The Current Events, News, and Politics Thread

#2261

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

So I take it that you have no problem with the FED's lending $7.7 Trillion dollars to Euro banks during the bank crisis. No problems not because they didn't tell anybody, but because it's not real money anyway. PFEW! I was worried and fearmongered there for a second, but your graph has made me feel much better!

What will be the negative impact of swapping ~$100 bln worth of USD for ~$100 bln worth of euros (plus interest) during the first quarter of 2012?

If you really want to educate yourself on the topic, I'm happy to take it to PM or email. If you have no interest in being open to a different perspective, I'll let you take the blue pill and not waste any more of anyone's time.

#2262

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,488

Total Cats: 4,077

Obama in 2007 told CNN that Executive Priviledge was not a good reason to with hold information from Congress.

Obama in 2012 asserts executive privilege on some Fast and Furious documents

http://www.cnn.com/2012/06/20/politi...html?hpt=hp_t1

Obama in 2012 asserts executive privilege on some Fast and Furious documents

http://www.cnn.com/2012/06/20/politi...html?hpt=hp_t1

#2263

[QUOTEIf you really want to educate yourself on the topic, I'm happy to take it to PM or email. If you have no interest in being open to a different perspective, I'll let you take the blue pill and not waste any more of anyone's time.  [/QUOTE]

[/QUOTE]

No blue pill--and no "education" needed from you, Jack. I'm aware of the issues, and side with the WSJ article.

Perhaps this little rap video will put things in more perspective...

[/QUOTE]

[/QUOTE]No blue pill--and no "education" needed from you, Jack. I'm aware of the issues, and side with the WSJ article.

Perhaps this little rap video will put things in more perspective...

#2264

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Mark - For a bonus prize, what did Hayek, Keynes, and von Mises all operate under that is no longer relevant to the analysis of US economic and banking operations?

#2266

$9 Billion in ‘Stimulus’ for Solar, Wind Projects Made 910 Final Jobs -- $9.8 Million Per Job

http://cnsnews.com/news/article/9-bi...98-million-job

...house of cards

http://cnsnews.com/news/article/9-bi...98-million-job

...house of cards

#2267

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Saying a government controlled fixed currency (e.g a peg to gold) is better than what we have is an opinion. Basing predictions on what someone thinks should be, rather than what is, leads to flawed analysis like those examples I have pointed out (and many more that I haven't).

And, in many cases, that flawed analysis leads to high blood pressure and pulling out of one's hair unnecessarily (

) or to being curmudgeonly far beyond one's years (

) or to being curmudgeonly far beyond one's years ( ).

).

#2269

Being a sovereign issuer of a free-float fiat currency is not a theory. It is an observation of what is.

Saying a government controlled fixed currency (e.g a peg to gold) is better than what we have is an opinion. Basing predictions on what someone thinks should be, rather than what is, leads to flawed analysis like those examples I have pointed out (and many more that I haven't).

And, in many cases, that flawed analysis leads to high blood pressure and pulling out of one's hair unnecessarily ( ) or to being curmudgeonly far beyond one's years (

) or to being curmudgeonly far beyond one's years ( ).

).

Saying a government controlled fixed currency (e.g a peg to gold) is better than what we have is an opinion. Basing predictions on what someone thinks should be, rather than what is, leads to flawed analysis like those examples I have pointed out (and many more that I haven't).

And, in many cases, that flawed analysis leads to high blood pressure and pulling out of one's hair unnecessarily (

) or to being curmudgeonly far beyond one's years (

) or to being curmudgeonly far beyond one's years ( ).

).

I'm sympathetic to the communication struggle going on in this thread right now.

I'm still ideologically committed to the principles of an extremely limited government and an almost entirely free market. I firmly believe that only allowing individuals to make economic decisions using their own money results in increased and long-lasting wealth. I believe that government spending, by its nature (see: Milton Friedman's Four Ways to Spend Money), is economically inefficient compared to private spending, and actually drains resources that would otherwise be available for private consumption. Moreover, the inevitable malinvestment created through government spending distorts market prices for the private sector, creating all kinds of false incentives and disincentives with long-lasting detrimental effects on the economy.

