Just curious... anybody dabble in the stock market?

#84

Junior Member

iTrader: (1)

Join Date: Jul 2018

Location: Coral Springs, FL

Posts: 187

Total Cats: 57

In theory. Studies show people, especially non-professionals, are pretty bad at this timing and end up underperforming the market even when they are investing almost entirely in indexes. Pick an asset class that fits your risk tolerance and stick with it. Rebalance quarterly. If your stomach turns from short term volatility you are either overestimating your risk tolerance or you need a Xanax.

Its sucks, but Im just going to roll through it like always.

Also, professionals are pretty bad at timing markets too. Building a market portfolio is always the answer unless you know how to cheat (like building an infrared laser computer network all over wall street).

Also, professionals are pretty bad at timing markets too. Building a market portfolio is always the answer unless you know how to cheat (like building an infrared laser computer network all over wall street).

Keep in mind, most traders are emotional and instead of sticking to rules and a system, trade on feelings, which makes the market akin to a hormonal teeanger who's parents dont get them. Even when disciplined traders stay the course with their strategy, they're still fighting against an often illogical market that in many respects is driven off emotion.

#85

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,050

Total Cats: 6,615

Keep in mind, most traders are emotional and instead of sticking to rules and a system, trade on feelings, which makes the market akin to a hormonal teeanger who's parents dont get them. Even when disciplined traders stay the course with their strategy, they're still fighting against an often illogical market that in many respects is driven off emotion.

Fighting against an illogical market is what me got me into trouble in '07. So I swore that the next time the herd panicked, I'd go along with the flow.

That's not worked well the past two days.

#87

Article for you in case you aren't keeping track: Three straight weeks of gains in the new year on Wall Street have erased nearly all of 2018ís losses. Itís the best start to a year since 1987..

#88

I follow a different method than most with 100% self directed stocks (no bonds or ETF's).

80% of the total dollars invested equally spread amongst high quality stocks in search of long term diversification (AMZN, AAPL, HD, V, BP, GS) that I only review each quarter to decide how much to hold/put/call.

The other 20% is in speculative growth, which is where I have actually have made most of my money.

What I am looking at is money that falls thru the cracks of the big buyers/sellers that buy & sell in baskets.

The theory being that when the big guys push the sell (or buy) button they are actually not doing individual stocks but specific amounts of various groups of stocks that somebody puts into a single basket.

When the decision happens to sell energy (for example) there might be 20 individual stocks in that basket that get sold off as a group.

This tends to make smaller cap stock prices swing short term more than the large stocks in that same basket.

I watch for big volume sell days where pretty much everything in the market is moving down as this tells me the big guys are all hitting the sell button.

Latest example of this was back in October of 2018 when the market peaked then started selling off until some time in December with lots of volume and lots of downward pressure.

I was watching WPX since it made it up to a hair over $20 in October before the entire market did the dump.

By December it was down below $12 with no good reason other than the overall market dump and the price of Oil dropping from the 70's to the 50's.

Set a trigger and bought a position at about $12.25 but it continued dropping so I doubled my position when it hit $11.

It continued dropping to high 9's but it never hit my next trigger so my current position cost is break even at about $11.80

Currently it is in the low 12's but my sell trigger is for $18.25, which should happen when crude gets back up to over $70 hopefully before the end of 2019.

The Russians and Saudis have indicated they will be cutting supply in order to get the price back up to that level and they have the focus and discipline to make that happed as they have proven in the past.

Another possibility to raise crude prices is supply disruption (Venezuela?) or news headlines that indicate potential supply problems.

It works real well for me but is not for people who are not willing to do homework and have a list of potential smaller stocks in baskets to watch for opportunities.

Update for April 16 2019; The price on WPX is currently just above $14.50 so it is climbing nicely.

Haven't sold any yet because I am still happy with my $18.25 sell trigger.

Being up 22% in 4 months is a really nice cushion to let me sleep at night while waiting for the next few months.

80% of the total dollars invested equally spread amongst high quality stocks in search of long term diversification (AMZN, AAPL, HD, V, BP, GS) that I only review each quarter to decide how much to hold/put/call.

The other 20% is in speculative growth, which is where I have actually have made most of my money.

What I am looking at is money that falls thru the cracks of the big buyers/sellers that buy & sell in baskets.

The theory being that when the big guys push the sell (or buy) button they are actually not doing individual stocks but specific amounts of various groups of stocks that somebody puts into a single basket.

When the decision happens to sell energy (for example) there might be 20 individual stocks in that basket that get sold off as a group.

This tends to make smaller cap stock prices swing short term more than the large stocks in that same basket.

I watch for big volume sell days where pretty much everything in the market is moving down as this tells me the big guys are all hitting the sell button.

Latest example of this was back in October of 2018 when the market peaked then started selling off until some time in December with lots of volume and lots of downward pressure.

I was watching WPX since it made it up to a hair over $20 in October before the entire market did the dump.

By December it was down below $12 with no good reason other than the overall market dump and the price of Oil dropping from the 70's to the 50's.

Set a trigger and bought a position at about $12.25 but it continued dropping so I doubled my position when it hit $11.

