Who here is using Bitcoin?

#21

I wouldn't be so negative towards central bank legal-tender money if they targeted 0 inflation as opposed to 2-3% steady inflation.

Such inflation steals from savers and those on a fixed income. Even Keynes said that steady central bank inflation is a means of reducing the real income of wage-earners. 2-3% inflation as opposed to 0%, makes it much more difficult to save money for the future and requires people to play investor. This funnels a lot more money into the stock market than otherwise, again subsidizing the financial industry, and arguably increases the volatility of said stock market.

Secondly such steady inflation distorts the market to subsidize individuals and corporations that can effectively borrow at or near inflation rates, at the expense of said savers. And it obviously dis-incentivizes saving, and incentivizes borrowing and spending. One can argue that this biases the masses towards taking a short-term as opposed to a long-term view, and is thus a net negative.

Thirdly the money-creation power itself gives the gov't/central bank the ability to bail out the financial industry which as a result enjoys privatized profits and socialized risk. The cronyism is immense.

Such inflation steals from savers and those on a fixed income. Even Keynes said that steady central bank inflation is a means of reducing the real income of wage-earners. 2-3% inflation as opposed to 0%, makes it much more difficult to save money for the future and requires people to play investor. This funnels a lot more money into the stock market than otherwise, again subsidizing the financial industry, and arguably increases the volatility of said stock market.

Secondly such steady inflation distorts the market to subsidize individuals and corporations that can effectively borrow at or near inflation rates, at the expense of said savers. And it obviously dis-incentivizes saving, and incentivizes borrowing and spending. One can argue that this biases the masses towards taking a short-term as opposed to a long-term view, and is thus a net negative.

Thirdly the money-creation power itself gives the gov't/central bank the ability to bail out the financial industry which as a result enjoys privatized profits and socialized risk. The cronyism is immense.

#22

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,022

Total Cats: 6,590

Such inflation steals from savers and those on a fixed income. Even Keynes said that steady central bank inflation is a means of reducing the real income of wage-earners. 2-3% inflation as opposed to 0%, makes it much more difficult to save money for the future and requires people to play investor. This funnels a lot more money into the stock market than otherwise, again subsidizing the financial industry, and arguably increases the volatility of said stock market.

Secondly such steady inflation distorts the market to subsidize individuals and corporations that can effectively borrow at or near inflation rates, at the expense of said savers. And it obviously dis-incentivizes saving, and incentivizes borrowing and spending. One can argue that this biases the masses towards taking a short-term as opposed to a long-term view, and is thus a net negative.

Thirdly the money-creation power itself gives the gov't/central bank the ability to bail out the financial industry which as a result enjoys privatized profits and socialized risk. The cronyism is immense.

Secondly such steady inflation distorts the market to subsidize individuals and corporations that can effectively borrow at or near inflation rates, at the expense of said savers. And it obviously dis-incentivizes saving, and incentivizes borrowing and spending. One can argue that this biases the masses towards taking a short-term as opposed to a long-term view, and is thus a net negative.

Thirdly the money-creation power itself gives the gov't/central bank the ability to bail out the financial industry which as a result enjoys privatized profits and socialized risk. The cronyism is immense.

And none of them are anywhere near as bad as subscribing to a monetary system which is controlled principally by speculators rather than by a chartered federal agency which is directly accountable to the congress.

The same congress, by the way, which is specifically granted the power, in Article I Section 8 of the US Constitution, to create money and regulate its value.

It's like the old joke about how democracy is the worst possible form of government, with the exception of all the other ones which have been tried. You're pointing out how bad the central bank is, and yet the only alternative which you can offer is far, far worse.

#23

The same congress, by the way, which is specifically granted the power, in Article I Section 8 of the US Constitution, to create money and regulate its value.

#24

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,022

Total Cats: 6,590

You are using the concepts of "currency" and "commodity" as though they were interchangeable.

To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;

"To regulate the value thereof."

Doesn't say anything at all about backing, paper, etc. It says that they get to regulate the value of money.

Don't take too literal an interpretation of the word "Coin" in section 8. In the late 18th century, the word, when used as a verb, meant simply to create new monetary instruments.

The Continental Congress had actually been printing paper money since 1775, a year prior to the revolutionary war. And almost immediately after the adoption of the constitution, in 1789, the Congress chartered the First Bank of the United States and authorized it to issue banknotes.

Far from the founders of the US being opposed to unbacked paper money, they'd been issuing it themselves for years, and continued the practice after federalization.

And the so-called Gold Standard? It wasn't even adopted until 1900. (The first US Dollar was actually pegged to the Spanish Milled Dollar, and it bounced around all sorts of different standards from 1785 to 1899.)

