Demand for U.S. Debt Is Not Limitless

#21

Between the 2nd Bank of the US (Andrew Jackson killed them by simply pulling their gov't protected monopoly status), and the Federal Reserve Act of 1913. Gold and silver circulated as money.

Between the end of the Civil War and 1913, the value of money increased as the prices of almost all goods fell.

Between the end of the Civil War and 1913, the value of money increased as the prices of almost all goods fell.

Last edited by JasonC SBB; 04-17-2012 at 08:39 PM.

#22

It seems to me that many MMT'ers fall prey to the "God Complex", aka "The Fatal Conceit".

This is the belief that a person or committee is so smart that they can control something as complex as the modern economy and make it better, than leaving the free market alone, which features millions of actors making economic decisions for themselves.

This is the belief that a person or committee is so smart that they can control something as complex as the modern economy and make it better, than leaving the free market alone, which features millions of actors making economic decisions for themselves.

#23

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

It seems to me that many MMT'ers fall prey to the "God Complex", aka "The Fatal Conceit".

This is the belief that a person or committee is so smart that they can control something as complex as the modern economy and make it better, than leaving the free market alone, which features millions of actors making economic decisions for themselves.

This is the belief that a person or committee is so smart that they can control something as complex as the modern economy and make it better, than leaving the free market alone, which features millions of actors making economic decisions for themselves.

Certainly some of the prescriptive aspects (like the jobs guarantee) could be considered guilty of a fatal conceit.

To say there is any element of a fatal conceit in the descriptive elements strikes me as similar to saying an electrical engineer has a god complex because he has an excellent understanding of circuit board design and operation.

Read this if you haven't already or read it again if it's been a while (there have been some updates):

Understanding the Modern Monetary System.

If anything, I think most of the MMT proponents take a skeptical view of "free markets" because of an inherent skepticism on the power of large corporations and their executives, especially in the FIRE industries. I would think you would be sympathetic to that perspective.

#24

If anything, I think most of the MMT proponents take a skeptical view of "free markets" because of an inherent skepticism on the power of large corporations and their executives, especially in the FIRE industries.

Yes the God complex can happen to electrical engineers. It happens when complex problems are believed to be reducible to simple conclusions and the engineer doesn't do proper testing. I've seen it happen.

#25

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

From this thread

Help me understand why you believe there has been or will be "a continually increasing [Federal fiscal] deficit?"

If there is massive government over-spending beyond productive capacity, there will very likekly be high price inflation.

If there is an oil shock, there will be high cost-push inflation.

If there is a massive increase in the Federal Reserve's balance sheet or the amount of reserves in the banking system in a period of deleveraging, there will likely not be a high price inflation. To insist otherwise is to ascribe to the money multiplier and loanable funds theories. I have repeatedly shown you links to high end research papers from NON-MMTers that have shown there is no observable evidence to support those gold-standard based theories still apply to our current monetary system.

I am starting to think that I am defining insanity by repeating myself over and over with you. You are clearly not open to any new information that counters what is seeming more and more to me as a morally based economic religion or ideology. It comes across as:

I am starting to think that I am defining insanity by repeating myself over and over with you. You are clearly not open to any new information that counters what is seeming more and more to me as a morally based economic religion or ideology. It comes across as:

"Because a gold-standard economy or non-government controlled currency is better, I reject your description of the current monetary system."

If you and I were sipping bourbon on a front porch at dusk and I told you that I rejected that the sky was presently shades of pink because I thought it should be blue, would that be a discussion worth having?

Exactly. And the MMT'ers can't explain how a continually increasing deficit can be sustainable without mass inflation. Nor explain gov't that continually increases its expenditures as a % of GDP can possibly be a good thing. Hell, even Bernanke himself has warned Congress about it.

If there is massive government over-spending beyond productive capacity, there will very likekly be high price inflation.

If there is an oil shock, there will be high cost-push inflation.

If there is a massive increase in the Federal Reserve's balance sheet or the amount of reserves in the banking system in a period of deleveraging, there will likely not be a high price inflation. To insist otherwise is to ascribe to the money multiplier and loanable funds theories. I have repeatedly shown you links to high end research papers from NON-MMTers that have shown there is no observable evidence to support those gold-standard based theories still apply to our current monetary system.

I am starting to think that I am defining insanity by repeating myself over and over with you. You are clearly not open to any new information that counters what is seeming more and more to me as a morally based economic religion or ideology. It comes across as:

I am starting to think that I am defining insanity by repeating myself over and over with you. You are clearly not open to any new information that counters what is seeming more and more to me as a morally based economic religion or ideology. It comes across as:"Because a gold-standard economy or non-government controlled currency is better, I reject your description of the current monetary system."

If you and I were sipping bourbon on a front porch at dusk and I told you that I rejected that the sky was presently shades of pink because I thought it should be blue, would that be a discussion worth having?

