View Poll Results: What %age are you paying the IRS for 2011.

0%

3

6.25%

1-5%

4

8.33%

5-15%

14

29.17%

15-25%

7

14.58%

25-35%

15

31.25%

35%+

5

10.42%

Voters: 48. You may not vote on this poll

Your effective federal tax rate for 2011

#61

Household income was down in 2011. Total tax to the federal government was 23.1% of our income. Lowest tax rate I paid in a long time. The Obama 2% reduction in social security tax was substantially helpful as well.

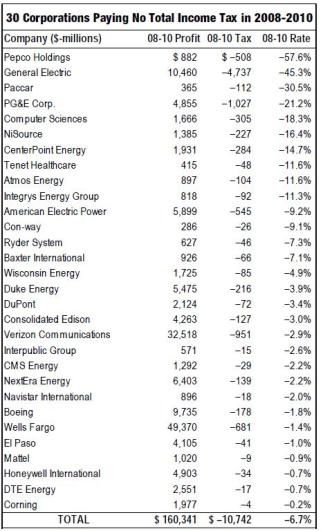

Looked and found the fortune 500 corporation I work for paid -30.5% federal income tax on 365 million in profit between 2008 and 2010 and assume the CEO paid roughly 15% on ~13 million a year in total compensation, got further depressed about how screwed middle class has become as we become a corporate fascist nation.

2012 Income will be up I’m trying to figure out if we will be paying alternative minimum and loosing deduction for mortgage interest.

Bob

Looked and found the fortune 500 corporation I work for paid -30.5% federal income tax on 365 million in profit between 2008 and 2010 and assume the CEO paid roughly 15% on ~13 million a year in total compensation, got further depressed about how screwed middle class has become as we become a corporate fascist nation.

2012 Income will be up I’m trying to figure out if we will be paying alternative minimum and loosing deduction for mortgage interest.

Bob

#62

Senior Member

iTrader: (2)

Join Date: May 2005

Location: Edmonton Ab, Canada

Posts: 1,202

Total Cats: 21

didn't pay much last year as I only worked 6months after graduating college so I only grossed $54k. Paid just over 25% federal/provincial combined. This year will be around 39% as I'll be over 132k... Gotta love Canadian tax rates lol

#63

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

Color me skeptical.

#64

GE is claimed to have received $3.2b in net tax benefits on an annual profit of $14.2b in 2010.

http://money.msn.com/top-stocks/post...3-2949588e90f6

I lol'ed at this.

http://money.msn.com/top-stocks/post...3-2949588e90f6

I lol'ed at this.

In a stroke of genius, it hired a former Treasury official to lead its tax department and filled its team with former IRS employees and Congressional tax specialists.

#67

GE is claimed to have received $3.2b in net tax benefits on an annual profit of $14.2b in 2010.

http://money.msn.com/top-stocks/post...3-2949588e90f6

I lol'ed at this.

http://money.msn.com/top-stocks/post...3-2949588e90f6

I lol'ed at this.

They keep on reciting claims like that like 50% pay no income tax and ignore the fact that nearly half of federal revenue comes from Payroll tax that amounts to a 15% tax on poor people supposedly paying no income tax and that anybody beyond middle class doesn’t pay as much or even zero.

It would be nice if my after tax income was 45% more than my pretax income. But that does not sound like a sustainable way to run a country.

Bob

#72

Elite Member

iTrader: (2)

Join Date: Sep 2008

Location: Central Florida

Posts: 2,799

Total Cats: 179

For example, is a lot of that temporary because of massive loss carry forward + R&D and capital investment depreciation pulled forward or is it something else? As close as GE is to the government, I am willing to entertain "all of the above" as a reasonable answer.

Sorry; had to enjoy a nice lunch outside on a beautiful afternoon in the sunshine.

Plus, I said I am trying not to be "that guy."

Plus, I said I am trying not to be "that guy."I voted based on our effective Federal income tax rate, per the thread title.

#73

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,501

Total Cats: 4,080

What are you talking about?! The government acts non-arbitrarily and in the public interest, and tax “loopholes” are as legitimate a part of the fiscal bargain between voters, taxpayers, interest groups, and politicians as are determinations of the tax base and tax rates themselves.

#75

What are you talking about?! The government acts non-arbitrarily and in the public interest, and tax “loopholes” are as legitimate a part of the fiscal bargain between voters, taxpayers, interest groups, and politicians as are determinations of the tax base and tax rates themselves.

I worked for one of those companies at the top of the list During that time frame compensation was reduced jobs were moved to countries where tax on employees was much lower.

Capital is the fruit of labor not moving capital around from bucket to bucket as the wealthy elite 1% seems to think.

Bob

#77

Can you link me to the source for that chart? I am curious about the calculation. I'm not trying to discredit it; I can believe that with tax subsidies and incentives it is possible to receive more in Federal income than you made in gross income, but I want to better understand their definitions.

For example, is a lot of that temporary because of massive loss carry forward + R&D and capital investment depreciation pulled forward or is it something else? As close as GE is to the government, I am willing to entertain "all of the above" as a reasonable answer.

For example, is a lot of that temporary because of massive loss carry forward + R&D and capital investment depreciation pulled forward or is it something else? As close as GE is to the government, I am willing to entertain "all of the above" as a reasonable answer.

Interesting somehow a corporation can pay stock options and somehow they get huge tax credits for doing so and the receiver of the stock options also gets them qualified at the long term capital gains rate. I don’t fully understand it.

Bob

#78

In deciding which country a corporation is going to hire workers in it is not income tax to the corporation that matters it is the total cost of the employees. It is the total cost of the employee including the employees tax that matters most in that calculation. A smart company is guided by profit motive not income tax avoidance.

Bob

Bob

Thread

Thread Starter

Forum

Replies

Last Post

chris101

Miata parts for sale/trade

5

02-19-2016 07:13 PM

chris101

Miata parts for sale/trade

2

10-09-2015 09:08 AM

russian

Miata parts for sale/trade

6

10-08-2015 03:01 PM