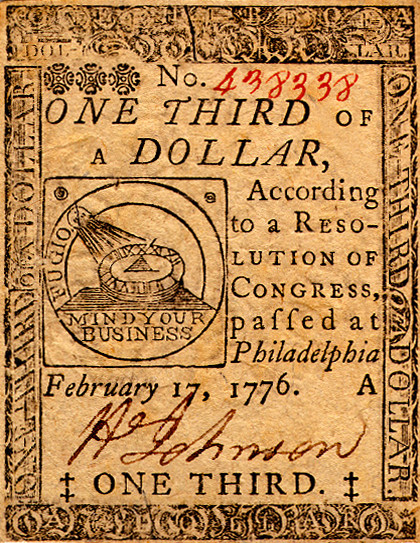

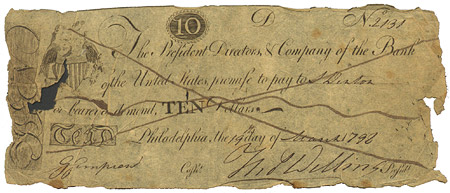

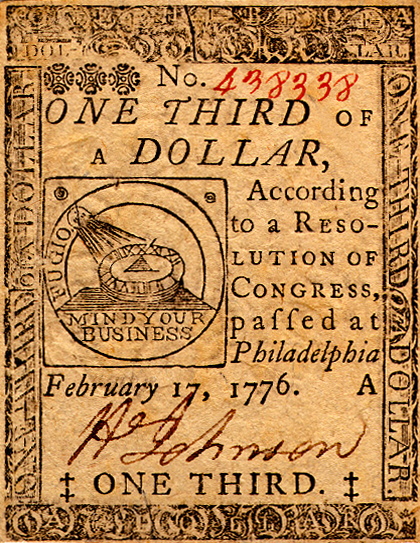

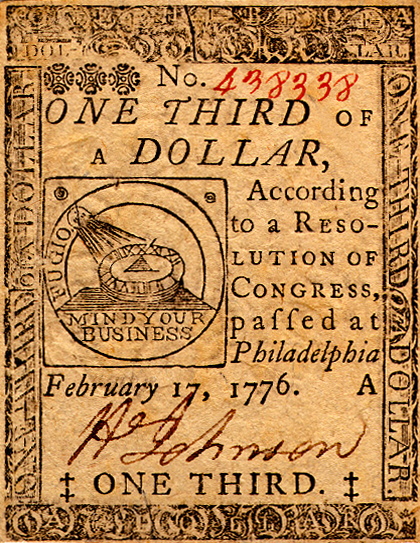

A Continental paper third-dollar:

A First Bank of the United States $10 note from 1798:

#26

The price of gold now is not stable because it is not currency/money, due to legal tender laws. As I mentioned earlier, it is the size of the economy that a currency is used in, that stabilizes its short term fluctuations. If gold had remained currency, it would have been more long-term stable than the USD, which has lost 96% of its value since the creation of the Federal Reserve.

You are using the concepts of "currency" and "commodity" as though they were interchangeable.

#27

Relevant.

There seems to be an inherent hatred of Bitcoin by certain groups of people. Some people feel the need to boldly declare that Bitcoin isn’t a form of money. Or they declare that Bitcoin is worth $0. This line of thinking tends to come from vehement backers of fiat money. I don’t understand this.

One of the beauties of viewing money as a medium of exchange that exists on a “scale of moneyness” is that it allows you to be more open-minded with regards to how you view the world of financial assets and non-financial assets. There is no need to draw a line in the sand and dogmatically declare that something is money or not money. You don’t have to fall victim to debates like the metallist versus chartalist debates or the gold versus fiat money debates. You can view money for what it is, as a medium of exchange and simply measure how well something serves as a medium of exchange or what its level of “moneyness” is.

Bitcoin is definitely a form of money through this lens because some people view it as a viable medium of exchange. It’s just not a great form of money. But there’s no need to draw a line in the sand here and be dogmatic about Bitcoin.

As for how its “moneyness” might change in the future – who knows? Money is something that is largely in the eye of the beholder. If more and more people believe Bitcoin is a viable medium of exchange then its “moneyness” could actually increase. Likewise, it could decrease. But there’s no need to get involved in an ideological aversion or worship of Bitcoin. I don’t think that will help anyone understand it any better. And it’s certainly not helping in the broader understanding of what “money” is to begin with.