It continued dropping to high 9's but it never hit my next trigger so my current position cost is break even at about $11.80

Currently it is in the low 12's but my sell trigger is for $18.25, which should happen when crude gets back up to over $70 hopefully before the end of 2019.

The Russians and Saudis have indicated they will be cutting supply in order to get the price back up to that level and they have the focus and discipline to make that happed as they have proven in the past.

Another possibility to raise crude prices is supply disruption (Venezuela?) or news headlines that indicate potential supply problems.

It works real well for me but is not for people who are not willing to do homework and have a list of potential smaller stocks in baskets to watch for opportunities.

Update for April 16 2019; The price on WPX is currently just above $14.50 so it is climbing nicely.

Haven't sold any yet because I am still happy with my $18.25 sell trigger.

Being up 22% in 4 months is a really nice cushion to let me sleep at night while waiting for the next few months.

Last edited by BGordon; 04-16-2019 at 11:24 AM. Reason: April 16 update

#89

Junior Member

iTrader: (1)

Join Date: Jul 2018

Location: Coral Springs, FL

Posts: 187

Total Cats: 57

For all the MT.net traders out there, looks like most of the big box brokers out there are going to commission free models (E*Trade, Fidelity, TD, Interactive, etc..). It's worth checking to make sure your accounts are reflecting these new pricing plans.

#90

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,050

Total Cats: 6,615

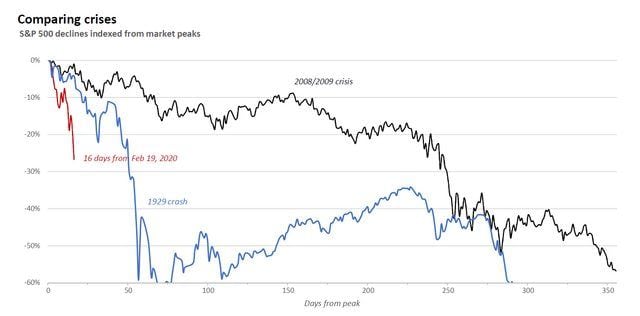

Been watching the DJIA / S&P 500 lately, as has everyone else, I am sure.

With respect to the very true fact that attempting to time the market is generally futile, I can't help but feel that there is going to be a very good "buy" opportunity coming up. Whether it'll be in days or months is going to be the tricky part.

With respect to the very true fact that attempting to time the market is generally futile, I can't help but feel that there is going to be a very good "buy" opportunity coming up. Whether it'll be in days or months is going to be the tricky part.

#91

2 Props,3 Dildos,& 1 Cat

iTrader: (8)

Join Date: Jun 2005

Location: Fake Virginia

Posts: 19,338

Total Cats: 573

Been watching the DJIA / S&P 500 lately, as has everyone else, I am sure.

With respect to the very true fact that attempting to time the market is generally futile, I can't help but feel that there is going to be a very good "buy" opportunity coming up. Whether it'll be in days or months is going to be the tricky part.

With respect to the very true fact that attempting to time the market is generally futile, I can't help but feel that there is going to be a very good "buy" opportunity coming up. Whether it'll be in days or months is going to be the tricky part.

But everyone also had their cash in the booming market and now does not have any purchasing power for more stock.

Unless they were already sitting on cash reserves in the record market for some reason.

or bear funds.

or double bear funds

or triple bear funds

#93

Retired Mech Design Engr

iTrader: (3)

Join Date: Jan 2013

Location: Seneca, SC

Posts: 5,009

Total Cats: 857

To me; any time it is down 30%; like today; the market should be considered ON SALE.

However, my cash reserves exactly match my goal level for the non-volatile bucket of my imminent retirement, so I have to restrain myself from buying.

The main thing is DO NOT SELL your market indexed mutual funds. HOLD THEM. Selling now is how you loose money in the stock market.

However, my cash reserves exactly match my goal level for the non-volatile bucket of my imminent retirement, so I have to restrain myself from buying.

The main thing is DO NOT SELL your market indexed mutual funds. HOLD THEM. Selling now is how you loose money in the stock market.

#95

I've done pretty decent swapping between short and long positions over the last week or so. The market hasn't seemed to sustain losses of 8% or more over the following trading day; and during the weekends, governments don't take any major economically stimulating actions, but the virus does continue to infect and kill at an exponential rate.

I was uncomfortable today on whether the market would go up or down, so remained in cash. We were fairly flat today. I'm hopeful that we'll see a few percentage gain tomorrow in which case I'll hold a short position over the weekend.

I was uncomfortable today on whether the market would go up or down, so remained in cash. We were fairly flat today. I'm hopeful that we'll see a few percentage gain tomorrow in which case I'll hold a short position over the weekend.

#97

I’m very much in the liquidate other assets (I.e. sell race car and other superfluous things) stage so that I can buy in with as much cash as I can in the next month or two.

Not gonna worry about timing it perfectly.

I am very recently LONG on a couple stocks I wasn’t planning on being long on. Have to hold now though...

Not gonna worry about timing it perfectly.

I am very recently LONG on a couple stocks I wasn’t planning on being long on. Have to hold now though...