Just curious... anybody dabble in the stock market?

#41

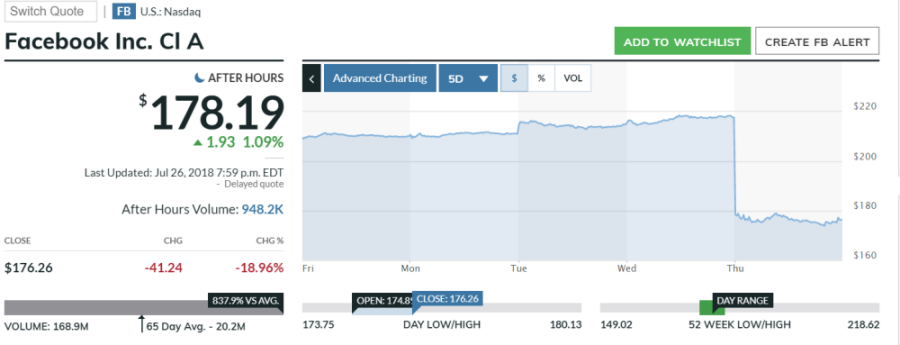

This is a view of a cynical middle-aged man, but I have a problem with tech stocks of companies that don't produce anything and just peddle your personal info to third parties so that they can peddle garbage to you. They said $120B of value was wiped out, to which i say who gives a **** about a company that doesn't produce anything? This is not General Atomics, Caterpillar, Intel, Apple, Microsoft...What's worse - Facebook has NOTHING to follow up with onto success of its social media platform (unlike Google, Amazon, Netflix and a few others). They do have an awful lot of cash and people willing to give them money.

#43

2 Props,3 Dildos,& 1 Cat

iTrader: (8)

Join Date: Jun 2005

Location: Fake Virginia

Posts: 19,338

Total Cats: 573

btw, do any of you ever use trading view to overwhelm yourself with data and shower in your own ignorance of how to use it?

https://www.tradingview.com/chart/?symbol=NASDAQ:FB

#44

Junior Member

iTrader: (1)

Join Date: Jul 2018

Location: Coral Springs, FL

Posts: 187

Total Cats: 57

Otherwise, the common thing i hear when them is awful client support, which tends to be the norm for the deep discount brokerage houses out there. Depending on the trader, it can make sense to actually pay commissions to get a certain level of support on things. I know i've been in positions where i needed to call a brokers trade desk to close out when my platform ***** the bed or some other act of god. Just something to consider as well.

Just a few thoughts. Going back to the n00b cave now.

Disclaimer because rules n' stuff - This post is not intended to make a recommendation.Trading is risky.

Last edited by sometorque; 07-31-2018 at 10:27 AM.

#45

Junior Member

iTrader: (1)

Join Date: Jul 2018

Location: Coral Springs, FL

Posts: 187

Total Cats: 57

I'm still about $110k long in my discretionary account. While I admit that I have a poor track record of predicting trends, my gut feeling is that this situation we're in right now is going to last a while, and will get worse before it gets better.

Wrestling with whether to stay in, or to step aside for a while and get ready to maybe pull the trigger on something like RYVTX.

Wrestling with whether to stay in, or to step aside for a while and get ready to maybe pull the trigger on something like RYVTX.

Disclaimer because rules n' stuff - This post is not intended to make a recommendation.Trading is risky.

#46

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,017

Total Cats: 6,587

**** it.

I'm back in at $100k long. Just bought 592 of IVW at 168.7814.

Tired of sitting on the sidelines.

And TDAmeritrade PWNS Vanguard when it comes to execution time on ETFs. 5 seconds vs. 24 hours.

I'm back in at $100k long. Just bought 592 of IVW at 168.7814.

Tired of sitting on the sidelines.

And TDAmeritrade PWNS Vanguard when it comes to execution time on ETFs. 5 seconds vs. 24 hours.

#47

Junior Member

iTrader: (1)

Join Date: Jul 2018

Location: Coral Springs, FL

Posts: 187

Total Cats: 57

Disclaimer because rules n' stuff - This post is not intended to make a recommendation.Trading is risky.

