The One True Politics Thread

#101

I'm not surprised, but a tax on my PlayStation controller? On my surprisingly excellent Status ear buds? Because they have massive 30ft range that will obviously impact the big Telecommunication companies in absolutely no way, shape, or form?

I realize the WiFi tax is about killing Microsoft's desire for wireless, rural broadband.

Mainly bitching about my disdain for crony capitalism.

I realize the WiFi tax is about killing Microsoft's desire for wireless, rural broadband.

Mainly bitching about my disdain for crony capitalism.

#103

Boost Pope

Thread Starter

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,036

Total Cats: 6,604

I mean, take a look at a cell phone bill. I just looked at mine. I directly pay exactly ten different, specifically-enumerated taxes and surcharges on it, plus a $7.38 "recovery fee," which is my provider's way of passing along to me the various fees and taxes which the local, state and federal governments impose upon them.

One of the specific, direct taxes is the Regional Transit Authority tax. A portion of my phone bill, therefore, goes to pay for busses and trains in northern Illinois.

What sense does that make? Answer: if it is possible for a government to collect revenue from something, they will do it.

Gas bills, electricity bills, water & sanitation bills, all of them are chock full of random little taxes and fees, many of which have absolutely nothing at all to do with the product or service being purchased.

Remember when a three cents per pound tax on tea was enough to lead to a war?

Granted three cents was worth more in 1767 than today, but then think about how much tea a pound is. It is a lot.

#104

I'm surprised the tax on emails never happened. The Post Office has for decades pointed at email as a main reason their revenue has decreased and the corresponding need to raise postage prices. Thinking about that I guess the tax was applied just not as a tax... which now leaves the door open for a true tax.

#105

Sure, why not?

I mean, take a look at a cell phone bill. I just looked at mine. I directly pay exactly ten different, specifically-enumerated taxes and surcharges on it, plus a $7.38 "recovery fee," which is my provider's way of passing along to me the various fees and taxes which the local, state and federal governments impose upon them.

One of the specific, direct taxes is the Regional Transit Authority tax. A portion of my phone bill, therefore, goes to pay for busses and trains in northern Illinois.

What sense does that make? Answer: if it is possible for a government to collect revenue from something, they will do it.

Gas bills, electricity bills, water & sanitation bills, all of them are chock full of random little taxes and fees, many of which have absolutely nothing at all to do with the product or service being purchased.

Remember when a three cents per pound tax on tea was enough to lead to a war?

Granted three cents was worth more in 1767 than today, but then think about how much tea a pound is. It is a lot.

I mean, take a look at a cell phone bill. I just looked at mine. I directly pay exactly ten different, specifically-enumerated taxes and surcharges on it, plus a $7.38 "recovery fee," which is my provider's way of passing along to me the various fees and taxes which the local, state and federal governments impose upon them.

One of the specific, direct taxes is the Regional Transit Authority tax. A portion of my phone bill, therefore, goes to pay for busses and trains in northern Illinois.

What sense does that make? Answer: if it is possible for a government to collect revenue from something, they will do it.

Gas bills, electricity bills, water & sanitation bills, all of them are chock full of random little taxes and fees, many of which have absolutely nothing at all to do with the product or service being purchased.

Remember when a three cents per pound tax on tea was enough to lead to a war?

Granted three cents was worth more in 1767 than today, but then think about how much tea a pound is. It is a lot.

#106

Boost Pope

Thread Starter

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,036

Total Cats: 6,604

This talk of taxing consumer goods and services got me to thinking about something peripherally related.

Having spent some time living and working in Germany, the way they express retail prices is a bit different. If you're in a store, and you see an item on the shelf with a price tag that says €10, that is exactly the amount that you will hand to the cashier. The price displayed on the shelf includes all of the applicable taxes and fees which the retailer is required to collect.

Here in the US, we don't do that. You pick up a product (let's call it a bottle of bourbon) with a price tag of $29.99, and you wind up paying $36.74. Because the price on the tag didn't include the state sales tax, the local sales tax, the local liquor tax, the bottle fee, etc.

With one exception: gasoline. If the pump says $3.69, you pay $3.69.

Why is that?

Having spent some time living and working in Germany, the way they express retail prices is a bit different. If you're in a store, and you see an item on the shelf with a price tag that says €10, that is exactly the amount that you will hand to the cashier. The price displayed on the shelf includes all of the applicable taxes and fees which the retailer is required to collect.

Here in the US, we don't do that. You pick up a product (let's call it a bottle of bourbon) with a price tag of $29.99, and you wind up paying $36.74. Because the price on the tag didn't include the state sales tax, the local sales tax, the local liquor tax, the bottle fee, etc.

With one exception: gasoline. If the pump says $3.69, you pay $3.69.

Why is that?

#110

Transparency FTW.

#111

Very transparent, and much easier for the customer.

Last edited by PaulF; 11-17-2021 at 09:17 PM. Reason: Ignore this, GM beat me to it.

#114

Boost Pope

Thread Starter

iTrader: (8)

Join Date: Sep 2005

Location: Chicago. (The less-murder part.)

Posts: 33,036

Total Cats: 6,604

If only all retailers in the US used computer-based systems to print all of their shelf labels, with this being part of the exact same system which supplies pricing info to the checkout registers to coordinate with the UPCs and is thus already programmed with all of the relevant information pertaining to the local tax rates.

