As of today, I am DEBT FREE!

#21

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Vash - congrats! For the vast majority of people, debt free is a great way to go if possible.

I am totally lost. How do you have $1,000,000+ of debt after your parents left you with more equity than debt? Did they leave you a $1 mil mortgage on property worth $1.1 mil or something?

I'm not asking for specific numbers or personally identifiable details, but you can't throw that teaser out there and leave it completely unexplained!

Of course, it depends on a lot of variables, but I would be in no rush to buy a house.

I'm not asking for specific numbers or personally identifiable details, but you can't throw that teaser out there and leave it completely unexplained!

Of course, it depends on a lot of variables, but I would be in no rush to buy a house.

#23

Congrats Vash!

You would be one of the last people on this thread I would suspect of having 6 figure debt. Student loans I presume, or was it the Ferraris?

Myself, I will (hopefully) never be in debt. If I want schooling, the it will be payed for. Another excellent reason to join the military.

Myself, I will (hopefully) never be in debt. If I want schooling, the it will be payed for. Another excellent reason to join the military.

#24

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

(Sent from phone via capitalism)

Sold a house.

Originally Posted by Gearhead_318

Congrats Vash!

You would be one of the last people on this thread I would suspect of having 6 figure debt. Student loans I presume, or was it the Ferraris?

Myself, I will (hopefully) never be in debt. If I want schooling, the it will be payed for. Another excellent reason to join the military.

Myself, I will (hopefully) never be in debt. If I want schooling, the it will be payed for. Another excellent reason to join the military.

#29

Elite Member

iTrader: (14)

Join Date: Sep 2009

Location: Birmingham, AL

Posts: 2,101

Total Cats: 180

I certainly hope you make lots o money with that degree- and hope you never have to file bankruptcy because of it - student loans do not go away in bankruptcy from what I understand

Starting new business 6 months ago, I am virtually debt free there, and we just refi'd from a 30yr to a 15yr @ 3.25% - and paying LESS than what we were on the 30...

Congrats Vash on the freedom!

Starting new business 6 months ago, I am virtually debt free there, and we just refi'd from a 30yr to a 15yr @ 3.25% - and paying LESS than what we were on the 30...

Congrats Vash on the freedom!

#30

Supporting Vendor

iTrader: (33)

Join Date: Jul 2006

Location: atlanta-ish

Posts: 12,659

Total Cats: 134

I have a family member who (who had several advanced degrees including an MD) was in the same boat. He had 2 houses paid off before his student loans. He is now retired and balling hard. In the end, it was worth it for him.

#31

Supporting Vendor

iTrader: (33)

Join Date: Jul 2006

Location: atlanta-ish

Posts: 12,659

Total Cats: 134

Same boat myself, with exception to the house. I do use the plastic, but I pay it off each month. Cards can offer additional protections against using cash plus you get points. Any purchases made on revolving credit are paid off that month, then the points are accumulated and eventually redeemed. There is no extra cost to me, and we get something cool out of it over time.

It takes a lot of will power to make sure I don't charge over my ability to pay off that month. The way I do it is I have a rule of 3, meaning I must have enough available cash to purchase 3 of the item I want at that time. If I can't buy 3, then I can't buy 1.

I'll also sometimes make large purchases on plastic if there is a 0% long term finance option. This is rare, but I've done it. I'll pay it off at minimum 1 month before end of term. Example, say I buy a new appliance for $1k with 18 month same as cash terms. First, I make sure we have $3k available as liquid cash. If I do and go through with the purchase, I make sure that that the payments are paid on time and finished by month 17; that's $59/mo in this example over 17 months. This keeps my cash available and it's also really good for the credit score. That's a more complicated issue though, and has other factors.

#32

Antisaint

Thread Starter

iTrader: (17)

Join Date: Feb 2007

Location: Danbury, CT

Posts: 4,564

Total Cats: 58

I'm hoping to build rather than buy. I've actually already played around with blueprints in hopes that I can go that route.

The loan was a consolidation of all my credit cards that I got carried away with at one point. Lesson learned.

I wish I cared this much about money 5 years ago before I went through it like water. lol

Today was a good day.

The loan was a consolidation of all my credit cards that I got carried away with at one point. Lesson learned.

I wish I cared this much about money 5 years ago before I went through it like water. lol

Today was a good day.

#33

I am totally lost. How do you have $1,000,000+ of debt after your parents left you with more equity than debt? Did they leave you a $1 mil mortgage on property worth $1.1 mil or something?

I'm not asking for specific numbers or personally identifiable details, but you can't throw that teaser out there and leave it completely unexplained!

#35

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,493

Total Cats: 4,080

I sorta misspoke. I saved hard for for years and had 6 figures in the bank in. On Jan '11 I sold my house and was only actually now 5 figures in debt. now it's down to a low 4 figure number and will all be paid off completely by the end of next month, next ill buy a new cheap house with a garage and yard.

#36

Too many bargains in the housing market to build right now. I cannot stand debt (completely debt free including the house) but I would have no problem going into debt to buy a first house.

For a data point, we finally got everything paid off on 9/11/09 (42 years old) so you are definitely well ahead of where I was. Fantastic job!

It is actually around 20%. My guess is that number will rapidly drop as the baby boomers die off.

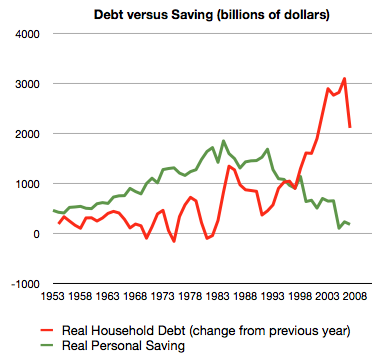

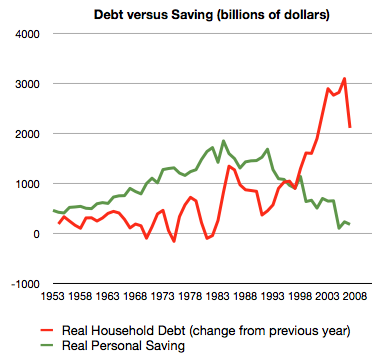

(the steep drop on the red line is people defaulting on their loans)

For a data point, we finally got everything paid off on 9/11/09 (42 years old) so you are definitely well ahead of where I was. Fantastic job!

It is actually around 20%. My guess is that number will rapidly drop as the baby boomers die off.

(the steep drop on the red line is people defaulting on their loans)

#39

Elite Member

iTrader: (1)

Join Date: Feb 2008

Location: Birmingham Alabama

Posts: 7,930

Total Cats: 45

I can't wait to experience this. Pretty much since I was 16, I have been in constant debt. I think I finally have a job that will allow me to pay it all off, relatively quickly at that. Congrats on being debt free. Not many people reach the point of being completely debt free.

#40

Hey, now that you are debt free don't forget about investing some money. You have a fantastic opportunity now to build a nice nest egg. The market will take off again in the near future and the more you initially have in there the more it will grow.

This chart does not have the years marked on it but the last green period ended in '99.

This chart does not have the years marked on it but the last green period ended in '99.

Feels ******* fantastic.

Feels ******* fantastic.