How (and why) to Ramble on your goat sideways

Struggling right now...

Found the house of my dreams (city-version.)

https://click.mail.zillow.com/f/a/4e...0lm3nhu1_1pt0h

$625k. 3 car garage. Technically, I can afford it, though it'd be a bit of a stretch.

Don't know what to do...

Found the house of my dreams (city-version.)

https://click.mail.zillow.com/f/a/4e...0lm3nhu1_1pt0h

$625k. 3 car garage. Technically, I can afford it, though it'd be a bit of a stretch.

Don't know what to do...

I've lived by the thought that owning property is preferred over renting/leasing but that's a mindset from being in a place for 5yr at least. If you're planning on moving soon you'll give up 6% in fees and the tendency with companies today is to not pay to relo (unless it's within the same company).

Another thing I followed is to never own the most expensive house on the street/neighborhood. Zillow isn't the best at this but do some work on true comps. With that house (nice house btw), you're paying dearly for someone else's sweat. If you're buying with the intent to flip in a yr or two I doubt you can time the real estate market so you need to be prepared to live with a house worth less in the short term (realtor fees to sell + potential down market at the same time).

With that particular house, and it's underlying age, I'd really look into the basement water control before I sunk that kind of money into it. Nothing helps to drop a house value more than a wet basement that's been "upgraded".

There's something about owning vs paying someone else that satisfies the mind though. Good luck!

Last edited by bahurd; 07-27-2018 at 12:23 PM.

We are trying to get prepared to sell this place in a 1.5-3 years, even though I just bought in September. We are hoping with the rate that homes are being purchased and fixed up and flipped like mine was, we will be able to just sell and break even soon.

Then it's do we stay in OKC, or do we move to Austin where my company just opened a massive new "hub/campus."

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,019

Total Cats: 6,587

- From San Diego to North Carolina

- From North Carolina to Florida

- From Florida to San Diego

- From San Diego to Santa Clara

- From Santa Clara to Hoboken, NJ

- From Hoboken to Poughkeepsie

- From Poughkeepsie to Manhattan

- From Manhattan to Chicago

- From Chicago to North Carolina, and

- From North Carolina to Chicago.

Lately, I've been feeling like I might be stuck in Chicago. But a part of me wonders if my feeling "stuck" is what normal (non-nomadic) people interpret as feeling "secure."

With that particular house, and it's underlying age, I'd really look into the basement water control before I sunk that kind of money into it. Nothing helps to drop a house value more than a wet basement that's been "upgraded".

There's something about owning vs paying someone else that satisfies the mind though. Good luck!

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,019

Total Cats: 6,587

Pretty much.

Seriously, I know this neighborhood well. It's a few blocks from where I live. Unless you're down in River North, this is as upscale as it gets.

I'm more worried about the fact that the housing market in California is looking a tad iffy again, and we know how that turned out the last time. I lost upwards of $100k (actual cash, not fictitious equity) in '08, and am terrified of making a similar mistake.

Seriously, I know this neighborhood well. It's a few blocks from where I live. Unless you're down in River North, this is as upscale as it gets.

I'm more worried about the fact that the housing market in California is looking a tad iffy again, and we know how that turned out the last time. I lost upwards of $100k (actual cash, not fictitious equity) in '08, and am terrified of making a similar mistake.

Feel your pain although I've never lost real money on property. The recent news about CA really stemmed from the fact the new inventory has been sold off and there isn't enough new stock to make up for it (if I remember the stats). Housing downturns do seem to happen more frequently then when I got into the market. Sucks to be underwater and owe the bank.

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,019

Total Cats: 6,587

Chicago is an old city. Hundred year old foundations are considered normal.

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,019

Total Cats: 6,587

While having spent some time living in Germany makes me agree, I fully appreciate why this is so, given the relative youth of the country as a whole.

I expect that it is much the same in Canada and Australia.

Unrelated: I made some poor decisions today. Nothing that affects my finances, but my stomach is in full revolt right now.

