Obama wins...

#182

Senior Member

iTrader: (4)

Join Date: Aug 2010

Location: Farmington Hills, MI

Posts: 460

Total Cats: 15

Because:

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

#183

Because:

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

#184

Because:

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

Im assuming you were referring to Romney.

I think his Tax rate in 2011 was around 13-14%, low because the majority of his income is from capital gains, which is taxed less than wages. His average effective tax rate from 90-09 was around 20%, im assuming due to more income derived from wages earlier.

Obama's was around 20% last year, and similar in 09 when he wrote his book and made like 5 million.

I haven't look at stats in a while but I think average income in the US is a lil over 50K, at least it was last time I heard. I think the effective tax rate for families making between 50-70k is like 8%.

Im just curios were you are getting your facts, or if your referring to Obamas comments about Romney's taxes.

#185

Im assuming you were referring to Romney.

I think his Tax rate in 2011 was around 13-14%, low because the majority of his income is from capital gains, which is taxed less than wages. His average effective tax rate from 90-09 was around 20%, im assuming due to more income derived from wages earlier.

Obama's was around 20% last year, and similar in 09 when he wrote his book and made like 5 million.

I haven't look at stats in a while but I think average income in the US is a lil over 50K, at least it was last time I heard. I think the effective tax rate for families making between 50-70k is like 8%.

Im just curios were you are getting your facts, or if your referring to Obamas comments about Romney's taxes.

I think his Tax rate in 2011 was around 13-14%, low because the majority of his income is from capital gains, which is taxed less than wages. His average effective tax rate from 90-09 was around 20%, im assuming due to more income derived from wages earlier.

Obama's was around 20% last year, and similar in 09 when he wrote his book and made like 5 million.

I haven't look at stats in a while but I think average income in the US is a lil over 50K, at least it was last time I heard. I think the effective tax rate for families making between 50-70k is like 8%.

Im just curios were you are getting your facts, or if your referring to Obamas comments about Romney's taxes.

#186

Senior Member

iTrader: (4)

Join Date: Aug 2010

Location: Farmington Hills, MI

Posts: 460

Total Cats: 15

I haven't look at stats in a while but I think average income in the US is a lil over 50K, at least it was last time I heard. I think the effective tax rate for families making between 50-70k is like 8%.

Im just curios were you are getting your facts, or if your referring to Obamas comments about Romney's taxes.

Im just curios were you are getting your facts, or if your referring to Obamas comments about Romney's taxes.

#189

The real problem here is that the government is too large. Every time they take on more responsibility they cost us more money than a private company could do it for. Most of the United States is made up of the middle class. Is there really enough rich people to pay the deficit and balance the budget? Yes the rich people should pay their share of the taxes too ,but that is not a solution to the problem. That will not create jobs. When ever the middle class is spending money and doing well then the government is also doing better financially because they get more tax money. The presidents plan seems more like distribution of wealth. Is that really what we want? well I guess so since he got voted back into office for four years. What ever happened to the saying that if you don't work you don't eat.

#190

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,488

Total Cats: 4,077

Because:

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

These are absolutely some of the worst reasons I've ever been privilege to. You sound like Hitler trying to control the Jews. Ever dictator needs a scape goat. amirite?

#191

This is stupid. Do you live like Jesus with only what you need and giving everything else that is excess in your life to those in need? No you don't so STFU. The problem is you feel like they should pay your way because you were not as successful.

Why? Is there any loical reason why a wealth gap is a problem if everyone is making strides forward? Don't even pull a bbundy and try to say the middle class has not advanced in the past 30 years. Look at your smart phone, access to internet, etc.

So you vote against the candidate that was going to try and close loopholes.

That's right!! They didn't build that!!! You're an idiot.

I guess blacks should have never gotten their freedom by that logic.

Why? Is there any loical reason why a wealth gap is a problem if everyone is making strides forward? Don't even pull a bbundy and try to say the middle class has not advanced in the past 30 years. Look at your smart phone, access to internet, etc.

I guess blacks should have never gotten their freedom by that logic.

#192

Boost Czar

iTrader: (62)

Join Date: May 2005

Location: Chantilly, VA

Posts: 79,488

Total Cats: 4,077

So to summarize, NJN is for:

Always regarding this small group of men as guilty, in any clash with any other group, regardless of the issues or circumstances involved.