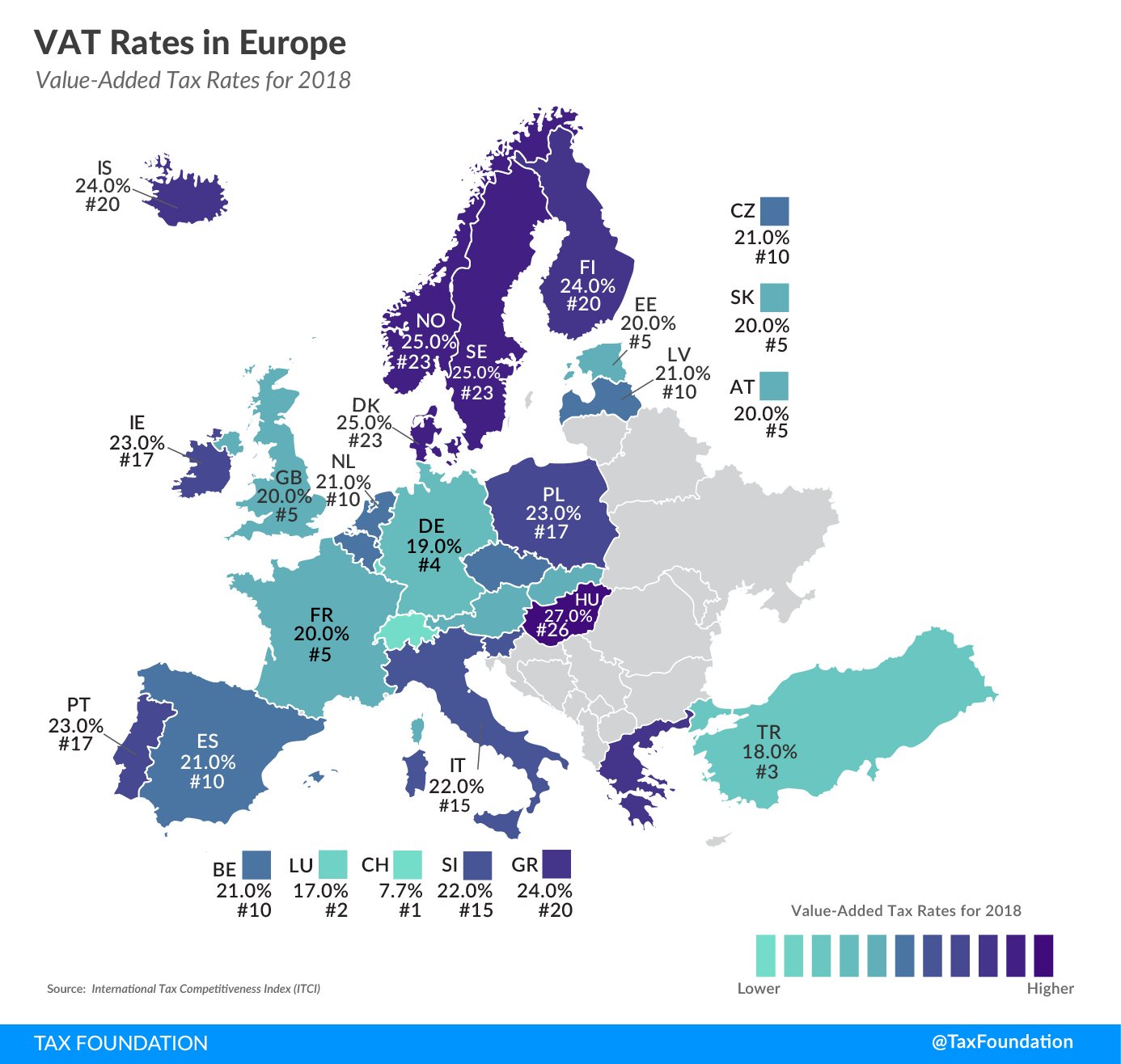

GST is just a different name for VAT. They mean the same thing.

GST doesn't include VAT, it is VAT.

#115

This classic politician move allowed them to raise the taxes back while also crowing about the income tax allowing them to lower the gas tax. Currently, gas in CT is taxed at $0.476/ gallon plus an 8.81% “windfall profits tax” - currently averaging about .34/gallon - and it’s still illegal for gas stations to post your gasoline price basis.

#117

I don't know why you think I'm crying on someone's shoulder or that I want sympathy for a non issue, you might want to head back to the euro part of the Internet until you learn to read English properly.

#119

What taxing issue is the problem that needs fixed? I certainly don't recall any problem being pointed out. I do recall a general question about why our taxes aren't included I'm advertised prices. I certainly don't see it as a issue, I see it as a benefit.

I don't know why you think I'm crying on someone's shoulder or that I want sympathy for a non issue, you might want to head back to the euro part of the Internet until you learn to read English properly.

I don't know why you think I'm crying on someone's shoulder or that I want sympathy for a non issue, you might want to head back to the euro part of the Internet until you learn to read English properly.

#120

I hate income tax, death taxes, capital gains, food taxes, property taxes and any other taxes that are immoral. I honestly don't care about any other tax that is avoidable, although with the world deciding that the Internet is a human right, the proposed WiFi tax would hit the immoral list.

I thought you were from euroland and their taxes are retarded. If you just have a flat 10% that's pretty reasonable and far more understandable to have the tax worked into the price.

I thought you were from euroland and their taxes are retarded. If you just have a flat 10% that's pretty reasonable and far more understandable to have the tax worked into the price.