The Current Events, News, and Politics Thread

California Considers Placing A Mileage Tax On Drivers

California Considers Placing A Mileage Tax On Drivers « CBS Local

The state says it needs more money for road repairs, and the gas tax just isn’t bringing in enough revenue. The state recently road-tested a mileage monitoring plan. The California Road Charge Pilot Program is billed as a way for the state to move from its longstanding pump tax to a system where drivers pay based on their mileage. But it’s not just a question about money, it’s also a question about fairness.

State Senator Scott Wiener and others are saying that when it comes to road taxes, it’s time to start looking at charging you by the mile rather than by the gallon. “If you own an older vehicle that is fueled by gas, you’re paying gas tax to maintain the roads. Someone who has an electric vehicle or a dramatically more fuel efficient vehicle is paying much less than you are. But they are still using the roads,” Wiener said.

“People are going to use less and less gas in the long run,” according to Wiener. And less gas means less gas tax, and less money for road repair. “We want to make sure that all cars are paying to maintain the roads,” Wiener said.One idea would be installing devices that would clock your mileage every time you pull up to the pump or electric car charging station. Or put a tracker on every car. “The reality is that if you have a smartphone your data of where you are traveling is already in existence,” Wiener said.

State Senator Scott Wiener and others are saying that when it comes to road taxes, it’s time to start looking at charging you by the mile rather than by the gallon. “If you own an older vehicle that is fueled by gas, you’re paying gas tax to maintain the roads. Someone who has an electric vehicle or a dramatically more fuel efficient vehicle is paying much less than you are. But they are still using the roads,” Wiener said.

“People are going to use less and less gas in the long run,” according to Wiener. And less gas means less gas tax, and less money for road repair. “We want to make sure that all cars are paying to maintain the roads,” Wiener said.One idea would be installing devices that would clock your mileage every time you pull up to the pump or electric car charging station. Or put a tracker on every car. “The reality is that if you have a smartphone your data of where you are traveling is already in existence,” Wiener said.

I feel like the most obvious solution here is to check mileage at an annual inspection. There are two issues with this solution.

1. You would get slapped with a large bill all at once which would be a problem for low income individuals who may not save enough to pay it in one swoop. The obvious answer to this issue is to have a setup like we do for quarterly estimated tax payments for self-employed individuals. You would go through a web portal and estimate your yearly mileage. It would calculate a monthly payment amount and you could true up upon the annual inspection.

2. Out of state passenger cars and long haul trucks would basically be exempt from this tax as there would be no way to trace them. Trucks would probably be easier to effectively tax since they do weigh stations, have paper trails for their routes, and any other regulation that would make them easier to track. I am not sure how you would handle out of state cars. They may just be exempt.

Thoughts anyone?

I don't believe a word of it.

The sad part is that CA just implemented yet another (previously approved) gas tax hike here just a few weeks ago. Back when it first took effect, the officials were on the news placating the public with nice stories of all the projects that they claimed would now be kicking off, even though they admitted that the money for many of those same projects had already been allocated from previous budgets (and the LAST "for the roads" gas tax hike they foisted off on us), yet had been sitting there unspent for a significant amount of time.

Their explanation for the delays was that they wanted to be sure they would be able to secure additional future funding before they actually spent what they already had allocated for those (promised) projects. WTF?? And now, they are claiming they need even more!

It's just another typical ******* money grab. Ultimately, the money will flow in and yet the roads will still be fucked, with the can just a little farther down it.

/rant

The sad part is that CA just implemented yet another (previously approved) gas tax hike here just a few weeks ago. Back when it first took effect, the officials were on the news placating the public with nice stories of all the projects that they claimed would now be kicking off, even though they admitted that the money for many of those same projects had already been allocated from previous budgets (and the LAST "for the roads" gas tax hike they foisted off on us), yet had been sitting there unspent for a significant amount of time.

Their explanation for the delays was that they wanted to be sure they would be able to secure additional future funding before they actually spent what they already had allocated for those (promised) projects. WTF?? And now, they are claiming they need even more!

It's just another typical ******* money grab. Ultimately, the money will flow in and yet the roads will still be fucked, with the can just a little farther down it.

/rant

Moderator

iTrader: (12)

Join Date: Nov 2008

Location: Tampa, Florida

Posts: 20,650

Total Cats: 3,011

It would suck to be a Californian (probably needs a period right there) who wanted to drive across the country or up to Alaska on summer vacation and have to pay gas taxes in the other states then still have to pay fat tax on miles traveled when you got back home.

