The Current Events, News, and Politics Thread

#2281

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

The ratings agencies were the ones rubber stamping "AAA" across pools of subprime mortgages. They also downgraded the USA's sovereign debt even though the only way the USA defaults on that debt is if it chooses to do so voluntarily for some asinine reason.

Explain to me why I should place a high value on their ratings?

I'm curious to hear your explanation of how your definition of a "real accounting system" differs from mine and still eagerly anticipating your response to my questions above:

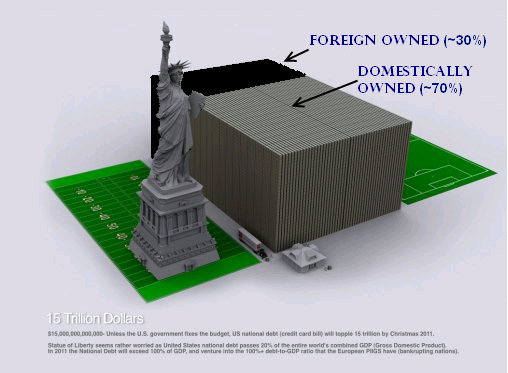

Whoa, look at all this domestic private sector savings! That's got to be bad! I wish we could pay off all that debt and swap all those interest paying savings accounts with non-interest paying cash! That would definitely benefit my grandmother and all those savers and pension funds. Right?

Explain to me why I should place a high value on their ratings?

I'm curious to hear your explanation of how your definition of a "real accounting system" differs from mine and still eagerly anticipating your response to my questions above:

What was the negative impact of swapping ~$600 bln worth of USD for ~$600 bln worth of euros (plus interest) during the global financial credit lockup of 2008-2009?

What will be the negative impact of swapping ~$100 bln worth of USD for ~$100 bln worth of euros (plus interest) during the first quarter of 2012?

What will be the negative impact of swapping ~$100 bln worth of USD for ~$100 bln worth of euros (plus interest) during the first quarter of 2012?

Whoa, look at all this domestic private sector savings! That's got to be bad! I wish we could pay off all that debt and swap all those interest paying savings accounts with non-interest paying cash! That would definitely benefit my grandmother and all those savers and pension funds. Right?

#2283

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

"Congressman Ackerman, you’ve been here 30 years. Can you define comity as it existed when you arrived versus how it exists now?," Bloomberg Businessweek asks.

Ackerman responds: " Your premise is that comity exists now. It may not be entirely accurate. It used to be you had real friends on the other side of the aisle. It’s not like that anymore. Society has changed. The public is to blame as well. I think the people have gotten dumber. I don’t know that I would’ve said that out loud pre-my announcement that I was going to be leaving. [Laughter] But I think that’s true. I mean everything has changed. The media has changed. We now give broadcast licenses to philosophies instead of people. People get confused and think there is no difference between news and entertainment. People who project themselves as journalists on television don’t know the first thing about journalism. They are just there stirring up a hockey game."

Ackerman responds: " Your premise is that comity exists now. It may not be entirely accurate. It used to be you had real friends on the other side of the aisle. It’s not like that anymore. Society has changed. The public is to blame as well. I think the people have gotten dumber. I don’t know that I would’ve said that out loud pre-my announcement that I was going to be leaving. [Laughter] But I think that’s true. I mean everything has changed. The media has changed. We now give broadcast licenses to philosophies instead of people. People get confused and think there is no difference between news and entertainment. People who project themselves as journalists on television don’t know the first thing about journalism. They are just there stirring up a hockey game."

#2284

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

CNBC article

Moody’s Downgrade of 15 Banks Expected After the Bell

Did I mention that I work for Moody's?

Moody’s Downgrade of 15 Banks Expected After the Bell

Did I mention that I work for Moody's?

“Moody’s is not going to detect some problem in advance and move a rating to warn the public,” said Ken Fisher, chief executive officer and founder of Woodside, California-based Fisher Investments, which has about $44 billion under management. “Whether it’s a stock or a bond, the free market already did that. Moody’s goes along afterwards and effectively validates what the market’s already done.”

