Cain and the greatest 9 words a politician has ever said

#64

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

What do people actually to gain from this? How would "we" benefit if we remove loopholes and raise taxes on the rich? Do people honestly believe that if we tax the rich, the poor will suddenly gain wealth or something? that they are hording the cash? The the gov't will stop spending us into debt? I seriously don't understand the argument other than being jealously driven.

#65

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Perhaps 90% of the financial industry are parasites enabled by the cartel known as the Federal Reserve. The big financial corporations essentially borrow money from the Fed Res at zero interest, and they leverage this to the hilt to make huge profits. In a free market nobody can print unbacked money unrestrainedly and get away with it.

i.e. When the Fed replaces Treasuries with reserves, to me that's an asset swap (replacing a savings account with a checking account) - not "printing money."

#66

We've moved further to the left? If Ronald Reagan were running for the republican nomination right now he would be immediately dispatched as a liberal commie.

As far as the federal government spending money on science and technology the world would be a much different place and I think the US would be much less prominent in it if it wasnít for actions taken to promote education and technology and doing frivolous things like sending people to the moon. Modern computers, lots of software, GPS, the internet you now take for granted all owe their roots to actions and spending by the federal government much of it probably wasteful a few things however changed the world as we know it. I certainly see alternative energy of some sort as being the next world changing thing. I expect some money to be wasted in that area.

Bob

As far as the federal government spending money on science and technology the world would be a much different place and I think the US would be much less prominent in it if it wasnít for actions taken to promote education and technology and doing frivolous things like sending people to the moon. Modern computers, lots of software, GPS, the internet you now take for granted all owe their roots to actions and spending by the federal government much of it probably wasteful a few things however changed the world as we know it. I certainly see alternative energy of some sort as being the next world changing thing. I expect some money to be wasted in that area.

Bob

Reagan was a monster, he cut funding for mental institutions in California as Governor and those who lived there (many where war vets) where left with nowhere to live, let alone get medical care for there psychiatric problems. If he was right-wing enough to cut spending on programs for those who need and deserve our help the most, then he was most certainly not a liberal, let alone a commie. He was a bastard though.

#67

Elite Member

Thread Starter

iTrader: (6)

Join Date: Sep 2010

Location: Seattle, WA

Posts: 3,611

Total Cats: 25

Half of what you said I agree with, and the other half I very much disagree with (bold section).

Reagan was a monster, he cut funding for mental institutions in California as Governor and those who lived there (many where war vets) where left with nowhere to live, let alone get medical care for there psychiatric problems. If he was right-wing enough to cut spending on programs for those who need and deserve our help the most, then he was most certainly not a liberal, let alone a commie. He was a bastard though.

Reagan was a monster, he cut funding for mental institutions in California as Governor and those who lived there (many where war vets) where left with nowhere to live, let alone get medical care for there psychiatric problems. If he was right-wing enough to cut spending on programs for those who need and deserve our help the most, then he was most certainly not a liberal, let alone a commie. He was a bastard though.

But with that said, I completely agree with bbundy's statement even factoring all of that in. The problem isn't that Reagan was not an extremist - it's that the right's extremists have gotten a lot more extreme since Reagan was president. When Reagan was president, if Rick Perry or Bachmann tried to run for president, people would be too busy laughing at them to actually be able to give them criticism.