Forcing this group to pay for the sins, errors, or failures of any other group.

Forcing this group to live under a silent reign of terror, under special laws, from which all other people were immune, laws which the accused could not grasp or define in advance and which the accuser could interpret in any way he pleased.

Penalize this group, not for its faults, but for its virtues, not for its incompetence, but for its ability, not for its failures, but for its achievements, and the greater the achievement, the greater the penalty.

Always regarding this small group of men as guilty, in any clash with any other group, regardless of the issues or circumstances involved.

Forcing this group to pay for the sins, errors, or failures of any other group.

Forcing this group to live under a silent reign of terror, under special laws, from which all other people were immune, laws which the accused could not grasp or define in advance and which the accuser could interpret in any way he pleased.

Penalize this group, not for its faults, but for its virtues, not for its incompetence, but for its ability, not for its failures, but for its achievements, and the greater the achievement, the greater the penalty.

#193

Senior Member

iTrader: (4)

Join Date: Aug 2010

Location: Farmington Hills, MI

Posts: 460

Total Cats: 15

Way too easy to rustle jimmies around here.

The real answer is taxes need to be increased on everyone slightly and spending needs to be cut significantly. The problem is a tax increase on the middle class that spends every penny they make will hurt the economy at a time when it's slowly correcting. And yes, you can draw the conclusion from that statement that I don't feel a small tax increase on the wealthy will have any impact on the economy.

I live in Illinois so my presidential vote didn't mean anything anyways.

And if Romney had the guts to detail what loopholes he was going to close I might of been able to support him. His constant "the math works, don't worry about it" bullshit didn't fly with me.

The real answer is taxes need to be increased on everyone slightly and spending needs to be cut significantly. The problem is a tax increase on the middle class that spends every penny they make will hurt the economy at a time when it's slowly correcting. And yes, you can draw the conclusion from that statement that I don't feel a small tax increase on the wealthy will have any impact on the economy.

And if Romney had the guts to detail what loopholes he was going to close I might of been able to support him. His constant "the math works, don't worry about it" bullshit didn't fly with me.

#195

Im assuming you were referring to Romney.

I think his Tax rate in 2011 was around 13-14%, low because the majority of his income is from capital gains, which is taxed less than wages. His average effective tax rate from 90-09 was around 20%, im assuming due to more income derived from wages earlier.

Obama's was around 20% last year, and similar in 09 when he wrote his book and made like 5 million.

I haven't look at stats in a while but I think average income in the US is a lil over 50K, at least it was last time I heard. I think the effective tax rate for families making between 50-70k is like 8%.

Im just curios were you are getting your facts, or if your referring to Obamas comments about Romney's taxes.

I think his Tax rate in 2011 was around 13-14%, low because the majority of his income is from capital gains, which is taxed less than wages. His average effective tax rate from 90-09 was around 20%, im assuming due to more income derived from wages earlier.

Obama's was around 20% last year, and similar in 09 when he wrote his book and made like 5 million.

I haven't look at stats in a while but I think average income in the US is a lil over 50K, at least it was last time I heard. I think the effective tax rate for families making between 50-70k is like 8%.

Im just curios were you are getting your facts, or if your referring to Obamas comments about Romney's taxes.

Peak average tax paid group is in the few hundred K group under 500k The super-rich multi-millionaire investor types and I exclude most celebrities and sports stars have already purchased their exemptions from taxes and still want more.

If you define an economic parasite as one that sucks the wealth and privilege out of society and you’re looking at the weak and starving who work and thus submit tax returns as the cause of the parisitism sucking the life out of the economy then with a little rational thought you might realize you might be looking in the wrong spot for the parasites. The successful parasites are often the fat and healthy ones.

#196

Because:

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

1. They can afford to.

2. The wealth gap has to be controlled.

3. They have bought tax breaks that make no sense. There is a good portion of the rich that pay a lower effective rate than the middle class (including one of our presidential candidates).

4. The majority of the rich were not born that way and they owe the country that allowed some kickback to the country that gave them the opportunity to succeed.