“To downgrade a BofA or Citigroup or companies that are sitting on hundreds of billions of dollars of cash in government-backed securities makes no sense,” Richard Bove, an analyst at Rochdale Securities LLC, said in an interview on Bloomberg Radio and Television’s “Bloomberg Surveillance.”

“You can forget Moody’s,” Bove said. “You should have forgotten them a long time ago.”

Moody's cuts bank stock ratings and the stocks of the banks affected trade up. S&P cuts the rating of US debt and prices traded up.

“You can forget Moody’s,” Bove said. “You should have forgotten them a long time ago.”

Last edited by Scrappy Jack; 06-22-2012 at 01:05 PM.

#2285

Don't care about Moody's and downgrades--that's a symptom. We're talking "big picture". When the housing bubble burst, it couldn't be contained. Just months prior Barney and Co. were saying that there was no problem. This is the equivalent of your yawn picture.

I'm taking a 3 day hiatus from this thread--at least--as I'm very close to being called a hijacker.

I'm taking a 3 day hiatus from this thread--at least--as I'm very close to being called a hijacker.

#2286

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Have a good weekend, Cord. Maybe scroll over to the "Drinking Like a King" thread for a few ideas on how to make it even better.

#2290

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Written Nov. 9, 1999

Robert Rubin Rewrites the Rules

Former Treasury Secretary Robert Rubin gets cozy with the banking industry while helping push through a bill freeing financial institutions to merge into ever larger megacorporations while largely absolving them of much of their legal obligation to invest in the communities in which they do business.

—By Russell Mokhiber and Robert Weissman

Few top government officials, whether elected or appointed, have managed to emerge as unscathed from the Washington, D.C. spotlight as former Treasury Secretary Robert Rubin. And Rubin did better than escape without scratches—he ended his term of office with his image enhanced.

Wall Street and the financial press practically beatified him for his role in overseeing the global economy through difficult times and working in tandem with Federal Reserve Chair Alan Greenspan to keep the US economy working smoothly.

Rubin orchestrated the bailout of foreign bankers and investors in connection with the Mexican and Asian financial disasters, and crafted or helped implement domestic policies that ensured the overwhelming portion of benefits from economic growth would go to the rich—but none of this managed to sully the reputation of the Secretary Rubin.

When he stepped down from his Treasury post this past summer, Rubin left unfinished a legislative effort to re-write the nation's banking laws. Misnamed "financial modernization" legislation was really a deregulatory initiative—reminiscent of the S&L deregulation that led to a corporate crime spree, the collapse of the industry and the subsequent taxpayer bailout of epic proportions.

The centerpiece of the deregulatory bill, which different fragments of the finance industry have pushed for a decade and a half, is the repeal of the revered Glass-Steagall Act, which bars companies from owning banks and insurance companies or securities firms at the same time.

Although powerful interests have long backed the new legislation, it has repeatedly failed to make it through Congress because of a maze of intra-industry disputes, turf fights between different parts of the federal regulatory structure, and the concerted efforts of consumer and community development advocates.

Another failure seemed possible or likely this fall, especially as Senate Banking Chair Phil Gramm, R-Texas, refused to compromise on privacy and community development issues.

Another failure, however, was not acceptable to one company above all—Citigroup. The product of the merger between Citibank and Travelers, Citigroup is operating in apparent violation of the bar on common ownership of banking, and insurance and securities, thanks to a loophole that provides for a two-year transition period.

Enter Robert Rubin. According to a report in The New York Times, Rubin helped broker the final compromise language on financial deregulation.

And while he was brokering a deal between Congress and the White House, he was also, according to The New York Times account, negotiating his own deal with Citigroup. A few days after the banking deal was finalized, Citigroup announced it was hiring Rubin as a de facto co-chair of the corporation.

This chronology and these arrangements raise serious issues about whether federal ethics statutes and informal Clinton administration rules have been violated.

Rubin told The New York Times that he was proud of his work in preserving the Community Reinvestment Act (CRA), an important law that requires banks to make loans in minority and lower-income communities in which they do business. In fact, the final version of the bill significantly weakens CRA: It provides for no ongoing sanctions against holding company banks that fail to meet CRA standards, it lessens the number of CRA examinations, and provisions of the bill will discourage community groups from challenging banks' CRA records.