I'm troubled that the MMT structure requires our government to wield public spending and taxation as tools to adjust sectoral balance, and that the trade-off for the (apparent) resilience of the monetary system is a constant unequal distribution of created money via government spending (see: poured honey analogy). While I recognize the problems with a strict gold standard or gold-pegged standard, I am by my nature much more comfortable with the natural budget constraint it places on government spending (admitting that plenty of gold or commodity-constrained governments have spent themselves into bankruptcy).

That said --

I am trying to learn how to re-apply my ideological principles to the language and structure of the monetary system as it currently operates. Any critique of MMT itself or of current government policy is doomed to confusion and failure if it's couched in the language of a gold-pegged, budget-constrained system.

#2271

This.

I'm sympathetic to the communication struggle going on in this thread right now.

I'm still ideologically committed to the principles of an extremely limited government and an almost entirely free market. I firmly believe that only allowing individuals to make economic decisions using their own money results in increased and long-lasting wealth. I believe that government spending, by its nature (see: Milton Friedman's Four Ways to Spend Money), is economically inefficient compared to private spending, and actually drains resources that would otherwise be available for private consumption. Moreover, the inevitable malinvestment created through government spending distorts market prices for the private sector, creating all kinds of false incentives and disincentives with long-lasting detrimental effects on the economy.

I'm troubled that the MMT structure requires our government to wield public spending and taxation as tools to adjust sectoral balance, and that the trade-off for the (apparent) resilience of the monetary system is a constant unequal distribution of created money via government spending (see: poured honey analogy). While I recognize the problems with a strict gold standard or gold-pegged standard, I am by my nature much more comfortable with the natural budget constraint it places on government spending (admitting that plenty of gold or commodity-constrained governments have spent themselves into bankruptcy).

That said --

I am trying to learn how to re-apply my ideological principles to the language and structure of the monetary system as it currently operates. Any critique of MMT itself or of current government policy is doomed to confusion and failure if it's couched in the language of a gold-pegged, budget-constrained system.

I'm sympathetic to the communication struggle going on in this thread right now.

I'm still ideologically committed to the principles of an extremely limited government and an almost entirely free market. I firmly believe that only allowing individuals to make economic decisions using their own money results in increased and long-lasting wealth. I believe that government spending, by its nature (see: Milton Friedman's Four Ways to Spend Money), is economically inefficient compared to private spending, and actually drains resources that would otherwise be available for private consumption. Moreover, the inevitable malinvestment created through government spending distorts market prices for the private sector, creating all kinds of false incentives and disincentives with long-lasting detrimental effects on the economy.

I'm troubled that the MMT structure requires our government to wield public spending and taxation as tools to adjust sectoral balance, and that the trade-off for the (apparent) resilience of the monetary system is a constant unequal distribution of created money via government spending (see: poured honey analogy). While I recognize the problems with a strict gold standard or gold-pegged standard, I am by my nature much more comfortable with the natural budget constraint it places on government spending (admitting that plenty of gold or commodity-constrained governments have spent themselves into bankruptcy).

That said --

I am trying to learn how to re-apply my ideological principles to the language and structure of the monetary system as it currently operates. Any critique of MMT itself or of current government policy is doomed to confusion and failure if it's couched in the language of a gold-pegged, budget-constrained system.

#2273

I could use some white privileges right now, whatever they may be, lol

http://d-umn.campusreform.org/group/...hite-privilege

http://d-umn.campusreform.org/group/...hite-privilege

#2274

http://www.cnbc.com/id/47903018

Moody’s Downgrade of 15 Banks Expected After the Bell

Did I mention that I work for Moody's?

#2276

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,017

Total Cats: 6,587

It depends on your definition of "collapse", which is a word that can be applied in many different ways. (Economic, moral, political, lemon meringue pie, etc.)

If you mean a complete collapse of both the economy and the government, it already did in 1991. Except that it was the USSR. Different name, same sandvich.

If you mean a complete collapse of both the economy and the government, it already did in 1991. Except that it was the USSR. Different name, same sandvich.

