View Poll Results: What's your income level?

<$25,000

16

18.18%

$25,001-$50,000

21

23.86%

$50,001-$75,000

22

25.00%

$75,001-$100,000

6

6.82%

$100,001-$150,000

10

11.36%

$150,000+

13

14.77%

Voters: 88. You may not vote on this poll

What is your income level?

#62

So I voted based on an estimate of our household (DINK) AGI. I have no way of telling if I am in the top 1% of MTers by income, but we are in the top 25%for sure. I think it's like Hornetball said - most of us "mass affluent" weren't necessarily born that way and didn't move up the socio-economic scale by overspending, overpaying or otherwise consistently making bad economic decisions.

While most of us are not quite as stingy as Braineack seems to be, we didn't end up with Miatas for project cars because that's all we could afford. It's what we chose to spend.

While most of us are not quite as stingy as Braineack seems to be, we didn't end up with Miatas for project cars because that's all we could afford. It's what we chose to spend.

Living here in the gloriously over-priced and over-taxed Northeast, I seem to make a good buck but get to keep a pretty small chunk of it. We're in our 50's and saving carefully so that we can(hopefully) continue to eat and live indoors when we retire. The expense of a more upscale car toy isn't justified.

Besides, on a practical note - I'm past the point to think a Porsche is going to get me laid.

#63

2 Props,3 Dildos,& 1 Cat

iTrader: (8)

Join Date: Jun 2005

Location: Fake Virginia

Posts: 19,338

Total Cats: 573

So I voted based on an estimate of our household (DINK) AGI. I have no way of telling if I am in the top 1% of MTers by income, but we are in the top 25%for sure. I think it's like Hornetball said - most of us "mass affluent" weren't necessarily born that way and didn't move up the socio-economic scale by overspending, overpaying or otherwise consistently making bad economic decisions.

While most of us are not quite as stingy as Braineack seems to be, we didn't end up with Miatas for project cars because that's all we could afford. It's what we chose to spend.

While most of us are not quite as stingy as Braineack seems to be, we didn't end up with Miatas for project cars because that's all we could afford. It's what we chose to spend.

I drive a miata because 11 years go when I got it, it was the perfect "new and reliable" way to complement a modded wh0re of a celica alltrac turbo.

now the tables have turned and the miata is the modded wh0re of a car. naturally we bought something new again.

I wonder what the Countryman will look like in a decade after I get my hands on it. Either lifted safari wagon or dropped tarmac rally car... who can say?

#66

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,057

Total Cats: 6,619

See, this is what I don't understand. And I'm not pointing fingers at you, this is more of a general observation.