#27

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

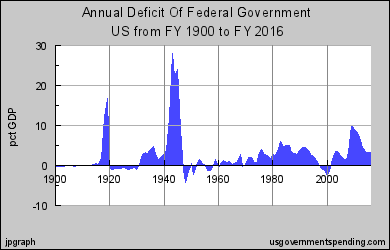

To understand the fact that, mostly since the early '70s, the Federal fiscal deficit has mostly trended in a large channel between about 2.5% and 7.5% of GDP, it is helpful to compare the Government Sector balance with the Capital Account balance and the Private Sector balance over the same time frames.

#30

Elite Member

Thread Starter

iTrader: (7)

Join Date: Jul 2009

Location: Jackson, MS

Posts: 7,388

Total Cats: 474

Austrian Insights on ‘Full’ Employment

A commentator on my recent daily article, “Not Enough Inflation,” asked,

“John (and I really hope you answer this question),

Why is no one dismissing the “concept” of full-employment as utter nonsense? Doesn’t that give Krugman and his ilk a route to deceive people while sounding economically profound? I see the use of full employment as a goal to justify Keynesian prescriptions all over the place and yet no Austrian seems to be dismissing it from the discussion space.

Why?”

My response:

Employment in free economy, like growth, is the result of voluntary choices and associations. It, as argued by Rothbard on growth, is thus not an ethic. Hayek provides a key Austrian insight on the source of unemployment, it is caused by the “existence of discrepancies between the distribution of the demand among the different goods and services and the allocation of labor and other resources among the production of those outputs” (Hayek 1979, 25); a microeconomic problem requiring adjustments in relative prices. (The work also provides a strong critique of Keynesian explanations of unemployment.) Rothbard’s Great Depression and Vedder and Galloway document how it is interventions, impediments to the necessary relative price adjustments that prolong unemployment – turn garden variety recessions into prolonged crisis. Higgs’s regime uncertainty or even regime worsening is most relevant today.

Steve Horwitz has some great insights on jobs:

“More important, though, is that both Krugman and politicians from both parties are much too concerned about job creation when they should be concerned about value creation. Creating jobs is easy; it’s creating value that’s hard. We could create millions of jobs quite easily by destroying every piece of machinery on U.S. farms. The question is whether we are actually better off by creating those jobs—and the answer is a definite no. We want labor-saving, job-destroying technology because it creates value by enabling us to produce things at lower cost and thereby free up labor for more urgent uses.”

See Creating Jobs versus Creating Value (www.thefreemanonline.org).

Hayek, Friedrich A. 1979. Unemployment and Monetary Policy: Government as Generator of the “Business Cycle”. San Francisco, CA: Cato Institute. Available on request.

“John (and I really hope you answer this question),

Why is no one dismissing the “concept” of full-employment as utter nonsense? Doesn’t that give Krugman and his ilk a route to deceive people while sounding economically profound? I see the use of full employment as a goal to justify Keynesian prescriptions all over the place and yet no Austrian seems to be dismissing it from the discussion space.

Why?”

My response:

Employment in free economy, like growth, is the result of voluntary choices and associations. It, as argued by Rothbard on growth, is thus not an ethic. Hayek provides a key Austrian insight on the source of unemployment, it is caused by the “existence of discrepancies between the distribution of the demand among the different goods and services and the allocation of labor and other resources among the production of those outputs” (Hayek 1979, 25); a microeconomic problem requiring adjustments in relative prices. (The work also provides a strong critique of Keynesian explanations of unemployment.) Rothbard’s Great Depression and Vedder and Galloway document how it is interventions, impediments to the necessary relative price adjustments that prolong unemployment – turn garden variety recessions into prolonged crisis. Higgs’s regime uncertainty or even regime worsening is most relevant today.

Steve Horwitz has some great insights on jobs:

“More important, though, is that both Krugman and politicians from both parties are much too concerned about job creation when they should be concerned about value creation. Creating jobs is easy; it’s creating value that’s hard. We could create millions of jobs quite easily by destroying every piece of machinery on U.S. farms. The question is whether we are actually better off by creating those jobs—and the answer is a definite no. We want labor-saving, job-destroying technology because it creates value by enabling us to produce things at lower cost and thereby free up labor for more urgent uses.”

See Creating Jobs versus Creating Value (www.thefreemanonline.org).

Hayek, Friedrich A. 1979. Unemployment and Monetary Policy: Government as Generator of the “Business Cycle”. San Francisco, CA: Cato Institute. Available on request.

#31

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Without having read the cited articles (or not having read them any time recently enough to pull from the top of my head), I am not sure what your question is specifically?

I think Mosler says that you will have a buffer stock, one way or the other. Presently, most economies use a buffer stock of the unemployed. I believe his position is that it is far more beneficial to use a buffer stock of employed people. That is, rather than temporarily paying people to do nothing, temporarily pay them a minimal amount to do something. Preferably it would be somewhat productive like basic manual labor for infrastructure purposes, keeping towns and parks clean, painting low-income senior homes, etc. Think: basic municipal labor or things a volunteer group would do because there is no financial incentive for the average capitalist.

In addition to potentially doing some good for the community, it could allow workers a bridge to train for a new career (i.e. from roofing to welding, from hospitality to healthcare, etc). Like the current unemployment system, it would be "self-adjusting." As the economy picked up, people would leave the day-labor pool to take full-time employment at higher rates, reducing the government expenditures on the JG.