#68

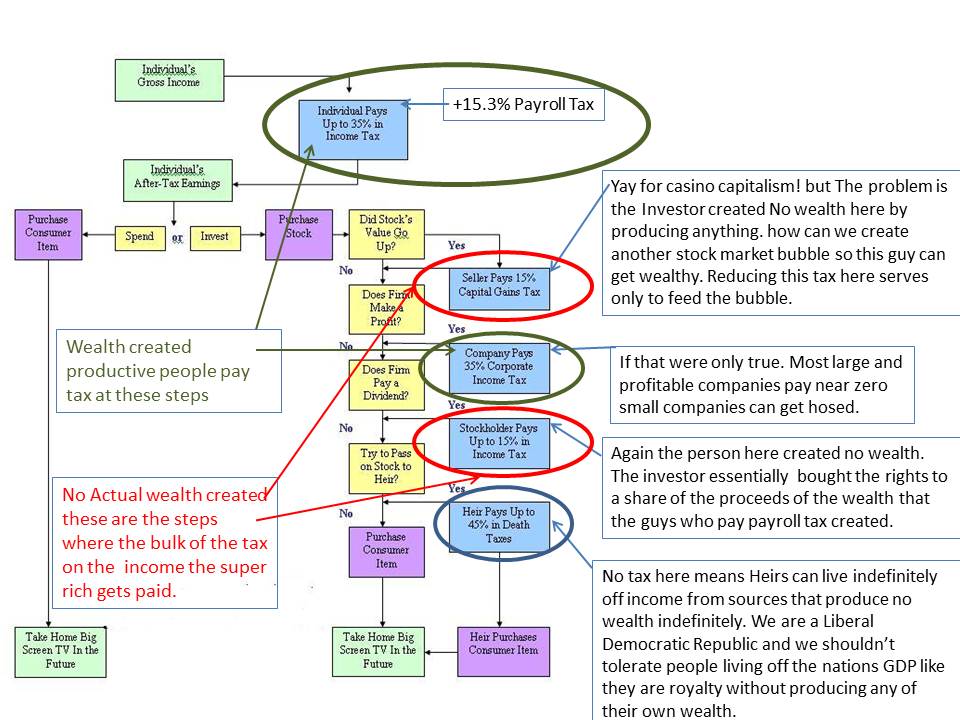

Your chart is not quite the whole truth or even reality. It’s not always the same person making the money at every step of the way from top to bottom and I will again pick on hedge fund managers who use leveraged money and only collect income in the form of long term capital gains along the way, also the trust fund babies who never really earned there own welth. Once you have some welth bult up you can avoid the higher tax productive steps all together.

But tell my why should the tax on income from sources in the process that produce nothing in terms of wealth be taxed at less than half the rate of the productive steps where wealth is actually created.

This tax scheme pushed so hard by the republicans for so many years is screwed up it only serves to crates market bubbles and it funnels money to the wealthy rather than the productive. It hasn’t worked and yet both Romney and Gingrich economic recovery plans both include reducing just this tax even more. Gengrich wants 0% tax on capital gains and large scale inheritance. A plan that would most definitely create economic royal families sucking off the wealth generated by the productivity of the working class, Class war over you lost.

While I might agree dividends are double taxed I actually think companies should be able to write them off when they pay them. The scheme for paying out executive compensation in the form of stock options that cost the company one price then writing off the stock options at a later date a much higher value when they are exercised is just insane and another thing republicans are stomping there feet to keep.

Bob

#69

Can you explain the highlighted portion? I understand your premise regarding carried interest taxation, but not the second part. Are you suggesting that a CEO being paid $600k in salary before options, grant, bonuses, etc is not taxed in a similar way to a ballplayer?

Take Steve Jobs for example, his salary was $1. he paid a payroll tax of $0.15

Bob

#71

Bob, you're operating under an artificial definition of "productivity." Capital investment is an important component of production. You might not like to think of it as productive, since the investor isn't "laboring" to physically make a product for sale, but nevertheless investment is a component of production, not of consumption.

Seriously though, why should government be allowed to double and triple tax the same money? Inheritance, for example -- that money was already taxed (at least) one time -- what justification does the government have for taxing it yet again, other than for the purposes of shaping society according to the enlightened vision of our anointed leaders?

Seriously though, why should government be allowed to double and triple tax the same money? Inheritance, for example -- that money was already taxed (at least) one time -- what justification does the government have for taxing it yet again, other than for the purposes of shaping society according to the enlightened vision of our anointed leaders?

#72

Bob, you're operating under an artificial definition of "productivity." Capital investment is an important component of production. You might not like to think of it as productive, since the investor isn't "laboring" to physically make a product for sale, but nevertheless investment is a component of production, not of consumption.

Seriously though, why should government be allowed to double and triple tax the same money? Inheritance, for example -- that money was already taxed (at least) one time -- what justification does the government have for taxing it yet again, other than for the purposes of shaping society according to the enlightened vision of our anointed leaders?

Seriously though, why should government be allowed to double and triple tax the same money? Inheritance, for example -- that money was already taxed (at least) one time -- what justification does the government have for taxing it yet again, other than for the purposes of shaping society according to the enlightened vision of our anointed leaders?