On a different tax topic, what are the total property tax millage rates some of you are subject to in the rest of the country? My total in this locale is 19.005.

On a different tax topic, what are the total property tax millage rates some of you are subject to in the rest of the country? My total in this locale is 19.005.

Last edited by Braineack; 10-08-2019 at 09:48 AM.

Former Vendor

iTrader: (31)

Join Date: Nov 2006

Location: Sunnyvale, CA

Posts: 15,442

Total Cats: 2,099

I feel like the most obvious solution here is to check mileage at an annual inspection. There are two issues with this solution.

1. You would get slapped with a large bill all at once which would be a problem for low income individuals who may not save enough to pay it in one swoop. The obvious answer to this issue is to have a setup like we do for quarterly estimated tax payments for self-employed individuals. You would go through a web portal and estimate your yearly mileage. It would calculate a monthly payment amount and you could true up upon the annual inspection.

2. Out of state passenger cars and long haul trucks would basically be exempt from this tax as there would be no way to trace them. Trucks would probably be easier to effectively tax since they do weigh stations, have paper trails for their routes, and any other regulation that would make them easier to track. I am not sure how you would handle out of state cars. They may just be exempt.

Thoughts anyone?

1. You would get slapped with a large bill all at once which would be a problem for low income individuals who may not save enough to pay it in one swoop. The obvious answer to this issue is to have a setup like we do for quarterly estimated tax payments for self-employed individuals. You would go through a web portal and estimate your yearly mileage. It would calculate a monthly payment amount and you could true up upon the annual inspection.

2. Out of state passenger cars and long haul trucks would basically be exempt from this tax as there would be no way to trace them. Trucks would probably be easier to effectively tax since they do weigh stations, have paper trails for their routes, and any other regulation that would make them easier to track. I am not sure how you would handle out of state cars. They may just be exempt.

Thoughts anyone?

You can lie through your teeth about the mileage reporting if you wish, but when the next owner of your car reports 50,000 more miles on your car than you did at the point of sale, the DMV sends you a bill with penalties and fees added on. All smog certificates typically indicate mileage as well, so that's a backup check on the owner's honesty. Yes, there will be poor people who drive shitty cars into the ground and avoid the tax altogether. I'm OK with this because they're poor and probably deserve a break from a highly regressive flat road tax.

Out of state passenger cars would be exempt, yes. This is a really fractionally tiny percentage of the total mileage driven on CA roadways, and it would be exponentially more expensive to figure out how to account for it than it would bring in revenue, so it's not worth it. As far as long-haul trucks go, it's already done this way, and it's dealt with in the form of apportioned registration fees. Google "IRP" and "IFTA" for more details.

Sooner or later it's going to have to go this way. Europe is dealing with the repercussions of not figuring this out - their gas tax revenue has plummeted as cars have gotten smaller and more efficient.

The only way to accurately charge for miles driven on any given road is to implement a toll system.

A toll will charge in and out of state drivers a set amount for distance driven. Surcharges can be added for larger vehicles.

Still no guarantee the money collected will be spent on roadways.

In the RTP they added a toll to pay for the I-540 extension from the park through Apex.

The money goes straight to the construction company, and we will probably be paying for it the rest of my life.

Luckily, there are no actual toll booths. They rely on cameras and "fast pass". A free trip just involves an out-of-state plate, or putting the tailgate down.

They are talking about putting booths on I-95 soon. Most traffic is out of state and the Fed doesn't help much with repairs.

A toll will charge in and out of state drivers a set amount for distance driven. Surcharges can be added for larger vehicles.

Still no guarantee the money collected will be spent on roadways.

In the RTP they added a toll to pay for the I-540 extension from the park through Apex.

The money goes straight to the construction company, and we will probably be paying for it the rest of my life.

Luckily, there are no actual toll booths. They rely on cameras and "fast pass". A free trip just involves an out-of-state plate, or putting the tailgate down.

They are talking about putting booths on I-95 soon. Most traffic is out of state and the Fed doesn't help much with repairs.

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

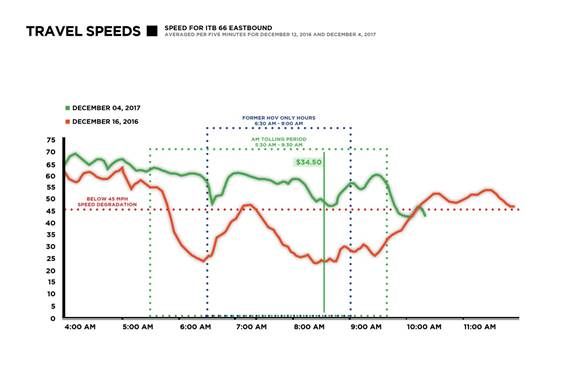

So we installed a toll road to pay for widening I-66 for 4 miles:

But traffic is so bad on our shitty roads built in 1940 despite being in the richest counties in the US -- people are willing to pay it:

WASHINGTON – In the first four days of tolls for solo drivers at rush hour on Interstate 66 inside the Beltway, commuters paid more than $100,000 each day, data obtained by WTOP show.