#49

Junior Member

iTrader: (1)

Join Date: Jul 2018

Location: Coral Springs, FL

Posts: 187

Total Cats: 57

Disclaimer because rules n' stuff - This post is not intended to make a recommendation.Trading is risky.

#50

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,017

Total Cats: 6,587

My recollection is that Vanguard-brand funds executed immediately, but third-party ETFs took forever. I kind of secretly suspected that this was something which they did deliberately. No limits, these were straight market orders.

#52

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,017

Total Cats: 6,587

Well, I seem to be good at picking the top of a market, that's for sure. Problem is that I seem to do the wrong thing.

After '08, I told myself that the next time the market started panicking, I'd follow the herd rather than stubbornly riding the bear. I'm having a difficult time convincing myself that that is truly the best idea right now.

After '08, I told myself that the next time the market started panicking, I'd follow the herd rather than stubbornly riding the bear. I'm having a difficult time convincing myself that that is truly the best idea right now.

#54

Well, I seem to be good at picking the top of a market, that's for sure. Problem is that I seem to do the wrong thing.

After '08, I told myself that the next time the market started panicking, I'd follow the herd rather than stubbornly riding the bear. I'm having a difficult time convincing myself that that is truly the best idea right now.

After '08, I told myself that the next time the market started panicking, I'd follow the herd rather than stubbornly riding the bear. I'm having a difficult time convincing myself that that is truly the best idea right now.

#55

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,017

Total Cats: 6,587

What gives me pause is that right now, I'd only be out 12.2% if I decided to exit.

In '07, at this point, I was thinking "Nah, the fundamentals haven't changed, it'd be stupid to take a loss." And then, of course, the market as a whole proceeded to lose an additional 40% or so. By the time I finally decided to get out (which turned out to be a dumb idea, hence my present hesitation), I'd have been better off buying a new Porsche 911 from the dealership, driving it exactly once, and then setting it on fire.

What's even scarier is that I've been eyeballing double-inverse ETFs...

#56

My non-401k exposure is just straight S&P 500 index.

What gives me pause is that right now, I'd only be out 12.2% if I decided to exit.

In '07, at this point, I was thinking "Nah, the fundamentals haven't changed, it'd be stupid to take a loss." And then, of course, the market as a whole proceeded to lose an additional 40% or so. By the time I finally decided to get out (which turned out to be a dumb idea, hence my present hesitation), I'd have been better off buying a new Porsche 911 from the dealership, driving it exactly once, and then setting it on fire.

What's even scarier is that I've been eyeballing double-inverse ETFs...

What gives me pause is that right now, I'd only be out 12.2% if I decided to exit.

In '07, at this point, I was thinking "Nah, the fundamentals haven't changed, it'd be stupid to take a loss." And then, of course, the market as a whole proceeded to lose an additional 40% or so. By the time I finally decided to get out (which turned out to be a dumb idea, hence my present hesitation), I'd have been better off buying a new Porsche 911 from the dealership, driving it exactly once, and then setting it on fire.

What's even scarier is that I've been eyeballing double-inverse ETFs...

My taxable accounts are all specific stocks & typically dividend paying stuff. Iíve sold some things this year; GE & J&J (recently, 1/2 the position) but otherwise theyíve done well. Iíve used the profits to increase our cash position.

I did make a mistake by buying back into GE near itís low which went lower so technically iím down on that.

#59

Moderator

iTrader: (12)

Join Date: Nov 2008

Location: Tampa, Florida

Posts: 20,645

Total Cats: 3,009

Take a look at this diversity: https://investor.vanguard.com/mutual...folio-holdings

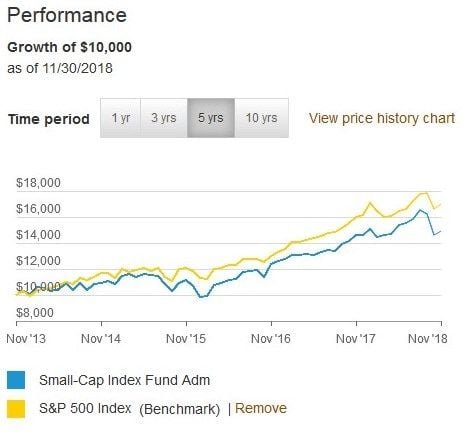

And the performance is nice, too.