Companies would likely pay more dividends I would guess. And it really seems like it would be easy for companies to pay little or no income tax because virtually everything they make is paid in salaries, dividends, or re-investment if that is the case there really isnít any company profit to realize it is the employees and investors realizing the profit.

Bob

#73

Now if that employee is more expensive than the profit he might generate for the company because he has to make enough to feed his family after paying his 15.3 % payroll tax plus income tax it could very well price himself out of a job and the employer canít afford to hire anybody to make a profit himself.

The availability of Universal healthcare would drastically reduce employer costs.

Bob

#74

"Free Market" means absence of gov't rules (other than protection of property rights, prosecution of fraud, and enforcement of contracts). It means the financial corps are free to leverage to the hilt but they can't be bailed out with taxpayer money (which leads to moral hazard). It means they don't have a rich uncle in the form of the Fed Res which prints money and loans it to them to leverage, at near zero interest rates.

Possibly worth noting, Greenspan's Federal Reserve relaxed some rules (i.e. de-regulated) relevant to the leverage of large investment banks in 2004.

i.e. When the Fed replaces Treasuries with reserves, to me that's an asset swap (replacing a savings account with a checking account) - not "printing money."

#76

Now if that employee is more expensive than the profit he might generate for the company because he has to make enough to feed his family after paying his 15.3 % payroll tax plus income tax

Hmm, major expenses are housing, energy, insurance. Prices keep going up (mostly). All heavily regulated by gov't. And look at all the innumerable taxes paid every step of the way before said good reaches the consumer.

In contrast let's look at the cost of clothes, TV, cellphone, internet connection, used car. Prices keep going down. All fairly unregulated, delivered by the market.

The availability of Universal healthcare would drastically reduce employer costs.

The reason health care is overpriced is that all the regulations stifle competition. The AMA is a monopoly guild, for example. The FDA is a monopoly organization that has no incentive to make their testing better, cheaper, faster. Monopolies are prone to corruption.

Just look at any other service industry that requires high skill, where the gov't hasn't written 100,000 regulations, and doesn't protect guilds like the AMA. The market produces safe high quality service at low cost.

#77

While I agree with much of that video (can’t actually watch it) I do not totally agree with the conclusion that it is entirely the result of government regulation or that eliminating all government will cure all our ills. Also it is the Republicans in congress along with the Tea party groups stamping there feet shutting down the process and screaming class warfare etc any time there is a proposal to correct or eliminate any of these problems with the rules in a way that might not be beneficial to the people at the top of the financial food chain.

Bob

Bob

Last edited by bbundy; 12-09-2011 at 03:56 PM.

#78

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

He wrote this week:

“Regulatory mandates flowing from federal health care reform may be the most visible, but the list also includes measures such as new mandatory paid leave provisions that require us to change the way we accommodate employees who need to take time off when they are ill and ever more unrealistic requirements regarding employee meal and rest breaks that, in California for example, force our employees to take breaks in the middle of serving lunch or dinner.

...

The difficult reality is that neither our shareholders nor our customers — who are of course, the very working people policymakers champion — can afford the cost of the unbridled increase in regulation we’re experiencing.”

...

The difficult reality is that neither our shareholders nor our customers — who are of course, the very working people policymakers champion — can afford the cost of the unbridled increase in regulation we’re experiencing.”

#79

Gov't has a monopoly on violence. Their rules are enforced by the barrel of a gun. The rules will be written by whomever has the most money and influence. Society effectively gets ruled by the wealthy elite.

You need to ask a more fundamental question: "What is it that a free society can't do that gov't needs to do?"

A free market is part of a free society. In a free market, there would be competing central banks or groups of banks. There can be no monopoly without gov't's blessing, because monopolies seek to raise their profits, making it attractive for new competitors to get in and compete with them. In a free market, there would be no gov't protection of the big financial firms in the form of bailouts.

The idea that gov't regulation is needed to prevent abuses by corporations is silly. BP was protected by gov't regulators. They were shielded by lawsuits by gov't. In a free society, they would be taken to court for what they did. That would have been a death sentence for the company. The execs responsible would be in jail. It would not have been in their interest to take shortcuts. Instead, they hid behind "we followed gov't regulations". Their chutzpa comes from gov't protection.