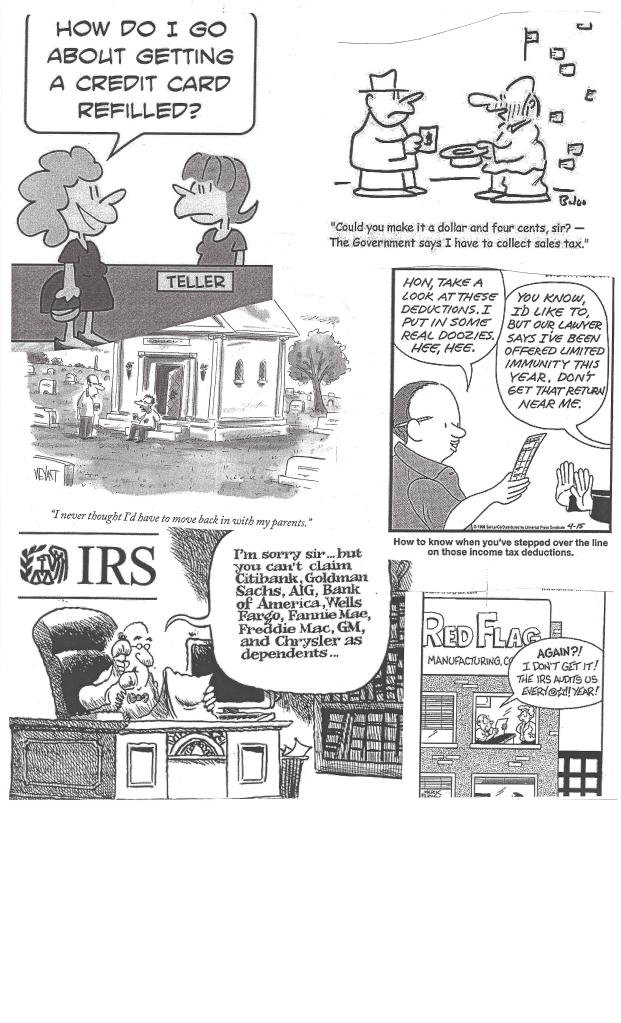

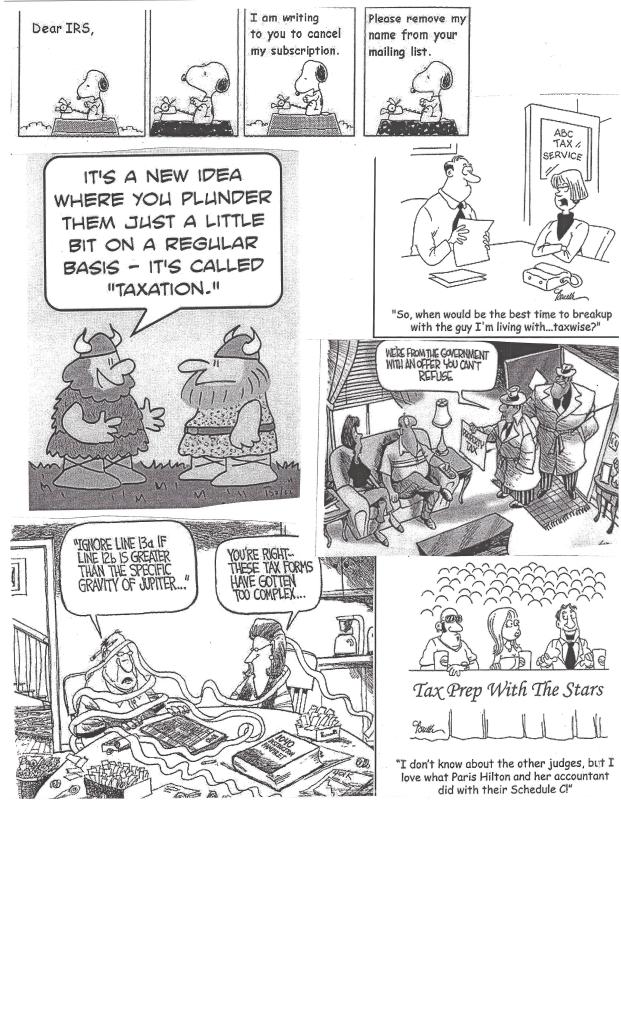

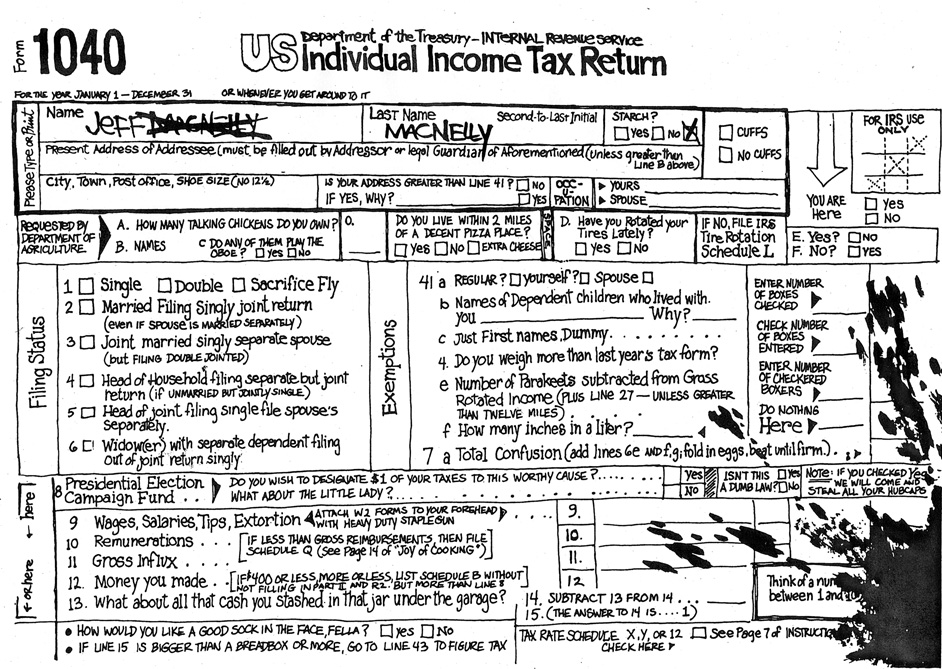

I just don't see why this idea exists that filing your income tax is difficult.

