I don't understand how Use Tax works

#21

See, this is the faulty underlying assumption.

People who run small online businesses are not keeping track of any tax codes at all. They are simply utilizing the services of one of a handful of e-commerce portal providers, and those providers are already experts on the tax code.

An analogous comparison would be pointing out that most individuals do not prepare their own income tax returns directly- they either use a software package (Turbotax, H&R Block, etc) to prepare the return, or they employ the services of a tax preparer to whom they just hand a pile of paperwork and walk away. Thus, the hundreds of tiny year-to-year changes in the income tax code aren't really noticeable to most people, since they utilize the services of a third-party expert whose job it is to absorb that responsibility.

Same principle applies here. The owners of small online businesses won't have to change anything, because they are already paying someone else to manage their e-commerce functions, including the assay of sales tax.

People who run small online businesses are not keeping track of any tax codes at all. They are simply utilizing the services of one of a handful of e-commerce portal providers, and those providers are already experts on the tax code.

An analogous comparison would be pointing out that most individuals do not prepare their own income tax returns directly- they either use a software package (Turbotax, H&R Block, etc) to prepare the return, or they employ the services of a tax preparer to whom they just hand a pile of paperwork and walk away. Thus, the hundreds of tiny year-to-year changes in the income tax code aren't really noticeable to most people, since they utilize the services of a third-party expert whose job it is to absorb that responsibility.

Same principle applies here. The owners of small online businesses won't have to change anything, because they are already paying someone else to manage their e-commerce functions, including the assay of sales tax.

#23

Yeah, I find it ironic that "we" (as a broad generalization) tend to rally around individual mom-n-pop small businesses as a cause célèbre, shouting about how box-box stores are killing them and so forth.

Now, we're arguing against something which would directly benefit these mom-n-pop operators, by forcing their online competitors to play fair.

Now, we're arguing against something which would directly benefit these mom-n-pop operators, by forcing their online competitors to play fair.

Also, I'm curious about these "box-box" stores.

#24

Fortunately for (really) small businesses, annual revenue under $1m online is exempted from this requirement.

Of course, that exemption kind of destroys the idea that this is about equal enforcement of tax law. It's really about giant online retailers forcing compliance and audit costs onto smaller online retailers.

Of course, that exemption kind of destroys the idea that this is about equal enforcement of tax law. It's really about giant online retailers forcing compliance and audit costs onto smaller online retailers.

I also agree with the fact that brick and mortar stores will not be saved by this tax. It is not like amazon is only cheaper because of the tax savings. It is cheaper because it doesn't need to maintain the retail outlets and staff to operate them. It just needs a central warehouse and a webpage. Businesses need to realize that a strong online presence is necessary in today's market if you are selling products and not just services.

#25

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

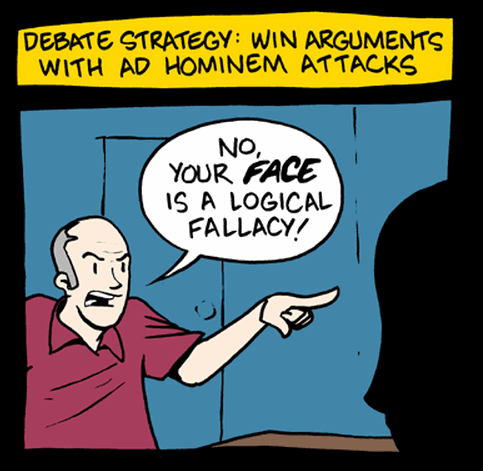

Because I felt his argument was very unpersuasive, you have determined that I:

- agree with the legislation

- think the law is appropriate

- think the tax is appropriate

- am a Statist who believes that top-down governmental control is both appropriate and beneficial

Now you are just being ridiculous, but not in a fun way.

#27

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,027

Total Cats: 6,593

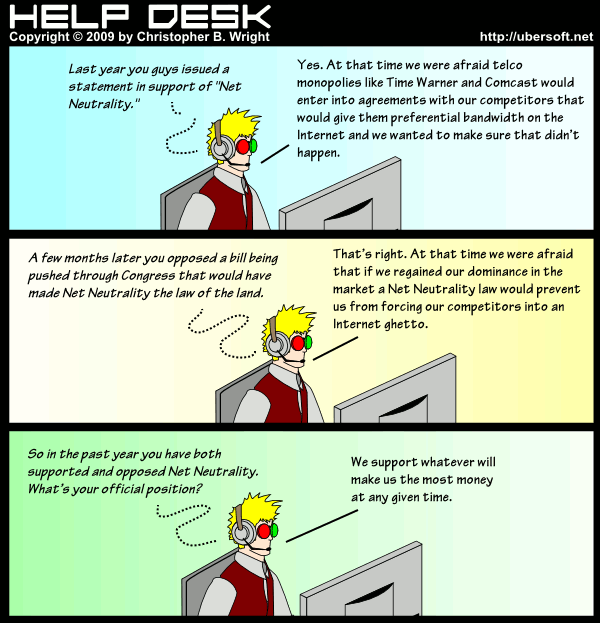

This is how free-market capitalism works in the presence of a representative democracy.

Were it to be any other way, I would accept that as evidence in support of a conspiracy / secret cabal / anticompetative collusion / etc.

#28

My point was simply that you think this bill will somehow benefit "mom-and-pop" businesses in competition with massive chain and online retailers.

So when I see that Amazon and Wal-Mart openly support the internet sales tax bill, I have to question who has a better grasp on the potential effects of proposed tax legislation: Joe Perez, or the people at Amazon and Wal-Mart who were hired specifically for the purpose of evaluating future tax legislation.

#29

Wal-Mart already has retail locations in every state - It doesn't make any sense - AT ALL - for them to oppose interstate internet taxes. If I can buy it today for the same price at both walmart.com and momnpop.com, walmart.com will always have to charge a sales tax, and momnpop.com will only have to charge a sales tax to 1 out of every 50+ transactions, therefore making momnpop.com cheaper. Wal-mart, by backing the internet sales tax, is simply raising everyone elses prices to make their own pricing more competitive.

As for Amazon, if they already have a software developed to support 10k different tax districts and can profit by selling this software to transaction management companies, then they too should support the tax requirements.

As for Amazon, if they already have a software developed to support 10k different tax districts and can profit by selling this software to transaction management companies, then they too should support the tax requirements.

#35

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,494

Total Cats: 4,080

it has nothing to do with business owners and everything to do with revenue collection.

they might "say" that's why they are doing it, but every politican needs a strawman to sell thier shitty policy to the useful idiots.

Thread

Thread Starter

Forum

Replies

Last Post

Frank_and_Beans

Supercharger Discussion

13

09-12-2016 08:17 PM