I expect that it is much the same in Canada and Australia.

Unrelated: I made some poor decisions today. Nothing that affects my finances, but my stomach is in full revolt right now.

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,019

Total Cats: 6,587

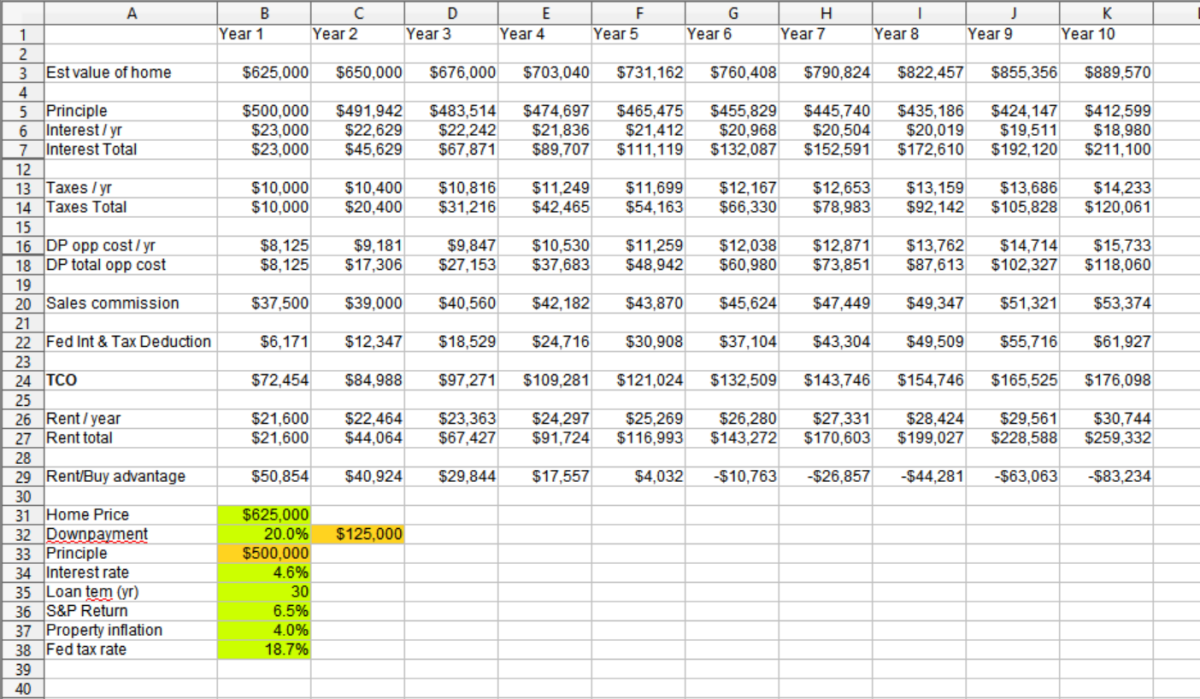

The math just isn't adding up here...

Assuming a $625k purchase price, a 20% downpayment, and ignoring closing costs, I'd be paying approximately $2,800 a month just in interest and property tax alone. That's $1,000 more than I pay in rent at present.

So the question becomes: Do I expect this property to appreciate in value by more than $1,000 per month?

The real-estate market in this area is so unpredictable that I really can't answer that question.

Assuming a $625k purchase price, a 20% downpayment, and ignoring closing costs, I'd be paying approximately $2,800 a month just in interest and property tax alone. That's $1,000 more than I pay in rent at present.

So the question becomes: Do I expect this property to appreciate in value by more than $1,000 per month?

The real-estate market in this area is so unpredictable that I really can't answer that question.

Elite Member

iTrader: (2)

Join Date: Jun 2009

Location: Istanbul, Turkey

Posts: 3,214

Total Cats: 1,687

The math just isn't adding up here...

Assuming a $625k purchase price, a 20% downpayment, and ignoring closing costs, I'd be paying approximately $2,800 a month just in interest and property tax alone. That's $1,000 more than I pay in rent at present.