I think the theory is perfectly sound, but the application would be rife with inefficiencies, corruption and politicization that would completely skew the actual outcomes from the intended. It seems it is always and ever the human element which causes the best laid plans of economists to fall apart.

I think Mosler says that you will have a buffer stock, one way or the other. Presently, most economies use a buffer stock of the unemployed. I believe his position is that it is far more beneficial to use a buffer stock of employed people. That is, rather than temporarily paying people to do nothing, temporarily pay them a minimal amount to do something. Preferably it would be somewhat productive like basic manual labor for infrastructure purposes, keeping towns and parks clean, painting low-income senior homes, etc. Think: basic municipal labor or things a volunteer group would do because there is no financial incentive for the average capitalist.

In addition to potentially doing some good for the community, it could allow workers a bridge to train for a new career (i.e. from roofing to welding, from hospitality to healthcare, etc). Like the current unemployment system, it would be "self-adjusting." As the economy picked up, people would leave the day-labor pool to take full-time employment at higher rates, reducing the government expenditures on the JG.

I think the theory is perfectly sound, but the application would be rife with inefficiencies, corruption and politicization that would completely skew the actual outcomes from the intended. It seems it is always and ever the human element which causes the best laid plans of economists to fall apart.

#32

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

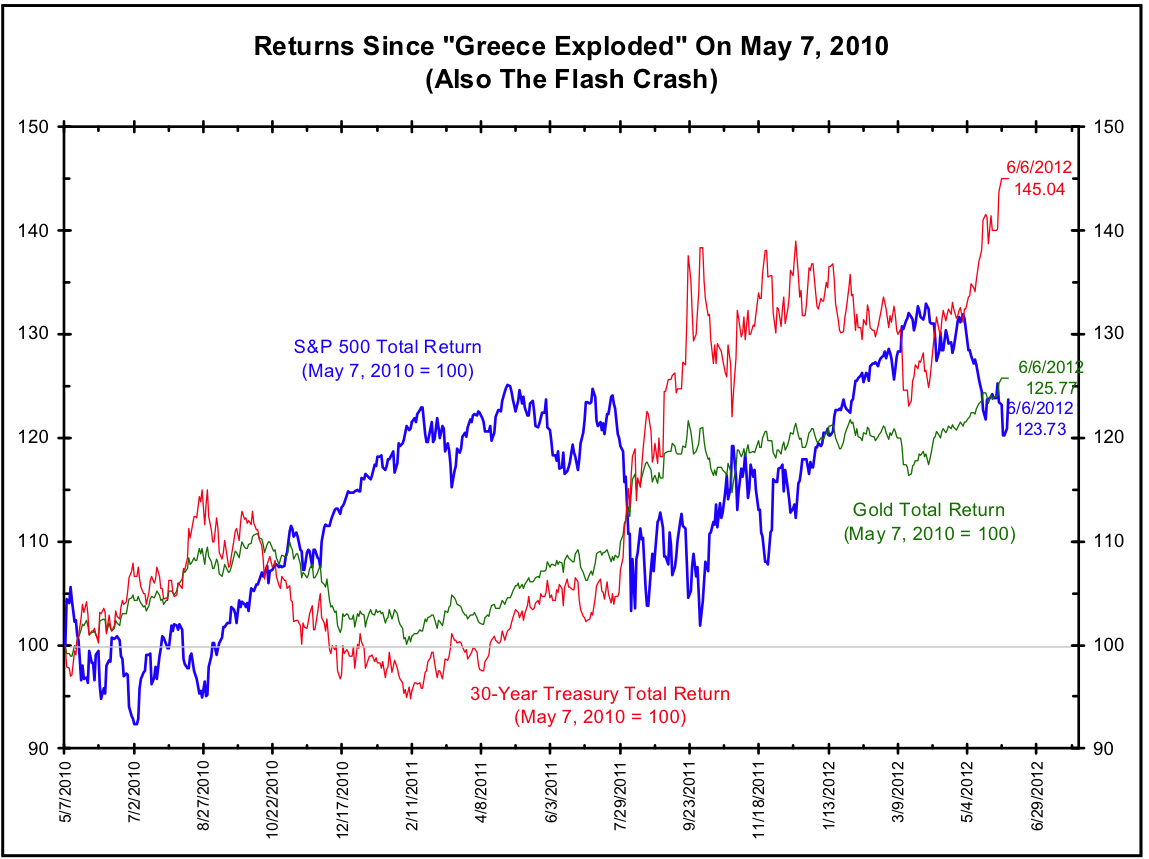

It used to be the long Japanese bond that was dubbed the "widow maker," but any of the gold bug/hyperinflationists/bond bubble guys that had the intestinal fortitude to actually put on (and hold) shorts against the US long bond the last two years are probably wondering when the rest of their fellow bond vigilantes are going to show up.

Thread

Thread Starter

Forum

Replies

Last Post

naarleven

Insert BS here

5

10-26-2008 12:19 AM