#2277

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

...What I said two days ago.

http://www.cnbc.com/id/47903018

Moody’s Downgrade of 15 Banks Expected After the Bell

Did I mention that I work for Moody's?

http://www.cnbc.com/id/47903018

Moody’s Downgrade of 15 Banks Expected After the Bell

Did I mention that I work for Moody's?

The ratings agencies are always and ever either behind the curve or completely wrong.

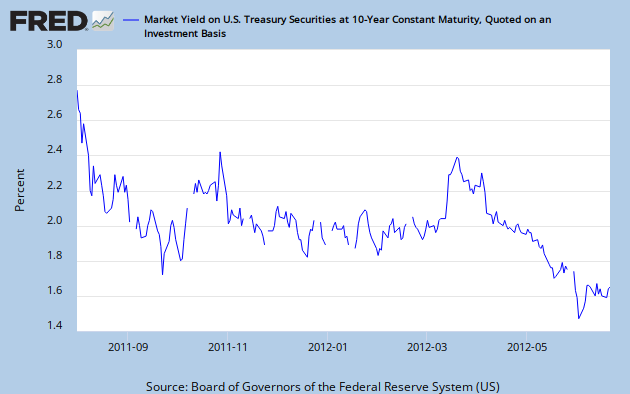

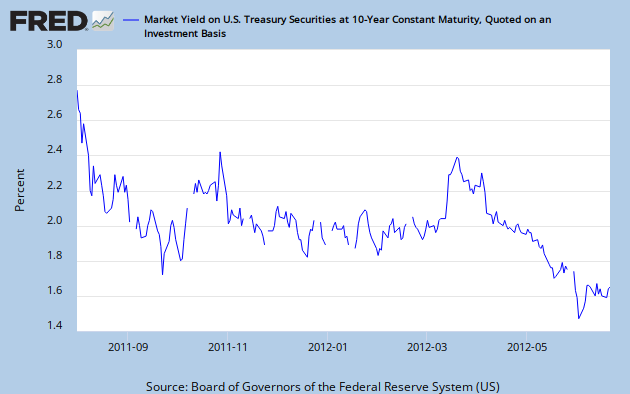

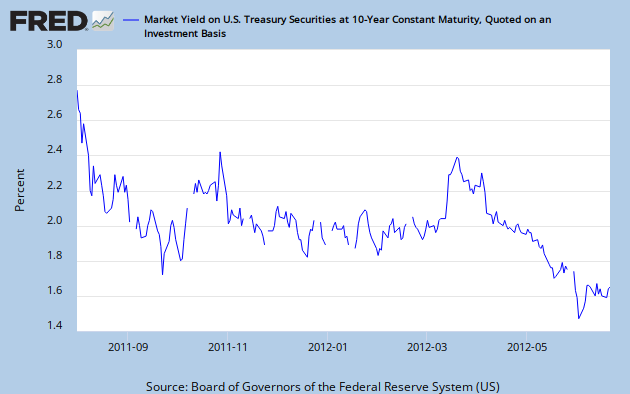

August 5, 2011: S&P downgrades US debt from AAA

On the other hand, European banks have been undercapitalized for a long time (they did not delever nearly as quickly as the US banks) and they are operating in a flawed currency system with each nation acting as a currency user like a US state but without the constant internal transfer system we have.

#2278

My first reaction is:

The ratings agencies are always and ever either behind the curve or completely wrong.

August 5, 2011: S&P downgrades US debt from AAA

On the other hand, European banks have been undercapitalized for a long time (they did not delever nearly as quickly as the US banks) and they are operating in a flawed currency system with each nation acting as a currency user like a US state but without the constant internal transfer system we have.

The ratings agencies are always and ever either behind the curve or completely wrong.

August 5, 2011: S&P downgrades US debt from AAA

On the other hand, European banks have been undercapitalized for a long time (they did not delever nearly as quickly as the US banks) and they are operating in a flawed currency system with each nation acting as a currency user like a US state but without the constant internal transfer system we have.

#2280

Whoever's in charge needs four more years!

http://articles.businessinsider.com/...s-news-reports

http://money.cnn.com/2011/08/04/pf/f...high/index.htm

http://www.cbsnews.com/8301-500395_162-57429655/student-debt-clock-strikes-$1-trillion/

Remain calm...all is well!