And the weakening of the CRA is only one element of the finance industry's deregulatory wish list which is included in the compromise legislation. The bill will:

■pave the way for a new round of record-shattering financial industry mergers, dangerously concentrating political and economic power;

■ create too-big-to-fail institutions that are someday likely to drain the public treasury as taxpayers bail out imperiled financial giants to protect the stability of the nation's banking system;

■ leave financial regulatory authority spread among a half dozen federal and 50 state agencies, all uncoordinated, that will be overmatched by the soon-to-be financial goliaths;

■ facilitate the rip-off of mutual fund insurance policy holders by permitting mutual insurance funds to switch domicile states -- thereby enabling them to locate in states where they can convert to for-profit, stockholder companies without properly reimbursing policyholders (a conversion of tens of billions of dollars);

■ permit the new financial giants to share finance, health, consumer, and other personal information among affiliates, compromising consumer privacy; and

■ allow banks to continue to deny services to the poor (Congress rejected an amendment requiring banks to provide "lifeline accounts" to the poor, so they would have refuge from check-cashing operations and the underground economy).

Robert Rubin helped deliver this ticking time bomb of a bill to Wall Street, first while in Treasury and then while in negotiations to land a top spot at the finance industry's largest and highest-profile company. He may well escape unscathed yet again, but it is sure to blow up on the rest of us.

Russell Mokhiber is editor of the Corporate Crime Reporter. Robert Weissman is editor of the Multinational Monitor. They are co-authors of Corporate Predators: The Hunt for MegaProfits and the Attack on Democracy.

Former Treasury Secretary Robert Rubin gets cozy with the banking industry while helping push through a bill freeing financial institutions to merge into ever larger megacorporations while largely absolving them of much of their legal obligation to invest in the communities in which they do business.

—By Russell Mokhiber and Robert Weissman

Few top government officials, whether elected or appointed, have managed to emerge as unscathed from the Washington, D.C. spotlight as former Treasury Secretary Robert Rubin. And Rubin did better than escape without scratches—he ended his term of office with his image enhanced.

Wall Street and the financial press practically beatified him for his role in overseeing the global economy through difficult times and working in tandem with Federal Reserve Chair Alan Greenspan to keep the US economy working smoothly.

Rubin orchestrated the bailout of foreign bankers and investors in connection with the Mexican and Asian financial disasters, and crafted or helped implement domestic policies that ensured the overwhelming portion of benefits from economic growth would go to the rich—but none of this managed to sully the reputation of the Secretary Rubin.

When he stepped down from his Treasury post this past summer, Rubin left unfinished a legislative effort to re-write the nation's banking laws. Misnamed "financial modernization" legislation was really a deregulatory initiative—reminiscent of the S&L deregulation that led to a corporate crime spree, the collapse of the industry and the subsequent taxpayer bailout of epic proportions.

The centerpiece of the deregulatory bill, which different fragments of the finance industry have pushed for a decade and a half, is the repeal of the revered Glass-Steagall Act, which bars companies from owning banks and insurance companies or securities firms at the same time.

Although powerful interests have long backed the new legislation, it has repeatedly failed to make it through Congress because of a maze of intra-industry disputes, turf fights between different parts of the federal regulatory structure, and the concerted efforts of consumer and community development advocates.

Another failure seemed possible or likely this fall, especially as Senate Banking Chair Phil Gramm, R-Texas, refused to compromise on privacy and community development issues.

Another failure, however, was not acceptable to one company above all—Citigroup. The product of the merger between Citibank and Travelers, Citigroup is operating in apparent violation of the bar on common ownership of banking, and insurance and securities, thanks to a loophole that provides for a two-year transition period.

Enter Robert Rubin. According to a report in The New York Times, Rubin helped broker the final compromise language on financial deregulation.

And while he was brokering a deal between Congress and the White House, he was also, according to The New York Times account, negotiating his own deal with Citigroup. A few days after the banking deal was finalized, Citigroup announced it was hiring Rubin as a de facto co-chair of the corporation.

This chronology and these arrangements raise serious issues about whether federal ethics statutes and informal Clinton administration rules have been violated.