My Federal tax package for this year consisted of Forms 1040 and 2210, Schedules A, B, C, D and SE, and Publications 463 and 1542. And even that wasn't exactly difficult. No calculus, no linear algebra, just a bunch of simple fixed-point addition and subtraction. Basically mathematics at a second-grade level.

Can people really not follow simple instructions and add?

(Also specific gravity is a measure of density, so like all planets with atmospheres, the specific gravity of the Jovian atmosphere is not a constant- it varies with altitude. You'd think that the writers of editorial cartoons would have a better grasp of basic physics.)

I just don't see why this idea exists that filing your income tax is difficult.

My Federal tax package for this year consisted of Forms 1040 and 2210, Schedules A, B, C, D and SE, and Publications 463 and 1542. And even that wasn't exactly difficult. No calculus, no linear algebra, just a bunch of simple fixed-point addition and subtraction. Basically mathematics at a second-grade level.

Can people really not follow simple instructions and add?

(Also specific gravity is a measure of density, so like all planets with atmospheres, the specific gravity of the Jovian atmosphere is not a constant- it varies with altitude. You'd think that the writers of editorial cartoons would have a better grasp of basic physics.)

#67

See, this is what I don't understand. And I'm not pointing fingers at you, this is more of a general observation.

I just don't see why this idea exists that filing your income tax is difficult.

My Federal tax package for this year consisted of Forms 1040 and 2210, Schedules A, B, C, D and SE, and Publications 463 and 1542. And even that wasn't exactly difficult. No calculus, no linear algebra, just a bunch of simple fixed-point addition and subtraction. Basically mathematics at a second-grade level.

Can people really not follow simple instructions and add?

I just don't see why this idea exists that filing your income tax is difficult.

My Federal tax package for this year consisted of Forms 1040 and 2210, Schedules A, B, C, D and SE, and Publications 463 and 1542. And even that wasn't exactly difficult. No calculus, no linear algebra, just a bunch of simple fixed-point addition and subtraction. Basically mathematics at a second-grade level.

Can people really not follow simple instructions and add?

I only wish I was joking.

#68

Boost Pope

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,057

Total Cats: 6,619

But that's what I'm talking about. Addition and subtraction are well within the bare minimums for anybody who was raised in a country with a basic compulsory education law. They covered this stuff just after shapes and colors.

#71

Elite Member

iTrader: (3)

Join Date: Apr 2008

Location: Outside Portland Maine

Posts: 2,023

Total Cats: 19

I know my biggest problem when filing taxes is knowing which numbers go on which forms. I was given some investments by grandparents and relatives, and some send me a statement, others do not. I never know what to claim and what to ignore. Once I figure out what to put in the boxes, the math is the easy part.

#73

I run a small business with about 1.5M-4M in sales annually.

Its not really about how easy or hard it is, its about the liability.

I pay $700 to have my CPA take care of everything, and that lets me sleep knowing I didn't miss anything.

Well worth it.

#74

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,504

Total Cats: 4,079

i feel bad for the non-english speaking people who go to places that work on comission, get crap tons in returns, leave very happy, then wonder why the irs is knocking on their door next year saying they took more in returns than they made in a year

#75

Commoners.

I also assumed that it was combined income for both myself and my wife. I could do it separately, but then I would have to allocate investment income separately since it is all commingled.

#76

My biggest beef is just how inefficient the taxation process is.

My second beef is that the tax code is a playground for Congress. They can reward cronies and supporters with tax breaks and it really doesn't rise to the level of scrutiny involved in passing a law. It's just squirelled away.

All in all, I am not a fan and I think it is much harder and less efficient than it should be.

OTOH, when going against the likes of Al Capone's lawyers, income tax evasion may be all you can get.

#77

Elite Member

iTrader: (1)

Join Date: Feb 2008

Location: Birmingham Alabama

Posts: 7,930

Total Cats: 45

I always go with the most simple form possible. Probably miss out on some money, but I can get that ---- done in about 5 minutes and move on with my day. Though this year I e-filed, and got both fed and state filled out in about 20 minutes, and had my refund in my bank account in about 10 days.

#80

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

so wait, you included your spousal income? if it was just yours, would it change the category? adding my wife in would definitely bump me up a bracket. it doesn't intimidate me at all that she works for what some here would call a "liberal hippie nonprofit" and may out-earn me within 5 years.

That's why I said we should just ban the OP and start over again.