5. They have for the last 100 years including in times of great economic prosperity.

#197

The real problem is voter fraud

The real problem is voter fraudThe Republican party gets hammered for being the bad guy when it wants to make laws that say. You must prove your a citizen to vote. So the laws don't get passed.

I show up to vote. I see a 15 passenger van pull up full of mexicans most cannot speek English. I provide prof to vote and i vote. Not one of them had a drivers license yet they all got to vote.

I leave there to go one mile away to my care provider health clinic.(I'm Indian) It's 8:00 A.M. The same van pulls up they all get out and vote. I could of and should have killed every last one of them worthless fu ks. F ck you if you dis agree with me your part of the problem. Vote early vote often Democrats.

A good friend of mine who is 82 yrs old voted for Obama because he believes the lies that the Republicans want to take away his social security. I love this old man but he is truly scared by democrat lies.

This statement is a partial answer to the response someone gave to braineack when he said that we need to get 75% of the white voters to turn out to vote.

But Obama won't let our military votes be counted. Un American I say

#198

Senior Member

iTrader: (4)

Join Date: Aug 2010

Location: Farmington Hills, MI

Posts: 460

Total Cats: 15

I have 0 faith in the current system being able to balance the budget with cuts alone. You'd need deep cuts in every major programs and it's just not going to happen.

The only way I can see the US balancing the budget is a combination of increased revenue and spending cuts. I could be wrong on that but I just can't imagine congress making deep cuts to medicare/medicaid/defense/etc. regardless of which party is in control.

The only way I can see the US balancing the budget is a combination of increased revenue and spending cuts. I could be wrong on that but I just can't imagine congress making deep cuts to medicare/medicaid/defense/etc. regardless of which party is in control.

#199

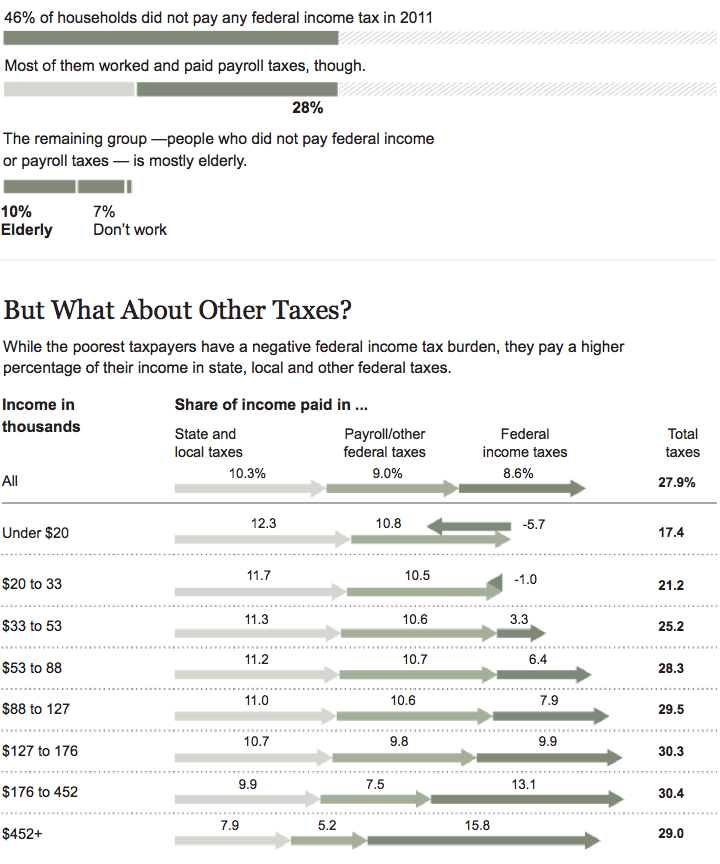

So looking at that chart, how do they come to the conclusion that people who make $20k or less pay 12% of their wages to state and local tax? Thats what I made in my early 20's and I can tell you there was no way I was paying $2400 a year in taxes to my state or local gov't. Sales tax was 6% back then, gas taxes are % higher but gas prices were much lower and I lived in an apartment or in my parents home so I didnt pay real estate tax. And of course food had no tax. Auto tag was like $40. I didnt stay at hotels as I couldnt afford it (20% tax rates and such), etc, etc.