The money supports the tolling system and transit options to provide alternatives to paying the toll.

Initial calculations by the Virginia Department of Transportation show drivers paid a total of:

The money supports the tolling system and transit options to provide alternatives to paying the toll.

Initial calculations by the Virginia Department of Transportation show drivers paid a total of:

- Monday AM – $89,777

- Monday PM – $42,980

- Tuesday AM – $110,531

- Tuesday PM – $42,515

- Wednesday AM – $60,649

- Wednesday PM – $40,940

- Thursday AM – $76,069

- Thursday PM – $50,112

neato right?

except this is govt. we were promised funding would be 100% to fund the i66 improvement. It didn't take them long to figure out they could use it as a slush fund after only 9 days:

State leaders are proposing changes to the use of toll revenue from Interstate 66 inside the Capital Beltway.

These potential plans could include allowing part of the money to support a public-private partnership to build a new Rosslyn Metro station or to construct a new, wider Long Bridge that carries CSX, Amtrak and Virginia Railway Express trains over the Potomac between Arlington and D.C.

The Northern Virginia Transportation Commission is now scheduled to take up the proposal next month that would allow the toll money to cover debt service or other payments for the CSX bridge and/or improvements at the Rosslyn Metro station.

These potential plans could include allowing part of the money to support a public-private partnership to build a new Rosslyn Metro station or to construct a new, wider Long Bridge that carries CSX, Amtrak and Virginia Railway Express trains over the Potomac between Arlington and D.C.

The Northern Virginia Transportation Commission is now scheduled to take up the proposal next month that would allow the toll money to cover debt service or other payments for the CSX bridge and/or improvements at the Rosslyn Metro station.

It would suck to be a Californian (probably needs a period right there) who wanted to drive across the country or up to Alaska on summer vacation and have to pay gas taxes in the other states then still have to pay fat tax on miles traveled when you got back home.

On a different tax topic, what are the total property tax millage rates some of you are subject to in the rest of the country? My total in this locale is 19.005.

On a different tax topic, what are the total property tax millage rates some of you are subject to in the rest of the country? My total in this locale is 19.005.

Total property tax will be around $1800/year on my $156000 home. I think, they calculated based on the auction price for this coming year (home was a smoke damage total loss before being renovated), so I expect my escrow payment to jump approx $100/month at the end of next year.

Our rate in Maine is 6.62/1000.

The rate for our place in CT is 32.17/1000, and rising. CT state income tax is 6%. Sales tax is 6.35 going to 7%.

The gummint can't understand why so many taxpayers are in a hurry to leave. We're trying to sell our house before values really start to tank.

The rate for our place in CT is 32.17/1000, and rising. CT state income tax is 6%. Sales tax is 6.35 going to 7%.

The gummint can't understand why so many taxpayers are in a hurry to leave. We're trying to sell our house before values really start to tank.

Our rate in Maine is 6.62/1000.

The rate for our place in CT is 32.17/1000, and rising. CT state income tax is 6%. Sales tax is 6.35 going to 7%.

The gummint can't understand why so many taxpayers are in a hurry to leave. We're trying to sell our house before values really start to tank.

The rate for our place in CT is 32.17/1000, and rising. CT state income tax is 6%. Sales tax is 6.35 going to 7%.

The gummint can't understand why so many taxpayers are in a hurry to leave. We're trying to sell our house before values really start to tank.

I hope to be able to move out of this state in the next few years.

$22.4/1000 here in SW Ohio. $15.23/1000 on property we own in Mid NH. A comparison of tax rate change since 1995 shows the same 31-32% increase in millage rate.

Last edited by bahurd; 12-15-2017 at 09:35 AM.

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,022

Total Cats: 6,590

Originally Posted by everyone

(serious posts about property tax rates.)

* = seriously, nothing fancy, 2,500 sqft, 3br 2ba, with a tiny garage. Standalone houses are annoyingly expensive here. I'm seriously considering moving to the southeast and taking a job driving a FedEx truck to get ahead in life.

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

TELL ME ABOUT THE IMPORANTANCE OF FLYNN!!!!! IM STILL WAITING!