Rubin told The New York Times that he was proud of his work in preserving the Community Reinvestment Act (CRA), an important law that requires banks to make loans in minority and lower-income communities in which they do business. In fact, the final version of the bill significantly weakens CRA: It provides for no ongoing sanctions against holding company banks that fail to meet CRA standards, it lessens the number of CRA examinations, and provisions of the bill will discourage community groups from challenging banks' CRA records.

And the weakening of the CRA is only one element of the finance industry's deregulatory wish list which is included in the compromise legislation. The bill will:

■pave the way for a new round of record-shattering financial industry mergers, dangerously concentrating political and economic power;

■ create too-big-to-fail institutions that are someday likely to drain the public treasury as taxpayers bail out imperiled financial giants to protect the stability of the nation's banking system;

■ leave financial regulatory authority spread among a half dozen federal and 50 state agencies, all uncoordinated, that will be overmatched by the soon-to-be financial goliaths;

■ facilitate the rip-off of mutual fund insurance policy holders by permitting mutual insurance funds to switch domicile states -- thereby enabling them to locate in states where they can convert to for-profit, stockholder companies without properly reimbursing policyholders (a conversion of tens of billions of dollars);

■ permit the new financial giants to share finance, health, consumer, and other personal information among affiliates, compromising consumer privacy; and

■ allow banks to continue to deny services to the poor (Congress rejected an amendment requiring banks to provide "lifeline accounts" to the poor, so they would have refuge from check-cashing operations and the underground economy).

Robert Rubin helped deliver this ticking time bomb of a bill to Wall Street, first while in Treasury and then while in negotiations to land a top spot at the finance industry's largest and highest-profile company. He may well escape unscathed yet again, but it is sure to blow up on the rest of us.

Russell Mokhiber is editor of the Corporate Crime Reporter. Robert Weissman is editor of the Multinational Monitor. They are co-authors of Corporate Predators: The Hunt for MegaProfits and the Attack on Democracy.

#2291

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

yeah you are.

Here's the thing, spread you arms out as wide as you can. Imagine Ron Paul is at the right most tip of your hand, and Romney is at the tip of your left pointer finger, followed by Obama at the tip of your left middle finger (fitting).

That's the gap I see when thinking about who I'd rather see in office, where obama and romney are more or less the same if you consider all the others I'd place before them.

But I'm voting for romney and would rather see him in office than obama. I voted for Paul in the primary, but that didn't matter. What matters is getting rid of obama, so you must vote against him. That vote HAS to then go to romney. A vote for paul or nader or whomever, is a vote against romney and therfore a vote for obama...I know others will try to kid themselves this isn't true, but it is.

Plus if you actually go review his record/past, he's not too shabby. But I'm also not going to kid myself into thinking he's some savior. But I'm also racist since I've voting against Obama, so what do i know.

#2292

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,026

Total Cats: 6,592

It's so refreshing to see someone acknowledge the reality of the electoral situation and take a well-reasoned and rational view of how the system must be operated in order to achieve the most desirable outcome possible.

#2294

Same Here.

I've been preaching this to everyone i know. Its insane the amount of power this man has given himself over the last 4 years. NDAA, NDRP, Attacks on the freedom of speech.. Its like this guy is setting himself up for absolute power during a martial law situation, which he could create pretty much any time he wants.

I've been preaching this to everyone i know. Its insane the amount of power this man has given himself over the last 4 years. NDAA, NDRP, Attacks on the freedom of speech.. Its like this guy is setting himself up for absolute power during a martial law situation, which he could create pretty much any time he wants.

#2299

Dang i didn't know the healthcare bill was going through this week!

#2300

Boost Czar

Thread Starter

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

food for thought:

The Food Stamp Program, administered by the U.S. Department of Agriculture, is proud to be distributing the greatest amount of free meals and food stamps ever.

Meanwhile, the National Park Service, administered by the U.S. Department of the Interior, asks us to "Please Do Not Feed the Animals."

Their stated reason for the policy is because the animals will grow dependent on handouts and will not learn to take care of themselves.

Meanwhile, the National Park Service, administered by the U.S. Department of the Interior, asks us to "Please Do Not Feed the Animals."

Their stated reason for the policy is because the animals will grow dependent on handouts and will not learn to take care of themselves.

Last edited by Braineack; 10-08-2019 at 09:48 AM.