather than being risky and trying multiplying it, IF I were to live in the US, I would probably try to find save investments in Asia, then in 40 years when the value of the US dollar is much lower, cash in on the international investments and buy land in the US...

BUT, I plan on moving to Japan so that's another story.

1) Theres not enough gold, and even if there was, it cannot be created fast enough to keep up with the wealth/money being created in the world economy. (for gold backing)

2) Gold as money, is not flexible and creation of credit is difficult. Credit expansion is needed for growth.

3) Most people and countries want and need growth or governments will face revolution. (this is putting aside the fact that environment will be trashed from the always grow idea)

With that said, I do understand gold as a way to hedge against the devaluation of the dollar. BUT, I don't know of the regulations and what not to buy, sell and trade large amounts of gold in or from US to other countries... Are there not barriers and fee's to buying and selling gold internationally? I would be afraid that even if I had physical gold while living in the US, it would be rendered must less useful because of government intervention.. If I am trying to maintain wealth rather than being risky and trying multiplying it, IF I were to live in the US, I would probably try to find save investments in Asia, then in 40 years when the value of the US dollar is much lower, cash in on the international investments and buy land in the US...

BUT, I plan on moving to Japan so that's another story.

#56

This thread got me thinking again about currencies so in reference to gold as a currency. I'll throw my basic assumptions of mine but am open to learn and discuss..

1) Theres not enough gold, and even if there was, it cannot be created fast enough to keep up with the wealth/money being created in the world economy. (for gold backing)

1) Theres not enough gold, and even if there was, it cannot be created fast enough to keep up with the wealth/money being created in the world economy. (for gold backing)

2) Gold as money, is not flexible and creation of credit is difficult. Credit expansion is needed for growth.

3) Most people and countries want and need growth or governments will face revolution.

With that said, I do understand gold as a way to hedge against the devaluation of the dollar.

#57

Holy crap this bitcoin mining thing is confusing...

On the discussion of currencies..

1) I think that not one government of the world will let a non governmental entity control the money supply. Nor do I think it is a smart idea. (not that I think the US central bank is is doing a particularly good job but they too are limited in their capacity)

On the discussion of currencies..

1) I think that not one government of the world will let a non governmental entity control the money supply. Nor do I think it is a smart idea. (not that I think the US central bank is is doing a particularly good job but they too are limited in their capacity)

2) I believe as China returns back to the top as biggest world economic power, and with India and the rest of Asia in the mix, we are talking about having over half of the worlds economic activity happening in the continent of Asia in perhaps 30-40 years. As economic influence of the US wanes, a new world reserve currency will rise from the Asia region.

3) With that said, I believe that the American dollar will continue to remain the world currency for many many decades and even when they loose that position, it will remain to be very influential in the world economy, just as the Euro. The US still has allot of natural resources, land, capital, military and wheat/corn and these will remain important in the world economy.

#58

No, I get it.

You just seem to be ignoring the fact that other countries exist. If the US were to standardize on gold as a peg for its currency, the fact that gold is speculated upon as a commodity in every other nation in the world would mean that its value would continue to fluctuate as it does presently.

You just seem to be ignoring the fact that other countries exist. If the US were to standardize on gold as a peg for its currency, the fact that gold is speculated upon as a commodity in every other nation in the world would mean that its value would continue to fluctuate as it does presently.

One problem was that despite the "peg" (fixed price wrt gold), the Federal Reserve kept on inflating the USD, and of course other countries then kept redeeming their USD for gold, until Nixon refused. The other problem was that US citizens couldn't do the same, only foreign governments. Redeeming a commodity-backed paper currency for said commodity is an automatic check on over-creation of said paper (beyond how much commodity there is), unless of course a law prevents you from doing it.

You will note that the rate of inflation increased after what Nixon did.

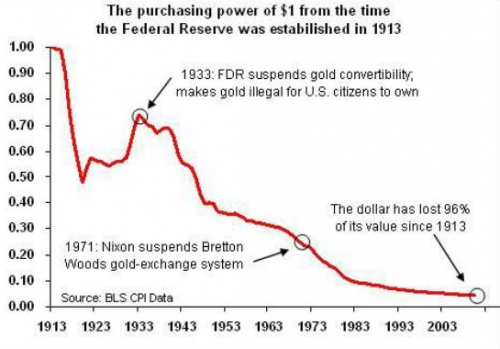

(Needs to have a log Y axis but good enough:

The only way your idea could possibly work would be for all of the industrialized nations of the world to simultaneously agree upon a single currency,