One of the beauties of viewing money as a medium of exchange that exists on a “scale of moneyness” is that it allows you to be more open-minded with regards to how you view the world of financial assets and non-financial assets. There is no need to draw a line in the sand and dogmatically declare that something is money or not money. You don’t have to fall victim to debates like the metallist versus chartalist debates or the gold versus fiat money debates. You can view money for what it is, as a medium of exchange and simply measure how well something serves as a medium of exchange or what its level of “moneyness” is.

Bitcoin is definitely a form of money through this lens because some people view it as a viable medium of exchange. It’s just not a great form of money. But there’s no need to draw a line in the sand here and be dogmatic about Bitcoin.

As for how its “moneyness” might change in the future – who knows? Money is something that is largely in the eye of the beholder. If more and more people believe Bitcoin is a viable medium of exchange then its “moneyness” could actually increase. Likewise, it could decrease. But there’s no need to get involved in an ideological aversion or worship of Bitcoin. I don’t think that will help anyone understand it any better. And it’s certainly not helping in the broader understanding of what “money” is to begin with.

#28

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,022

Total Cats: 6,590

Gold, all by itself, has never been a practical tool for day-to-day financial transactions outside of a few extremely isolated pockets of time and space (eg: gold flakes and dust were commonly traded in those parts of the North American continent which experienced gold rushes in the 19th century.)

One of the biggest problems with freestanding gold as a transactional medium is that it's hard to accurately measure, and not just because you need a good scale. The tools and knowledge to alloy gold have been commonplace for hundreds of years now, such that if I know what I'm doing, I can easily take a lump of 24k gold and alloy it down by 20-30% without adversely affecting its color or malleability. How is the girl at the cash register supposed to verify the purity of the lump of gold I'm handing her?

Sure, you can mint gold into coins, but that defeats the purpose of using gold in the first place (as opposed to, say, steel or paper.) At this point, you're involving a government and a central bank, and so you're right back to where we started. The gold is now worth whatever the government stamps on the front of it, but only so long as the face value of said coin, plus the hassle of melting the coin down and transporting it to another country, exceeds the expected return from doing so.

The price of gold now is not stable because it is not currency/money, due to legal tender laws. As I mentioned earlier, it is the size of the economy that a currency is used in, that stabilizes its short term fluctuations. If gold had remained currency, it would have been more long-term stable than the USD, which has lost 96% of its value since the creation of the Federal Reserve.

The Fed can no more dictate the price of gold on the world market than it can dictate the price of oil.

No, currency is something that is widely accepted as payment. Gold is not currency, has not been since FDR confiscated it from citizens in the 1930s.

#29

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,022

Total Cats: 6,590

Also, since you totally ignored the bulk of my previous message, I'm just going to go ahead and re-post it verbatim:

If this were the case, then they would have written that into the constitution. Article 1, in particular, is extremely specific about every little detail of the Congress. Here is the exact text of the relevant section:

"To regulate the value thereof."

Doesn't say anything at all about backing, paper, etc. It says that they get to regulate the value of money.

Don't take too literal an interpretation of the word "Coin" in section 8. In the late 18th century, the word, when used as a verb, meant simply to create new monetary instruments.

The Continental Congress had actually been printing paper money since 1775, a year prior to the revolutionary war. And almost immediately after the adoption of the constitution, in 1789, the Congress chartered the First Bank of the United States and authorized it to issue banknotes.

Far from the founders of the US being opposed to unbacked paper money, they'd been issuing it themselves for years, and continued the practice after federalization.

And the so-called Gold Standard? It wasn't even adopted until 1900. (The first US Dollar was actually pegged to the Spanish Milled Dollar, and it bounced around all sorts of different standards from 1785 to 1899.)

A Continental paper third-dollar:

A First Bank of the United States $10 note from 1798:

To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;

"To regulate the value thereof."

Doesn't say anything at all about backing, paper, etc. It says that they get to regulate the value of money.

Don't take too literal an interpretation of the word "Coin" in section 8. In the late 18th century, the word, when used as a verb, meant simply to create new monetary instruments.

The Continental Congress had actually been printing paper money since 1775, a year prior to the revolutionary war. And almost immediately after the adoption of the constitution, in 1789, the Congress chartered the First Bank of the United States and authorized it to issue banknotes.

Far from the founders of the US being opposed to unbacked paper money, they'd been issuing it themselves for years, and continued the practice after federalization.

And the so-called Gold Standard? It wasn't even adopted until 1900. (The first US Dollar was actually pegged to the Spanish Milled Dollar, and it bounced around all sorts of different standards from 1785 to 1899.)