I dont see that chart being factual for someone like myself almost 20 years ago. Today, sure I might see me paying 12% of my income to state and local taxes but I have a home, I make more so I spend much more on things I couldnt before, etc, etc.

Im not saying that chart is a lie, I just dont see how it can be true. I use myself 20 years ago as my income and situation matches a point in that chart so dont attack that point in my argument.

Edit: Oh and many people making $20k or less may not even have a car so they may not pay gas taxes or vehicle registration. That chart has to assume a certain general expenditure on state a local tax that would not be true for everyone in any of those tax brackets, especially so for the lower income side.

I dont see that chart being factual for someone like myself almost 20 years ago. Today, sure I might see me paying 12% of my income to state and local taxes but I have a home, I make more so I spend much more on things I couldnt before, etc, etc.

Im not saying that chart is a lie, I just dont see how it can be true. I use myself 20 years ago as my income and situation matches a point in that chart so dont attack that point in my argument.

Edit: Oh and many people making $20k or less may not even have a car so they may not pay gas taxes or vehicle registration. That chart has to assume a certain general expenditure on state a local tax that would not be true for everyone in any of those tax brackets, especially so for the lower income side.

#200

The tax system has its issues. Here's my take:

Being legally disabled, there are specific rules and regulations that essentially state that any opportunity available to a non-disabled person shall be available to me. For instance, in college, I parked in a public handicap spot on campus and got issued a warning ticket. I was pissed about it at first, but then researched the laws and figured out why I was breaking the university policy. Equal opportunity works both ways. I was taking advantage of the fact there were public handicap spots on campus. BUT since I was a student, students can only park on campus if they display a paid parking pass. All the university wanted from me was that I paid 100 bucks for a student parking permit. I refused and just stopped parking on campus. (The REAL issue I then had with the policy was that it blatantly discriminated against students in general. As an alumni or non-affiliate of the school, I can park legally in a handicap spot anywhere on campus. BUT for some reason, if I am a student, I am required to buy a permit. From every law I researched at the time, that policy was against the law.)

So, our tax system has big fat loopholes for reduced tax or tax free investments that aren't available to most of us. NOT because they aren't allowed for most of us, but because quite frankly most people live paycheck to paycheck and have an easy access savings account and not a long-term investment account sheltered away from their spending accounts.

The system needs to be balanced, not flipped to discriminate more against the wealthy. For investments, an easy step is this: tax personal savings accounts at the same rate as investments. Woah I just opened a can of worms!

I'm almost at the point that I'm ready to throw money back into the stock market. I'm eyeing quite a few REITs and others in the 10% reduced tax or tax free realm. That will surely beat the 0.7% (minus tax at full rate) the credit union pays!!!

Being legally disabled, there are specific rules and regulations that essentially state that any opportunity available to a non-disabled person shall be available to me. For instance, in college, I parked in a public handicap spot on campus and got issued a warning ticket. I was pissed about it at first, but then researched the laws and figured out why I was breaking the university policy. Equal opportunity works both ways. I was taking advantage of the fact there were public handicap spots on campus. BUT since I was a student, students can only park on campus if they display a paid parking pass. All the university wanted from me was that I paid 100 bucks for a student parking permit. I refused and just stopped parking on campus. (The REAL issue I then had with the policy was that it blatantly discriminated against students in general. As an alumni or non-affiliate of the school, I can park legally in a handicap spot anywhere on campus. BUT for some reason, if I am a student, I am required to buy a permit. From every law I researched at the time, that policy was against the law.)

So, our tax system has big fat loopholes for reduced tax or tax free investments that aren't available to most of us. NOT because they aren't allowed for most of us, but because quite frankly most people live paycheck to paycheck and have an easy access savings account and not a long-term investment account sheltered away from their spending accounts.

The system needs to be balanced, not flipped to discriminate more against the wealthy. For investments, an easy step is this: tax personal savings accounts at the same rate as investments. Woah I just opened a can of worms!

I'm almost at the point that I'm ready to throw money back into the stock market. I'm eyeing quite a few REITs and others in the 10% reduced tax or tax free realm. That will surely beat the 0.7% (minus tax at full rate) the credit union pays!!!