So the question becomes: Do I expect this property to appreciate in value by more than $1,000 per month?

The real-estate market in this area is so unpredictable that I really can't answer that question.

Assuming a $625k purchase price, a 20% downpayment, and ignoring closing costs, I'd be paying approximately $2,800 a month just in interest and property tax alone. That's $1,000 more than I pay in rent at present.

So the question becomes: Do I expect this property to appreciate in value by more than $1,000 per month?

The real-estate market in this area is so unpredictable that I really can't answer that question.

Home payments, on the other hand are largely a tax write off.

You get to deduct all interest at the end of the year, and actually come ahead - depending on the specifics of the region, etc.

And, since interest makes up of about 90-95% of your total house payments in the first half of your loan's life, you pretty much enjoy the house and the financial benefits.

Bu the time the principal starts making up the majority of your payments - meaning, there is little to deduct - inflation will have caught up already, and you will end up paying less than those around you who are renting.

Or, I could be wrong.

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,019

Total Cats: 6,587

I may be mistaken, but when you pay rent, you just pay it away to someone.

Home payments, on the other hand are largely a tax write off.

You get to deduct all interest at the end of the year, and actually come ahead - depending on the specifics of the region, etc.

And, since interest makes up of about 90-95% of your total house payments in the first half of your loan's life, you pretty much enjoy the house and the financial benefits.

Bu the time the principal starts making up the majority of your payments - meaning, there is little to deduct - inflation will have caught up already, and you will end up paying less than those around you who are renting.

Or, I could be wrong.

Home payments, on the other hand are largely a tax write off.

You get to deduct all interest at the end of the year, and actually come ahead - depending on the specifics of the region, etc.

And, since interest makes up of about 90-95% of your total house payments in the first half of your loan's life, you pretty much enjoy the house and the financial benefits.

Bu the time the principal starts making up the majority of your payments - meaning, there is little to deduct - inflation will have caught up already, and you will end up paying less than those around you who are renting.

Or, I could be wrong.

And, for me, portability is valuable. As I said, this job feels like one that will be relatively stable, but then, I've moved twelve times in the past 20 years. My Amazon.com addresses page is hilariously long (largely because it also contains a bunch of hotels.)

Real estate tax, state income tax, and mortgage interest are deductible from income when computing Federal tax, as itemized deductions on Schedule A. Since my income tax for IL already puts me very near the minimum Standard Deduction on form 1040, we'll assume that 100% of real estate tax and mortgage interest are deductible. Mortgage interest and real estate tax are not deductible when computing Illinois income tax, so we'll focus just on Federal form 1040.

Assume a $625k purchase price, 20% downpayment, and a 30 year conforming loan at 4.6% APR.

We'll assume that the following things all increase each year at a certain rate, for which I'll have a cell in the spreadsheet called "property inflation" that allows me to plug in different percentages:

- Market value of home

- Cost of real-estate tax

- Cost of rent

We're also going to explore the opportunity cost of using the downpayment to buy a home vs the average S&P 500 composite return, which is about 6.5% over any period of the past 10, 20, 30 or 40 years. (Range = 6.45 to 6.76)

And, in the end, we'll have to factor in a realtor's commission, which is generally 6%.

I'm gonna make a spreadsheet. Because that's what engineers do.

In the end, it's all coming down to cell B37. Making a 1% adjustment in that cell swings the break-even point by five years in either direction. And, of course, I'm completely ignoring the costs of maintenance.

How close to each other in functionality (size, quality, location, etc) are the two properties you're comparing?

--Ian

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,019

Total Cats: 6,587

Quality = 1.25x (one block in from the nearest major road, so slightly better quality of sleep due to noise.)

Location = -0.2x (same neighborhood quality, somewhat longer walk to work.)

When you really want to own that Tesla S but currently lease a Kia Rio it's hard to justify on a spreadsheet....

Can you buy a condo that's more equivalent? Seems silly to pay for the house if you don't need/want the space.

--Ian