Does everyone left of me not really have an answer to why its so important?

Crooked FBI Agent Peter Strzok is having a rough couple of months. Not only is he being investigated for plotting to use the Russia investigation as an "insurance policy" in case Trump won, but he was also revealed to be the one behind the substantial edits.

Remember when James Comey gave the press conference last summer? He laid out all the crimes that Hillary Clinton committed, and then exonerated her at the last minute.

We learned earlier this year that he had actually crafted that exoneration statement months before she was even interviewed. But we now know for a FACT that even that early draft said that Hillary Clinton had broke the law.

Under the Espionage Act statute she was being investigated for, the minimum for prosecution is "gross negligence."

In documents released yesterday, we know that even though James Comey didn't think Hillary should have been prosecuted, he believed she had acted with gross negligence. So much so that his early draft said it not once, but twice,

Only problem? Anti-Trump FBI Agent Peter Strzok edited the statement to protect Hillary.

Take this section as an example.

Remember when James Comey declared that Hillary Clinton had been extremely careless? He was originally going to say that she was "grossly negligent." The original draft called Hillary's actions grossly negligent twice.

Strzok edited it to say "extremely careless."

But that's not all. The original draft said that it was "reasonably likely" that Hillary's server had been hacked by foreign powers. Peter Strzok got rid of that phrase as well and changed it to "possible."

That is huge because one of the main arguments being put forward by the Clinton campaign at the time was that her emails had never been hacked.

All of these edits would seem normal to some. Except, Peter Strzok wasn't normal. He was so anti-Trump and pro-Hillary, that he actually used a secret cell phone to talk to his mistress about Clinton. One of the texts that the Inspector General discovered shows that Peter Strzok and his mistress, FBI lawyer Lisa Page, used a private "burner" phone to talk about Hillary so it couldn't be traced.

"You say we text on that phone when we talk about Hillary because it can't be traced," Page texted Strzok on March 16, 2016.

So, the very FBI agent who was caught planning an "insurance policy" against Trump in case he won, and who had a secret phone used to talk about Hillary Clinton so it couldn't be traced, was the one who edited the exoneration statement to remove language that could be used against Clinton.

This is criminal.

...

Remember when James Comey gave the press conference last summer? He laid out all the crimes that Hillary Clinton committed, and then exonerated her at the last minute.

We learned earlier this year that he had actually crafted that exoneration statement months before she was even interviewed. But we now know for a FACT that even that early draft said that Hillary Clinton had broke the law.

Under the Espionage Act statute she was being investigated for, the minimum for prosecution is "gross negligence."

In documents released yesterday, we know that even though James Comey didn't think Hillary should have been prosecuted, he believed she had acted with gross negligence. So much so that his early draft said it not once, but twice,

Only problem? Anti-Trump FBI Agent Peter Strzok edited the statement to protect Hillary.

Take this section as an example.

Remember when James Comey declared that Hillary Clinton had been extremely careless? He was originally going to say that she was "grossly negligent." The original draft called Hillary's actions grossly negligent twice.

Strzok edited it to say "extremely careless."

But that's not all. The original draft said that it was "reasonably likely" that Hillary's server had been hacked by foreign powers. Peter Strzok got rid of that phrase as well and changed it to "possible."

That is huge because one of the main arguments being put forward by the Clinton campaign at the time was that her emails had never been hacked.

All of these edits would seem normal to some. Except, Peter Strzok wasn't normal. He was so anti-Trump and pro-Hillary, that he actually used a secret cell phone to talk to his mistress about Clinton. One of the texts that the Inspector General discovered shows that Peter Strzok and his mistress, FBI lawyer Lisa Page, used a private "burner" phone to talk about Hillary so it couldn't be traced.

"You say we text on that phone when we talk about Hillary because it can't be traced," Page texted Strzok on March 16, 2016.

So, the very FBI agent who was caught planning an "insurance policy" against Trump in case he won, and who had a secret phone used to talk about Hillary Clinton so it couldn't be traced, was the one who edited the exoneration statement to remove language that could be used against Clinton.

This is criminal.

...

Does everyone left of me not really have an answer to why its so important?

When a SFH next to my apartment which most recently sold for $720,000* is assessed for property taxation at a value of $64,500, the system is broken.

* = seriously, nothing fancy, 2,500 sqft, 3br 2ba, with a tiny garage. Standalone houses are annoyingly expensive here. I'm seriously considering moving to the southeast and taking a job driving a FedEx truck to get ahead in life.

https://www.zillow.com/homes/for_sal...03_rect/12_zm/