The Current Events, News, and Politics Thread

#3941

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Can you expound on that?

In my industry, I might consider spreads or yields to indicate questions of creditworthiness. For example, CCC "junk" rated corporate debt, priced at very low spreads, is trading about 9%.

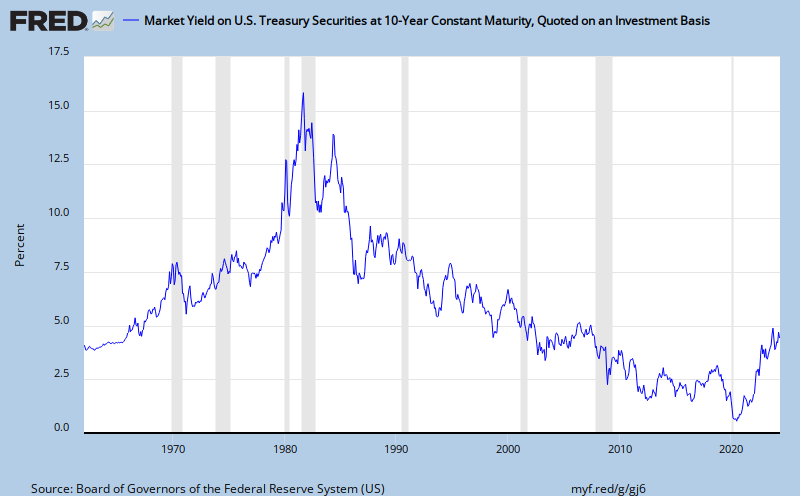

10-year US Treasury bonds are yielding less than 2% (within spitting distance of 50-year lows).

The only way the US Treasury cannot raise US dollars is in the event of a currency rejection. Every involuntary case of which in the history of monetary systems like the US has been after a major exogoneous shock which caused a major loss of productive capacity: loss of war on domestic soil, major governmental regime change (not going from a Neo-Con to a Liberal POTUS but from representative democracy to dictatorship), etc.

Currency rejection is possible, but so improbable given current and plausible outlooks, that it's hardly worth spending much time on (even though I have spent plenty of time on it here in the past ).

).

In my industry, I might consider spreads or yields to indicate questions of creditworthiness. For example, CCC "junk" rated corporate debt, priced at very low spreads, is trading about 9%.

10-year US Treasury bonds are yielding less than 2% (within spitting distance of 50-year lows).

By finding itself in a position in which it is unable to raise sufficient funds from a combination of revenue activity (tax collection) and debt (the issuing of bonds) to pay for 100% of Federal spending.

Currency rejection is possible, but so improbable given current and plausible outlooks, that it's hardly worth spending much time on (even though I have spent plenty of time on it here in the past

).

).

#3946

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

One rating agency downgraded the Treasury bonds a notch, based primarily on their perception of US political dysfunction. That can happen again, but see the second question in that post...

After all, those ratings agencies were the same one rubber stamping "AAA" on baskets of mortgage securities they either (A) didn't bother to try and understand or (B) understood and thought were high-risk. They have virtually no credibility in my mind.

That's close enough for government work.  (Technically, yields on the US 10-year went down and prices went up after the downgrade, but that was as much to do with Europe as it was to do with S&P).

(Technically, yields on the US 10-year went down and prices went up after the downgrade, but that was as much to do with Europe as it was to do with S&P).

After all, those ratings agencies were the same one rubber stamping "AAA" on baskets of mortgage securities they either (A) didn't bother to try and understand or (B) understood and thought were high-risk. They have virtually no credibility in my mind.

(Technically, yields on the US 10-year went down and prices went up after the downgrade, but that was as much to do with Europe as it was to do with S&P).

(Technically, yields on the US 10-year went down and prices went up after the downgrade, but that was as much to do with Europe as it was to do with S&P).

#3949

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Speaking of throwing down the gauntlet on the US bankruptcy idea...

From 2010-10-22. No one has taken him up on the offer.

Originally Posted by Warren Mosler

Senate Candidate Bets Congress $100 Million That the U.S. Government Cannot Run out of Money

Warren Mosler Offers $100 Million of His Own Money to Pay Down the Federal Deficit If Any Lawmaker Can Prove Him Wrong

Warren Mosler Offers $100 Million of His Own Money to Pay Down the Federal Deficit If Any Lawmaker Can Prove Him Wrong

#3959

One rating agency downgraded the Treasury bonds a notch, based primarily on their perception of US political dysfunction. That can happen again, but see the second question in that post...

After all, those ratings agencies were the same one rubber stamping "AAA" on baskets of mortgage securities they either (A) didn't bother to try and understand or (B) understood and thought were high-risk. They have virtually no credibility in my mind.

That's close enough for government work. (Technically, yields on the US 10-year went down and prices went up after the downgrade, but that was as much to do with Europe as it was to do with S&P).

(Technically, yields on the US 10-year went down and prices went up after the downgrade, but that was as much to do with Europe as it was to do with S&P).

After all, those ratings agencies were the same one rubber stamping "AAA" on baskets of mortgage securities they either (A) didn't bother to try and understand or (B) understood and thought were high-risk. They have virtually no credibility in my mind.

That's close enough for government work.

(Technically, yields on the US 10-year went down and prices went up after the downgrade, but that was as much to do with Europe as it was to do with S&P).

(Technically, yields on the US 10-year went down and prices went up after the downgrade, but that was as much to do with Europe as it was to do with S&P)....sorry, just trying to get used to the upside-down rules in this new world.

#3960

Perceptions have always been the only thing that mattered. Under normal circumstances the "fundamentals" guide perception. The difference in this situation is that the "fundamentals" do not apply to the U.S. govt. This is why the market did not react poorly to a downgrade. The U.S. will not run out of money to pay its debts and the country was no where near a complete political meltdown like a coup or something.