A Continental paper third-dollar:

A First Bank of the United States $10 note from 1798:

#30

I got into bitcoin/litecoin mining about 6 months ago just for fun as an experiment. It kind of turned into a hobby and with the recent inflation in price, I used the coins I mined to purchase a 3 T/H miner rig as a longer term investment. The key to the mining side of "game" is to have the biggest miner possible as soon as it hits the market.

If I was buying into the currency now, I'd buy heavily into Litecoin. Right now Litecoin is still Scrypt based mining (using GPU) and is effectively tied to BTC (think gold/silver). I think the longer term projection for LTC will be ~ 60-100 whereas it currently sits around 32 USD.

The reality is - I consider bitcoins similiar to options trading, its all based on opportunity and the ability to make a quick investment and not care what happens to the money

If I was buying into the currency now, I'd buy heavily into Litecoin. Right now Litecoin is still Scrypt based mining (using GPU) and is effectively tied to BTC (think gold/silver). I think the longer term projection for LTC will be ~ 60-100 whereas it currently sits around 32 USD.

The reality is - I consider bitcoins similiar to options trading, its all based on opportunity and the ability to make a quick investment and not care what happens to the money

#32

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,022

Total Cats: 6,590

Thanks to this, it literally costs more in electrical power to mine bitcoins with a general-purpose PC than you will earn from the task.

Much as a very small percentage of the US population controls a very large percentage of the total wealth in the US, this small group of miners have created a bitcoin 1%, and control the majority of currently-extant bitcoins.

To give you some sense of scale as to the futility of trying to compete with the bitcoin 1%, here are what some typical present-day bitcoin mining rigs look like:

Last edited by Joe Perez; 12-10-2013 at 01:59 PM.

#34

It's basically become a digital arms-race, in which certain small groups of people are spending large amounts of money to create dedicated, high-performance mining machines based on custom ICs dedicated specifically to the purpose. In doing so, they have caused massive deflation of the currency and driven down the "price" of bitcoin mining to the point where casual mining (eg: using a high-end gaming PC at home) has become pointless.

Thanks to this, it literally costs more in electrical power to mine bitcoins with a general-purpose PC than you will earn from the task.

Much as a very small percentage of the US population controls a very large percentage of the total wealth in the US, this small group of miners have created a bitcoin 1%, and control the majority of currently-extant bitcoins.

Thanks to this, it literally costs more in electrical power to mine bitcoins with a general-purpose PC than you will earn from the task.

Much as a very small percentage of the US population controls a very large percentage of the total wealth in the US, this small group of miners have created a bitcoin 1%, and control the majority of currently-extant bitcoins.

http://www.techfaster.com/what-is-bi...ng-work-video/

#35

"Mining" bitcoin is like mining gold - it's supposed to be expensive and difficult to mine, which reduces its inflation rate, so bitcoin's value doesn't dilute from inflation.

Last edited by JasonC SBB; 12-11-2013 at 11:17 AM.

#36

<gold> Such as being easily counterfeited

Central banks are LEGAL counterfeiters. They print more money and dilute its value.

Again if gold were widely accepted we wouldn't be walking around with coins. We'd be using receipts i.e. gold-backed paper money, or VISA or charge cards denominated in gold units.

And almost immediately after the adoption of the constitution, in 1789, the Congress chartered the First Bank of the United States and authorized it to issue banknotes.

And the so-called Gold Standard? It wasn't even adopted until 1900.

Greenspan himself wrote a great article on gold and why central bankers want to decouple paper money from any commodity:

http://www.constitution.org/mon/greenspan_gold.htm

Try to understand what he's saying.

Last edited by JasonC SBB; 12-11-2013 at 11:14 AM.

#37

One of the biggest problems with freestanding gold as a transactional medium is that it's hard to accurately measure, and not just because you need a good scale.

How is the girl at the cash register supposed to verify the purity of the lump of gold I'm handing her?

Unless I'm missing something blindingly obvious, you seem to be presupposing that the USA is the only government on earth, and that the American people are the only society who have any interest in gold. ...

The Fed can no more dictate the price of gold on the world market than it can dictate the price of oil.

The Fed can no more dictate the price of gold on the world market than it can dictate the price of oil.

Gold has never been currency in the US.

#38

Good article on the Fed's reaction to Bitcoin. Lots of Doublespeak in their paper:

Has the Fed Met Its Match? - Ludwig von Mises Institute Canada

Has the Fed Met Its Match? - Ludwig von Mises Institute Canada

#39

I tried mining some litecoins, but after 2-3 hours getting cgminer to run, and 5-6 hours of mining, the pool I had signed up for still showed I had no progress. The way the pool runs, supposedly I should get a percentage of each block found based on how much work I had done, but the pool wasn't ever reporting my worker doing anything. So I gave up.